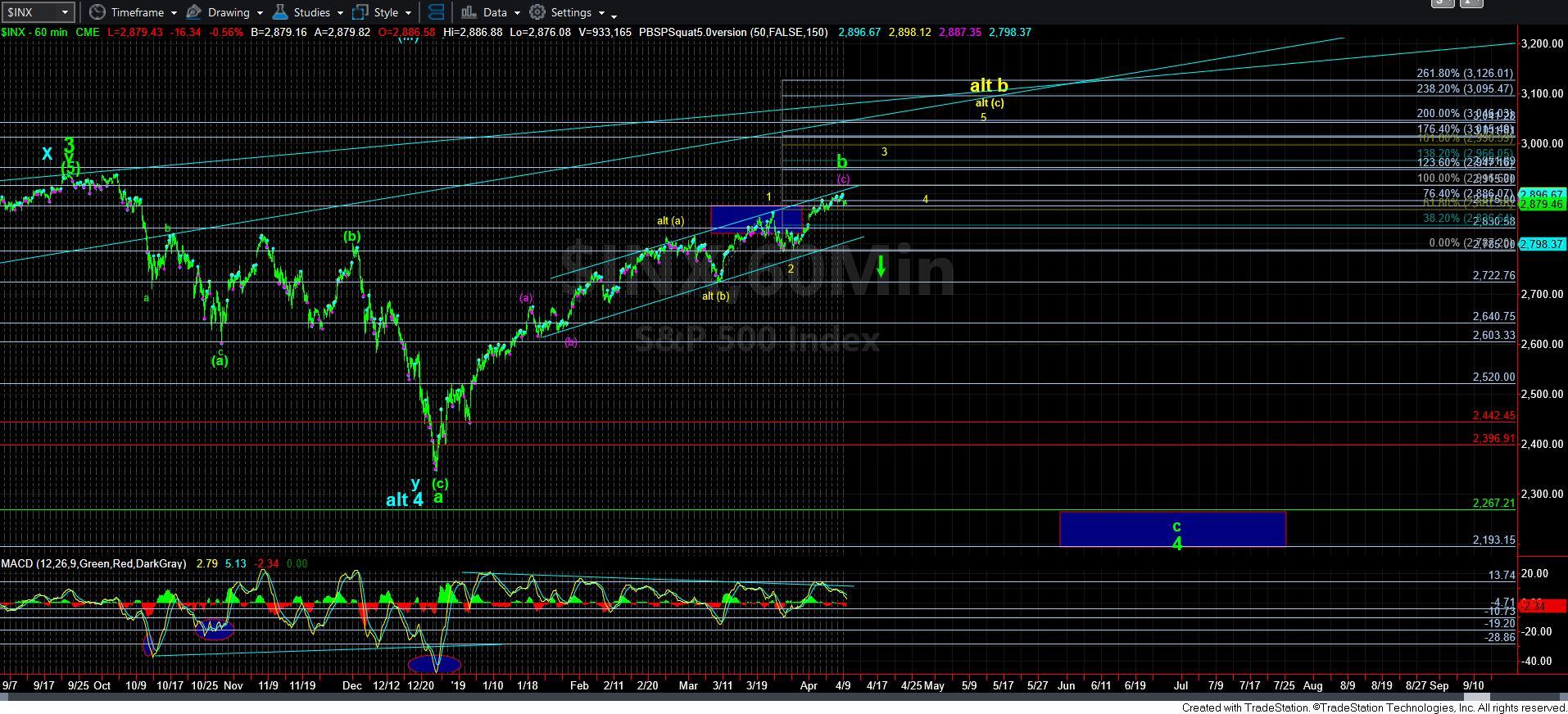

No Clear Topping Structure YET

With the market simply grinding sideways for the last week with marginal upside progress, it does seem as though we are losing our upward momentum. But, this market has had many opportunities to turn down over the last 3+ months and has refused to do so at each twist and turn. So, I have no clear indications it will do so this time either.

In fact, I really cannot make out a clear 5-wave downside structure off the overnight high in the futures (unless we have a truncated 5th wave bottom). So, that does not leave me with a strong expectation of downside follow through just yet. That being said, as of my writing this update around 2PM, the secondary decline we got after the corrective rally into the middle of the day does look like a micro 5-waves down. So, as long as we remain below yesterday’s high – and even more so below today’s corrective rally high, pressure will remain to the downside.

This brings me back to our basic analysis we have been presenting for the last week, and I will repeat what I sent out as an alert earlier today:

“So, our parameters remain the same. Below 2915, we can have a completed b-wave, but we need to see a sustained break of 2845 to begin that topping process, with the break down below 2785SPX providing the confirmation.

Over 2915 opens the door to 3011-40SPX, with 2865/85 then becoming support, which will eventually be raises to 2915 should we get through 2950 (which would then be support for yellow alt 4).”