No More Yellow - Market Analysis for May 1st, 2025

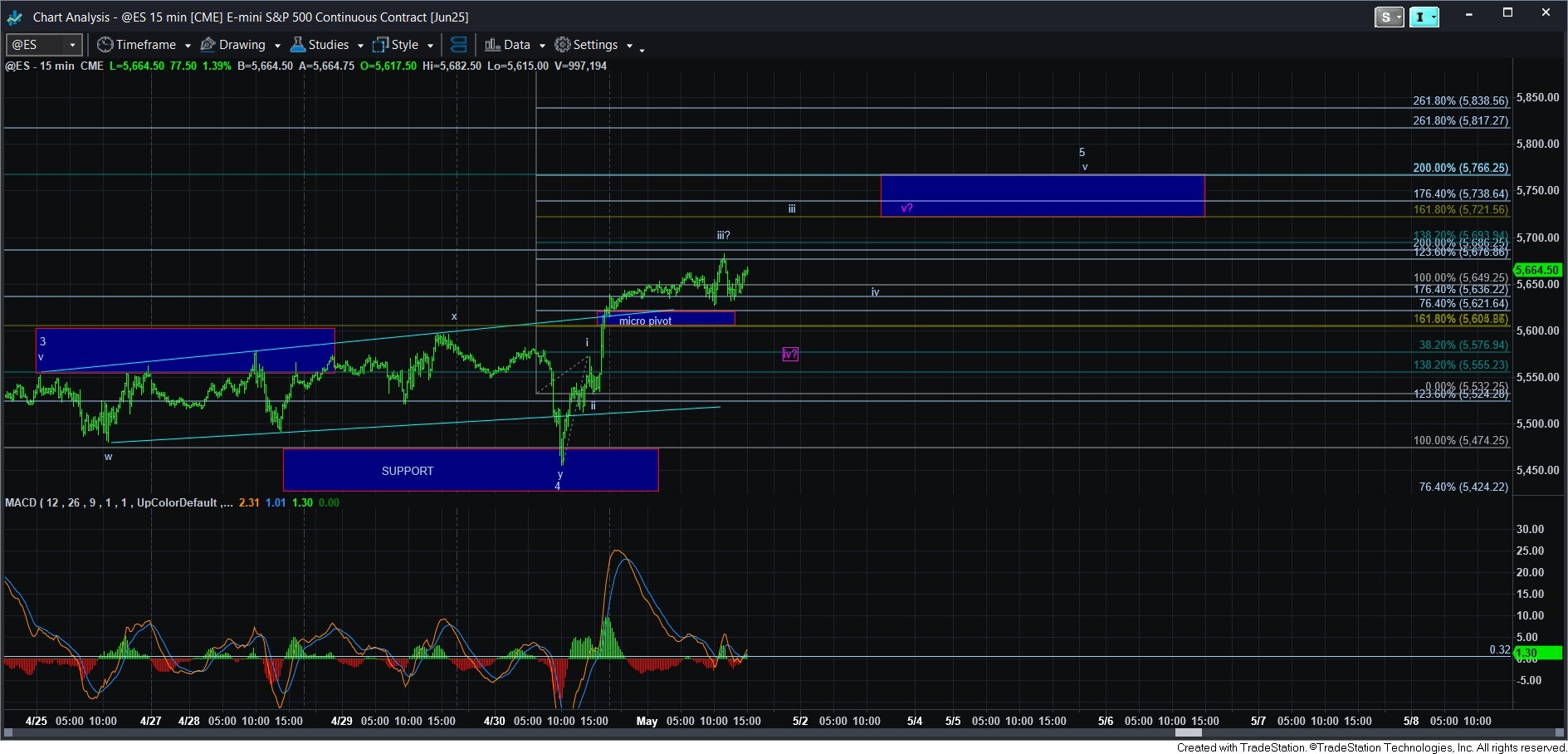

With the market taking out the recent highs and rallying in a 5th wave, I can state that the yellow count is done, as it represented a 3-wave structure. With us completing a 5th wave, we no longer have to worry about the yellow count.

Yet, we have bigger degree worries right now. You see, we are now approaching the completion of the [c] wave, based upon my wave count. We should be in the 5th wave of that [c] wave, and likely have a iv-v to complete within that wave 5.

If you look at the attached 15-minute ES chart, you will see that I am unsure if the wave iii will extend higher, or if it breaks lower, we may morph into an ending diagonal. But, I think it is reasonable to expect at least one more higher high before wave 5 is done.

In the meantime, price has now reached our target box on the 60-minute chart, and the MACD on that time frame is presenting us with negative divergences as well. Moreover, the MACD on the daily chart has now come up enough to support a red c-wave down at this time. Whether it will do so will be based upon whether we see 5-waves down after this rally completes.

So, we are now likely approaching the completion of this rally off the recent lows in an [a][b][c] fashion. Whether that represents the red b-wave or whether it represents the blue a-wave will depend on the wave structure of the next decline. And, once we break down below yesterday’s low, we will likely be within either the red wave 1 down or the blue b-wave corrective pullback, and we will assess it accordingly at that time.