One Down, Two To Go

With today’s rally, the first thing I can say is that the potential for the yellow count has decreased even further. In order for me to even reconsider it, we would have to turn down and break below yesterday’s low, which would suggest the c-wave down is taking shape as an ending diagonal. And, since I do not adopt diagonals this prematurely, I am putting the yellow count on the back burner for now.

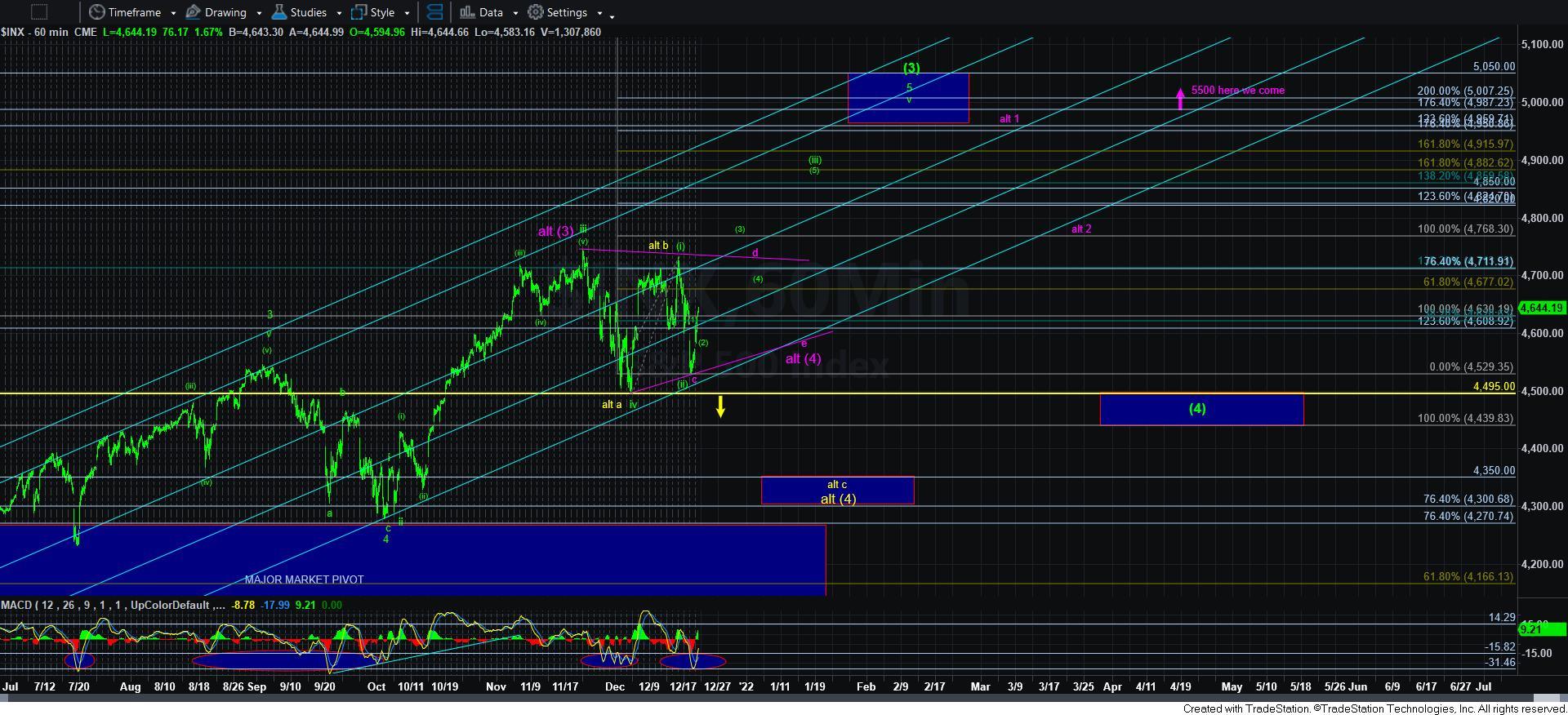

So, let’s discuss what we have left – purple and green. By the way, please recognize that both point us much higher, but the green count would be directly higher, whereas the purple count would still have at least a week or two of consolidation within this triangle before it likely completes.

Moreover, the purple count suggests we are one wave degree higher than the green count, which means if we see the 4th wave triangle in purple, the next rally likely has a target of 5500SPX in the bigger picture. What this means is that if the market tells us over the coming days that we are stuck in the purple triangle for several more weeks, then yesterday’s low is going to be our main support for now, and that the e-wave of the wave (4) will not break below that low. That means that you can buy the e-wave pullback, place your stops at the low of the c-wave, and ride the market up as high as 5500SPX after the triangle completes.

However, my favored count remains the green count. But, the next few days will tell us if I can maintain that as my favored count. Let me explain using our Fibonacci Pinball as our guide.

Based upon the rally off yesterday’s low, I am counting waves [1] and [2] of wave [iii] completed, as you can see on the 5-minute ES chart. As I am writing this, we are in the micro pivot on that chart (which is the .618-.764 extensions of waves [1][2]). Should the market continue higher towards the 1.00 extension of waves [1] and [2] in the 4658ES region, then the micro pivot becomes VERY IMPORTANT support. In the green count, once we get to that 1.00 extension, we should not break back below the micro pivot on the next pullback. Ideally, the next pullback from the 1.00 extension is wave iv of [3], again, as outlined on the 5-minute ES chart. And, as long as that pivot holds as support, then we will continue higher in the green count.

However, should the pivot break once we rally to at least the 1.00 extension in the 4658ES region, then it makes the purple count much more likely in my humble opinion, and suggests we can continue to consolidate in this range-bound triangle for at least another week or two before it completes.

So, with the yellow count being put on the back burner with this rally, the market will likely tell us over the coming days whether we rally directly to the 4900SPX region to the ideal larger wave [3] of [iii] target off the March 2020 lows, or if we are going to be stuck in a triangle for a bit more time before the next major rally begins. But under all circumstances now, as long as yesterday’s low holds, we should see at least the 4900SPX region, and potentially even higher depending on the market’s decision in this region. So, yesterday’s low is quite important.