Pullback In Progress - Market Analysis for Feb 13th, 2024

After outlining my views yesterday about the IWM still more likely taking the scenic route to the wave 5 target overhead, the market has made that much more likely today with the break down below 197.50. And, I am assuming that today’s decline is wave 1 down in the [c] wave of wave 4.

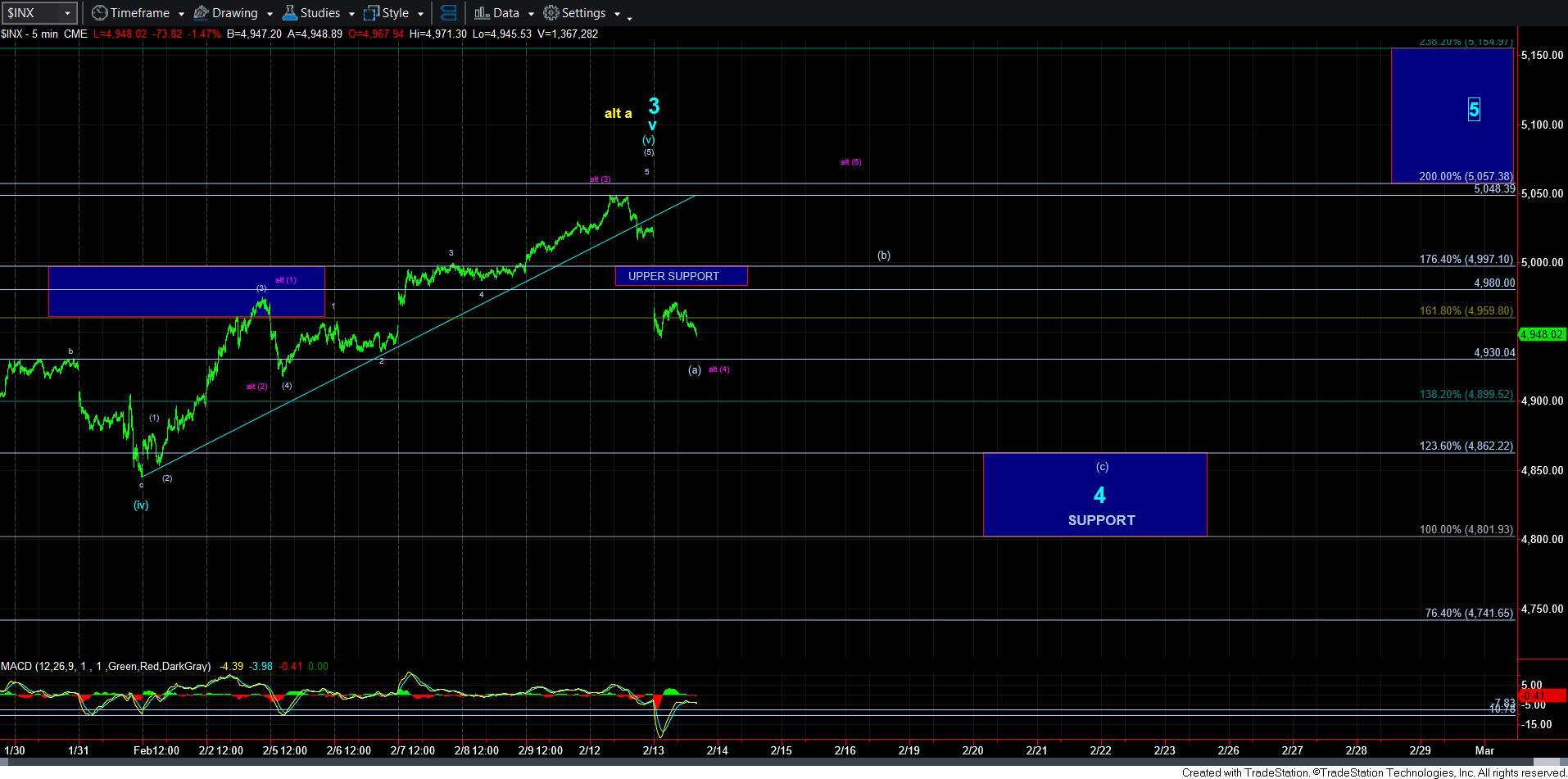

With regard to SPX, we have broken our upper support box, and we are approaching the ideal targe for the [a] wave of wave 4, which is the .236 retracement of wave 3 in the 4930SPX region. Thereafter, I am expecting a [b] wave bounce, followed by a [c] down to our wave 4 support box below. Once we have an [a] wave low in place, we will set out resistance/target for the [b] wave bounce.

Take note that the .382 retracement of wave 3, which is a traditional target for wave 4, is in the same region as the 1.236 extension of waves 1-2, and that is because wave 3 became quite extended. So, for now, I am going to assume we will target the 4860SPX region to complete wave 4.

As long as that support holds, I am going to be looking for that 5th wave higher in the coming months, which will likely target the region between 5057-5150, with the more likely target being the top end of that region. We will be able to narrow down the target once we have waves i-ii of the 5th wave in place.