Not Blowing My Socks Off Yet

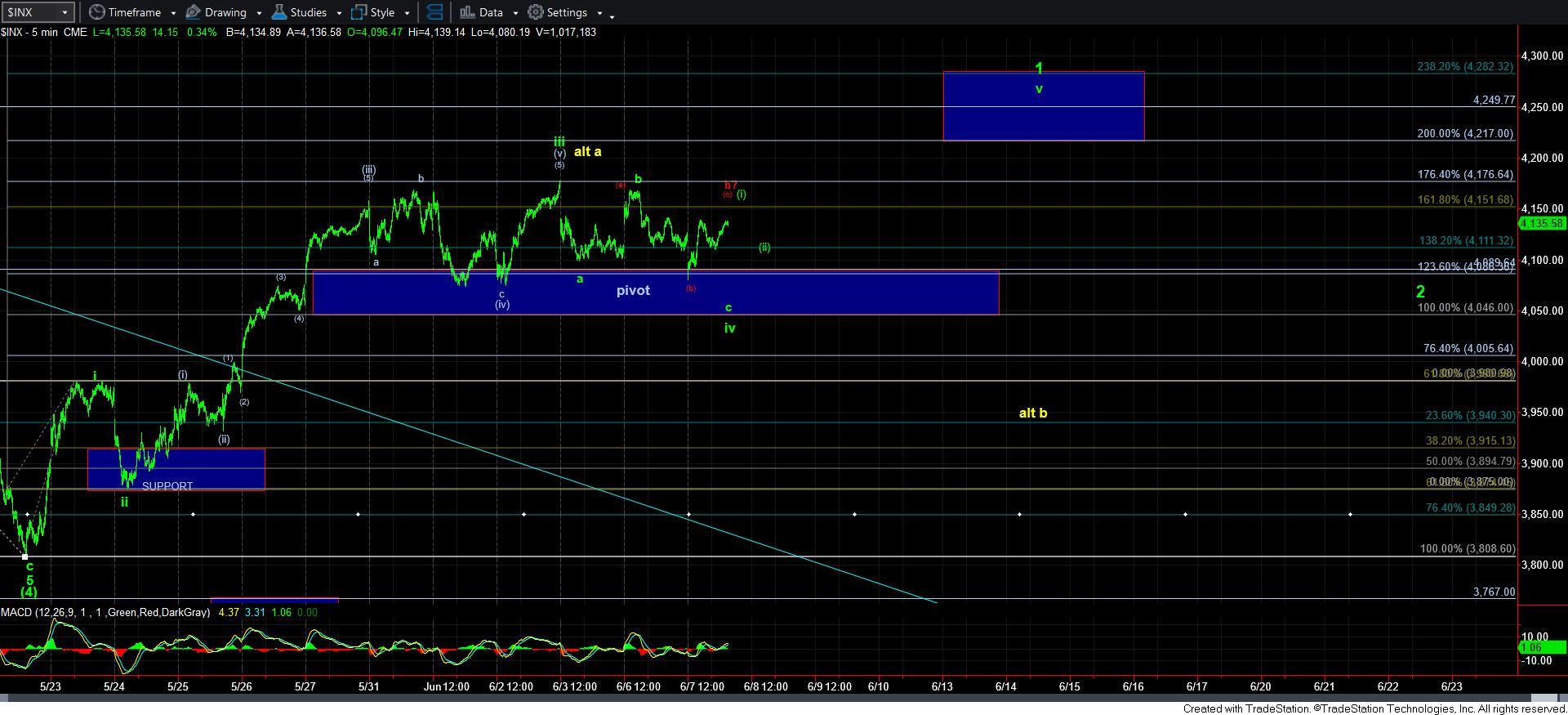

Well, we hit the market pivot again this morning. But, I can’t say I have anything that is reliable in either direction just yet.

Yesterday, when the market turned down from the intra-day high, it began as a potential impulsive decline to suggest that the c-wave of wave iv was potentially in progress. However, as I noted very early this morning, the market was losing its impulsive structure to the downside in the overnight session, and the market supported my view when we then reversed back up without completing a clear 5-wave c-wave.

As a reminder, an a-b-c structure usually completes with a 5-wave c-wave. And, when you do not complete 5-waves down, it makes it hard to determine that a correction has completed. Therefore, we need further confirmation with a potential 5-wave rally off a low.

This brings me to a problem I outlined during the day today. Even if we did see a 5-wave rally, since the low was struck with an amorphous structure, there is still potential for the morning low to be a [b] wave within a larger b-wave structure. And, that is what I have noted in red on the 5-minute SPX chart, with the red “b?” being the potential top to a larger b-wave within wave iv.

The other structure I am tracking is a wave [i][ii] set up in green, which would then suggest we have begun wave v of 1.

Now, the problem with viewing this rally as a 5-wave structure is that it looks more like a leading diagonal, thereby reducing my reliance on the potential green [i][ii] structure for wave v.

Where does all this leave us?

Well, I have to say that pressure remains down in wave iv unless and until the market can complete waves [i] and [ii] in green on the 5-minute chart, and then breaks out over the high of wave [i]. Only then will I view this set up as projecting us to our next higher target box to complete wave v of 1 off the recent lows, and placing a much stronger bullish bent on these charts, as I have been discussing now for several weeks.

Therefore, as long as we remain below the 4150/60SPX region, then I am going to keep looking down in wave iv because the more immediate bullish structure in the green wave [i][ii] would rely upon a leading diagonal which I do not trust until the market proves it to be so.

Lastly, I want to conclude with something I posted as an alert earlier today:

“As we approached last week's high, I noted that it was now time to be cautious. I still believe it is time to be cautious. Keep in mind what the context of the market is telling us. For us to be bullish, we still need a higher high followed by a wave 2 pullback. Therefore, for the bullish structure, it is not likely that we will be breaking out of here and heading to new all time highs anytime soon. Moreover, we do not even have a 5-wave rally off the low yet. So, until that happens, it is prudent to remain cautious. And, I see no reason to force anything right now, nor to be aggressive on either side right now.”