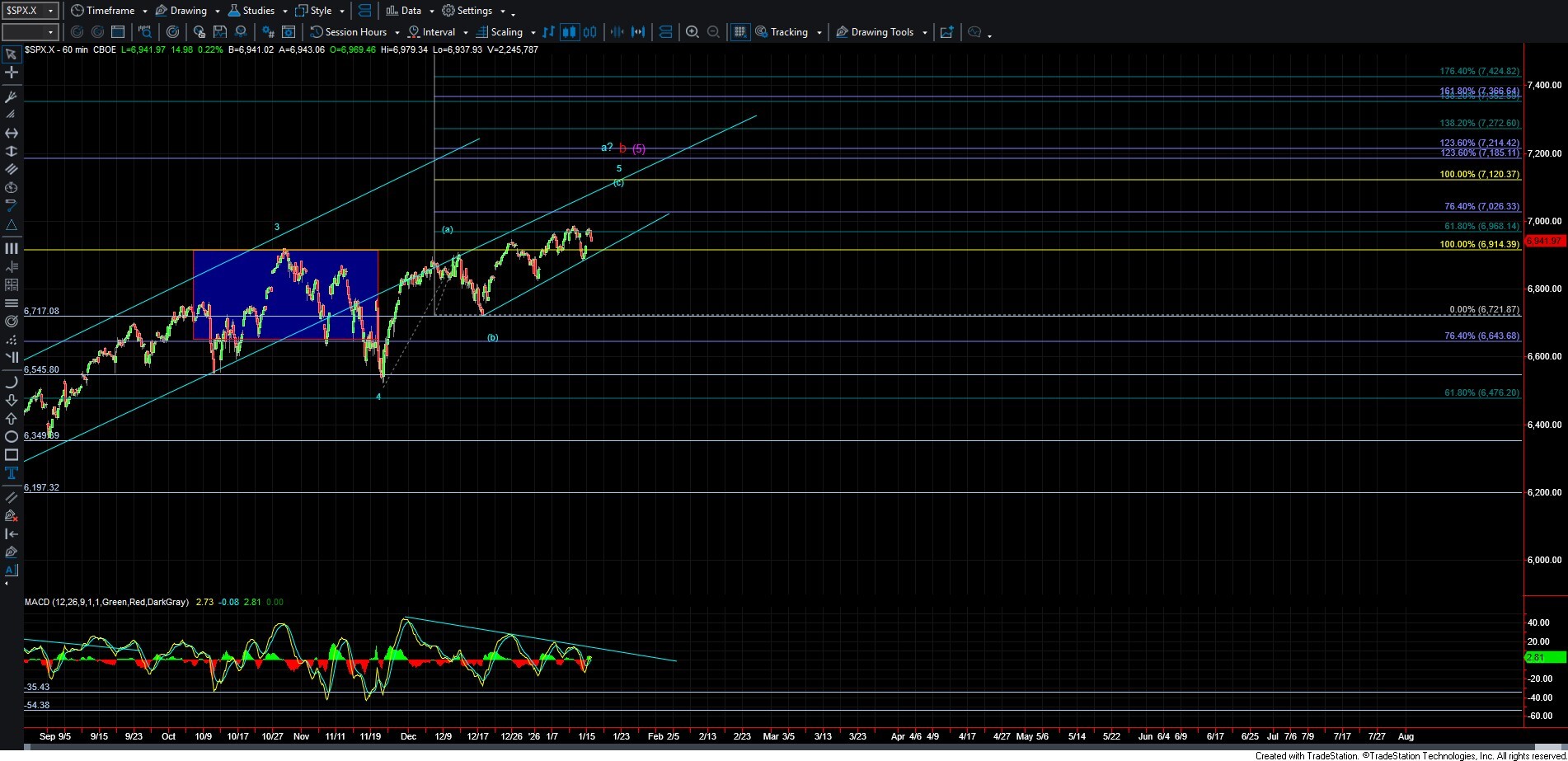

No Breakout for the Bulls Just Yet

Today the market pushed higher and tested the overhead pivot, which, if broken, would have provided a signal that the market was ready to move higher in the weeks ahead. However, as we moved into the close, the market began to break undera key micro support level. If we see a sustained break of this support level then it increases the likelihood that today’s advance was simply a wave b within a larger move to the downside.

While further confirmation is still required with a full five-wave decline off the highs and a sustained break of support, the initial poke under micro support is the first indication that we are unlikely to see immediate upside follow-through.

With the initial break of the 6979 level, the purple b-wave topping count has now become a more probable scenario. At this point, we only have three waves down off the high, so I would still want to see a sustained break of this level, followed by a complete five-wave decline and then a corrective retrace higher to more confidently suggest that wave b topped at today’s high. Should that structure develop, it would increase the likelihood of a break below the 6921 low.

Until we see that five-wave decline, the market remains in somewhat of a no-man’s-land on the smaller timeframes.

If price does break back below the 6921 level, I will once again shift focus to the larger support zone below, which remains in the 6876–6791 region. For now, however, and until that 6921 level is broken, the smaller-timeframe structure remains quite messy in this area.