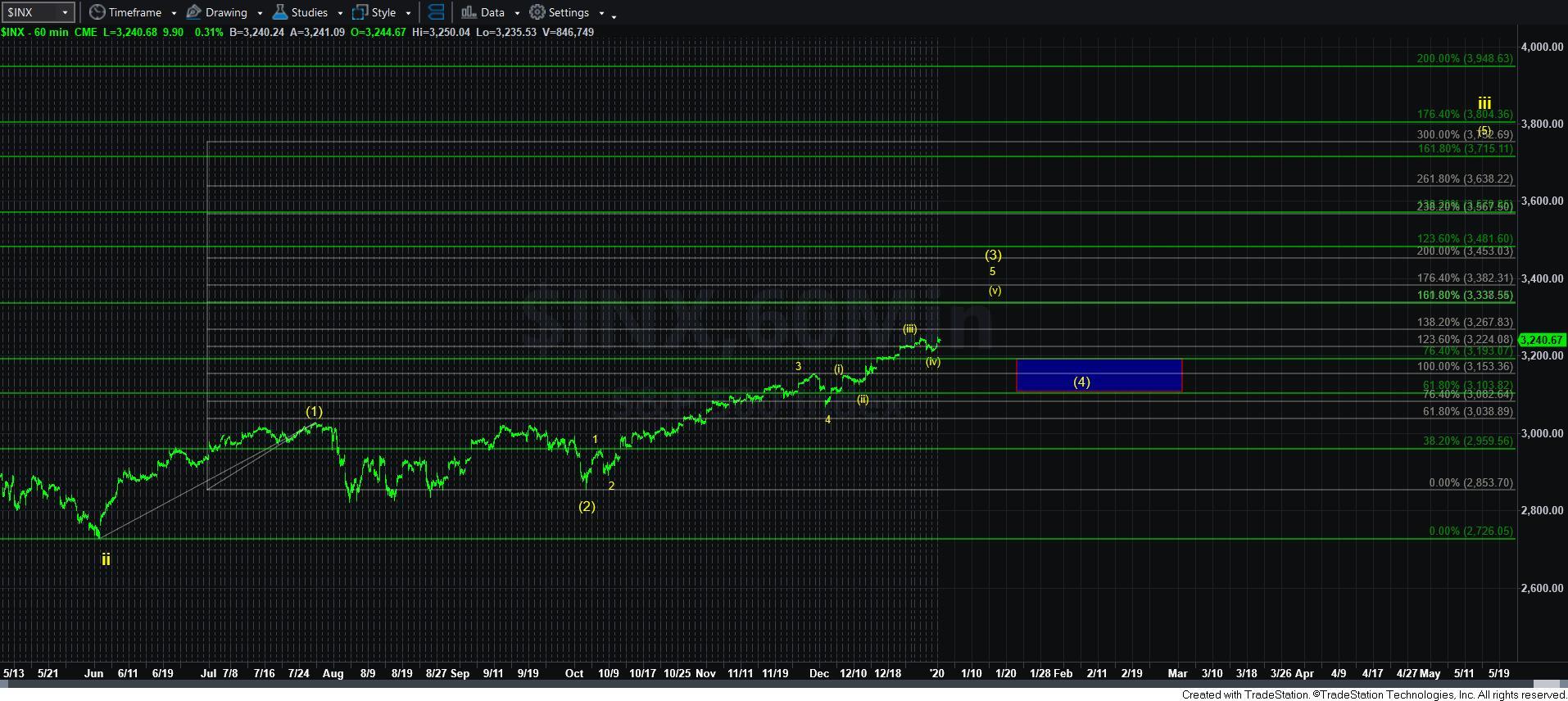

One Last Chance - Market Analysis for Jan 2nd, 2020

With today’s marginally higher high in SPX, we are now at my limit. Depending upon how the SPX reacts over the coming week will tell me if I have to move to the yellow count as my primary, no matter how many issues I have with the underlying structure.

You see, if the SPX is able to break out over the 3260SPX region in the coming days, I believe we will then rally towards the 3330/40SPX region, which is the ideal target for wave (3) of iii on the 60-minute yellow count chart. This will then have me looking at the next pullback as wave (4) of iii, and potentially set us up for a 500-700 point rally in 2020 to complete wave iii. This would leave waves iv and v to be completed into 2021 under this scenario.

Yet, as long as we remain below 3260SPX, I can still maintain some semblance of the blue/green potential. We still would need to break below 3190SPX to even begin assuming some top has been struck. The structure with which we break below 3150SPX would be instructive as to which count was more applicable.

The main issue I still have is the IWM. You see, if the SPX would rally in the yellow count, then I would have to view IWM as completing wave [1] of its wave iii, after which we would then see a wave [2] retrace while the SPX pulls back in its wave (4) of iii. This would mean that the IWM would have some significant catching up to do in 2020, and would make me believe that it will likely outperform in 2020.

So, at this point in time, I think we are on the cusp of a major decision within the market.