Not Much More To Glean From Today’s Action

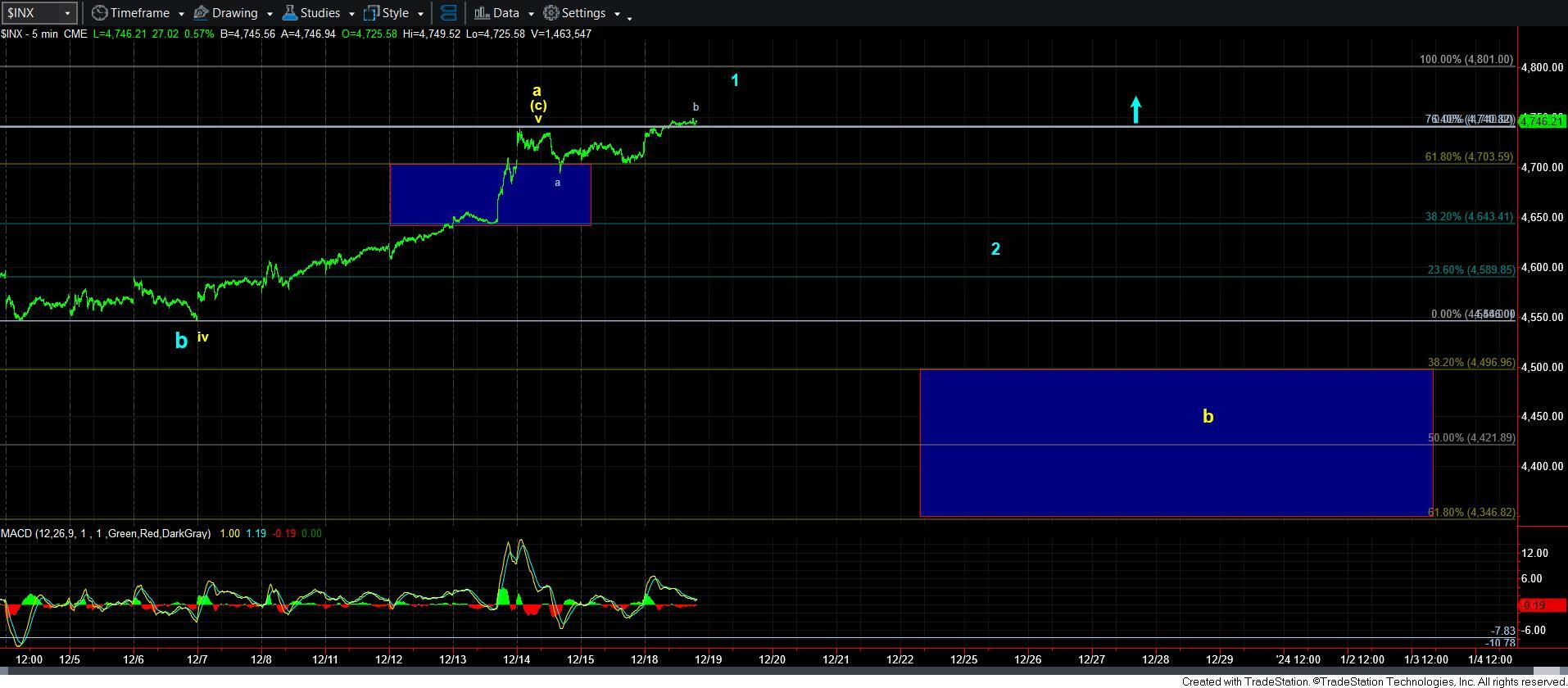

There is not much more we have learned from the SPX action thus far. But, as I outlined over the weekend, if we are able to continue higher in a direct manner, then it would start to increase the probabilities that a bigger pullback may not take shape before we top out in the market.

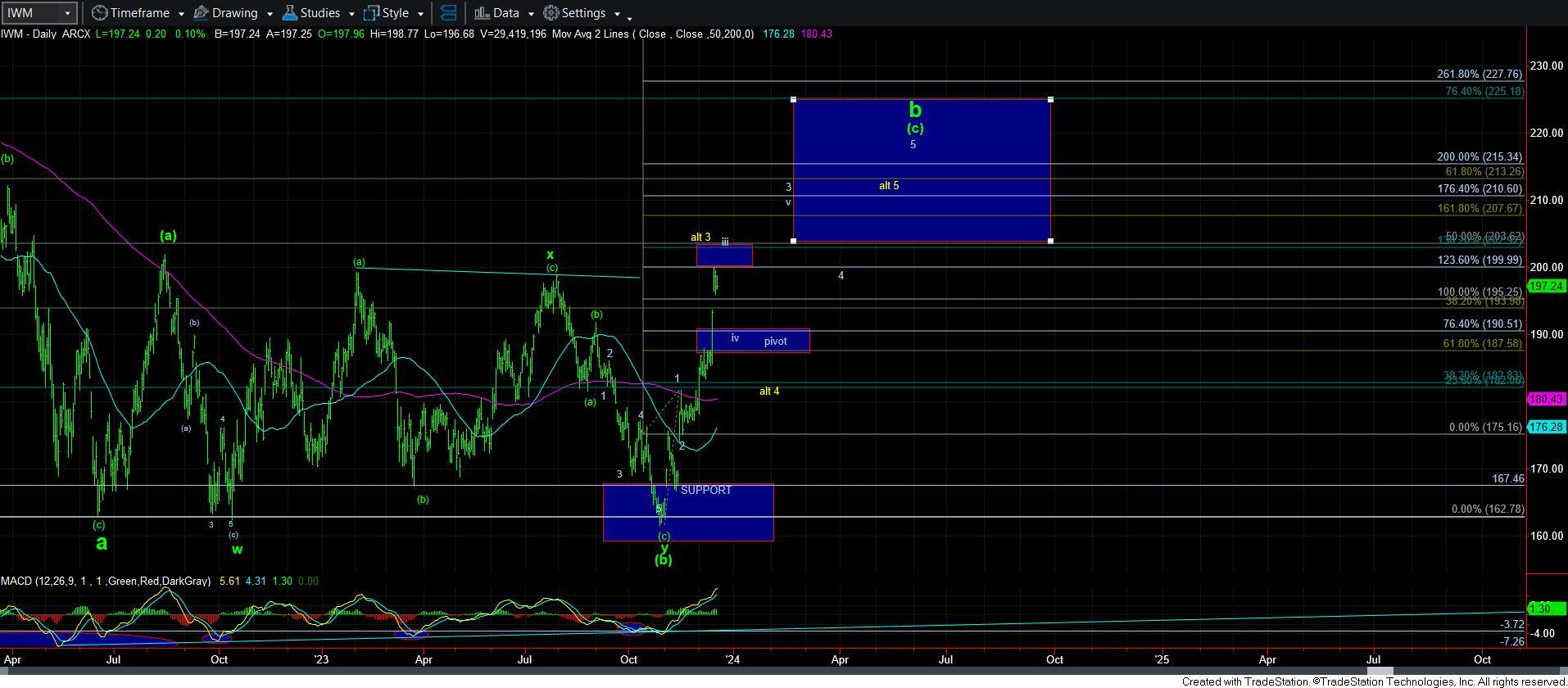

In the meantime, I want to make a mention of the IWM, as I think it may provide a clearer path to a market top. In the more immediate bullish path higher, I am still questioning if wave iii has completed. Until we actually break down below 195, I am still leaving the door open that we can see one more push higher to complete wave iii of 3 into the top of the target box overhead. But, once we break below 195, it makes it likely that we are in wave iv of 3 pullback (assuming that we do not break below the pivot). And, should we continue higher in an extension of wave iii, then the top of the pivot box is the true support which I would not expect to be broken on the likely ensuing pullback.

So, for now, the SPX still has me questioning the path to 4800+. But, I am going to continue to track the IWM, as it seems to present a clearer picture of the paths to completing this very large b-wave, which will likely coincide with the SPX completing its topping process.