Primary Count Still Holding

With the rally we completed today, which was telegraphed before yesterday’s close, the market seems to have found a top at the higher targets we presented yesterday.

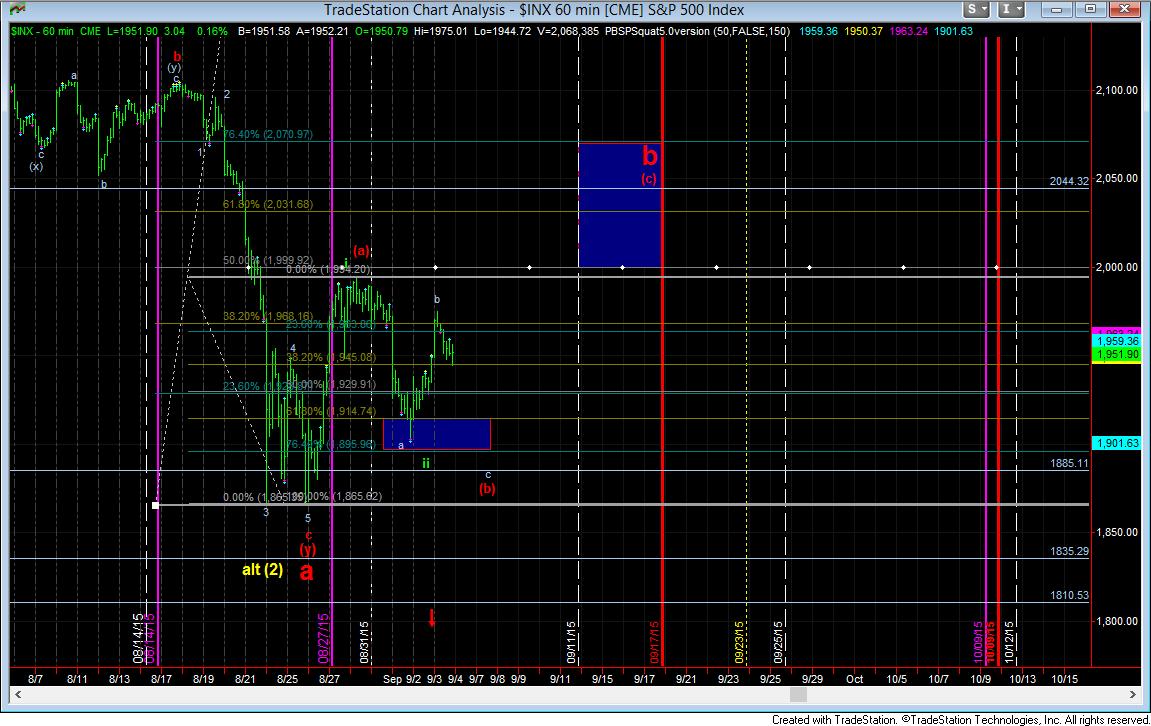

As I have been saying this week, the ideal count I would want to see is a larger red (b) wave which would call this top today the top of the b-wave of the (b) wave, which means a c-wave should take us down tomorrow. The a=c target is 1885SPX, but there is the potential we may see a double bottom at the 1906SPX level.

The alternative count as presented on the 60 minute ES chart provides for a much bigger decline, but I cannot entertain such a perspective at this time unless we see a break of the 1885SPX level.

For tomorrow, the market seems set up to head lower, with resistance to watch tonight around the 1962ES region, being the .618 retrace of today’s decline, with the 1966ES level over that as the .764 retracement.

For those that are looking at this market from the bullish perspective, you will need to take me over 1995SPX for me to even consider a bullish case scenario.

As I have also said so many times, we are dealing with corrective wave structures, and you do not need to place a lot of money in a trade to make a lot of money on a big move. But, from a risk management perspective, I still suggest smaller position sizes since we are dealing with corrective wave structures.