Parameters In Place For A Continued Push Lower

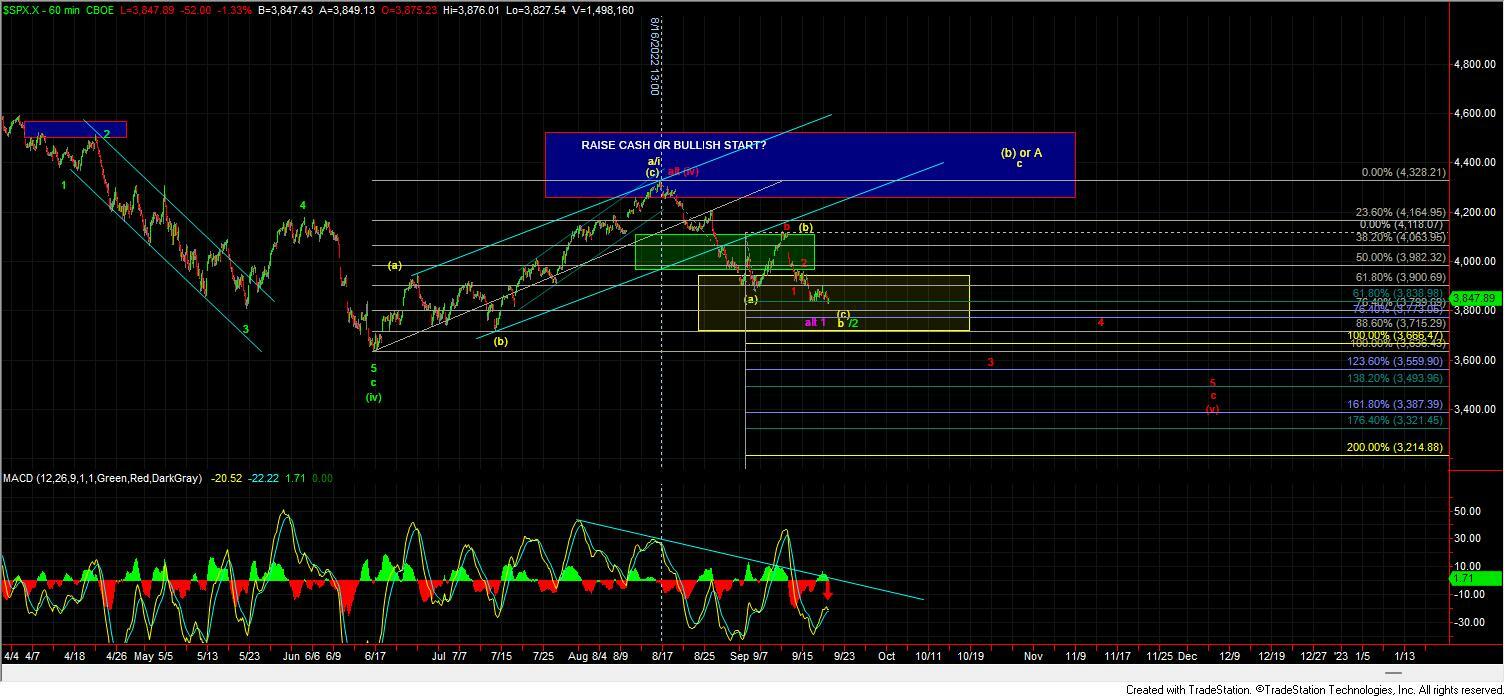

After retracing higher yesterday and overnight the market turned lower right at the key 61.8 retrae level from the move down off of the 3979 level and has now broken below the previous low at the 3845 level. This is still all very supportive of the red count being the primary path forward as this price action is fitting within our expected fib pinball guidelines quite well. So while we still have yet to fully confirm the red count with a break under the larger degree pivot and 100ext below there is still nothing to suggest that we are forming a bottom just yet and as long a we continue to remain under support the pressure will remain down in the markets.

Red Count

Under the red count, we should hold under the 3880-3916 zone. This represents the 38.2-76.4 retrace level of the move down off of the overnight high at the 3936 level. Assuming we can hold that zone we should see a turn back lower in the form of five waves that would then need to break back below the 3833-3799 pivot zone below followed by a break under the 3743 level which is the 100ext of the move down off of the 8/16 high. Moving through those levels would then clear the way for a move down into the 3653-3563 zone for the wave 3 of c with the ultimate wave 5 of c targets closer to the 3508-3362 zone below. If we were to see this break back over that zone followed by a break over the 3979 high then it would open the door for this to have put in a larger degree bottom in either the purple or green count.

Purple Count

The purple count would suggest that we are bottoming in a larger wave 1 needing a deeper retrae for a larger wave 2 of c down. There are several issues with this count in regards to the structure of that wave 1 which have become even more problematic with today's price action however if we move over the 3936 high on corrective wave action I am still going to leave the door open to this path however as I noted yesterday it is far from ideal thus making it a lower probability alternate path.

Green/yellow count

The green and yellow counts are going to trace out very similarly in the early stages and it will be tough to differentiate them which is why I am combining them into one narrative for the time being. Under this case, we should move back up over the 3979 high and then ultimately back over the 4135 level on its way back up over the highs that were struck in August. That move would then either be the start of a wave iii as part of a diagonal to new highs under the green path or as part of a larger wave (b) as I am showing in yellow. Again the early part of this move is likey to be similar so at this point I am going to combine the narrative to try to keep things a bit more simple.

Alhtough the larger degree pattern we are dealing with is corrective in nature we do appear to be in the midst of an impulsive wave c within that corrective price action. That was c is pointing down and still pointing quite a bit lower. So with that and as long as we continue to fill out the expected parameters of that impulsive wave c down per our fib pinball guidelines I will continue to give the benefit of the doubt to this pattern. Should we begin to see a break of the clearly defined parameters then I can begin to look more seriously at some of the more complex and less reliable alternate paths. Unless and until that occurs however the simplest and cleanest path forward is the red path which again is still pointing towards a lower resolution before finding any sort of a bottom.