Parameters Are In Place As We Wait For The Market To Tip It's Hand

Today we saw the market open lower and then continue to move down into the afternoon session. We have since moved back higher as we move into the final hour of trading but we still do not have confirmation as to whether we are going to see further downside follow-through or if the market has other intentions. We do have some fairly clear parameters in place that we can watch to help give us confirmation as to whether we will indeed see that downside follow-through or a push higher.

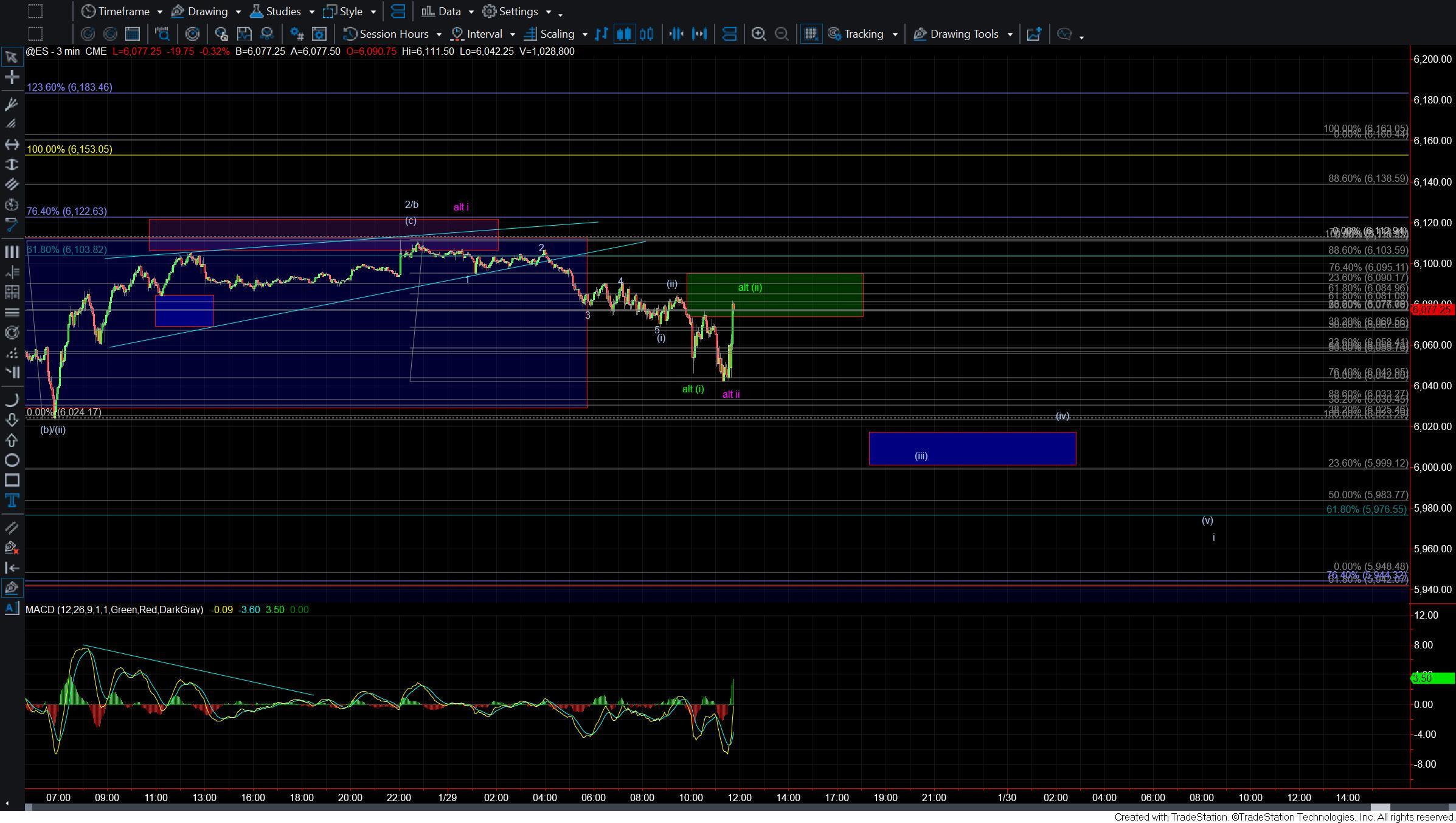

Drilling down to the five-minute ES chart I have overhead resistance coming in at the 6084-6095 zone. Should we be able to hold that zoe and then break back under the 6042 low then we are likely heading lower in the wave (iii) of i of the larger wave iii. That wave i of iii should target the 5976-5950 zone on the ES. If we can see a five-wave move into that region then it would give us the next level of confirmation that yesterday's high was indeed the top of the wave 2/b.

If we see this break over the 6095 level followed by a break over the 6103-6122 pivot zone overhead then it would give us the initial signal that we are following the purple count. Under that case the move up off of the 5944 low would likely count as a wave (i)-(ii) i-ii. The structure of those subwaves are far from ideal however which is making it a difficult count to rely on. With that being said if we do break over the pivot zone as noted above then this will be the path that we are likely following.

For now, we simply need to wait to see how this reacts at the pivot levels as noted which should give us a better idea as to where the market is likely headed in the weeks ahead.