Nice 70+ Point Squeeeezarooo

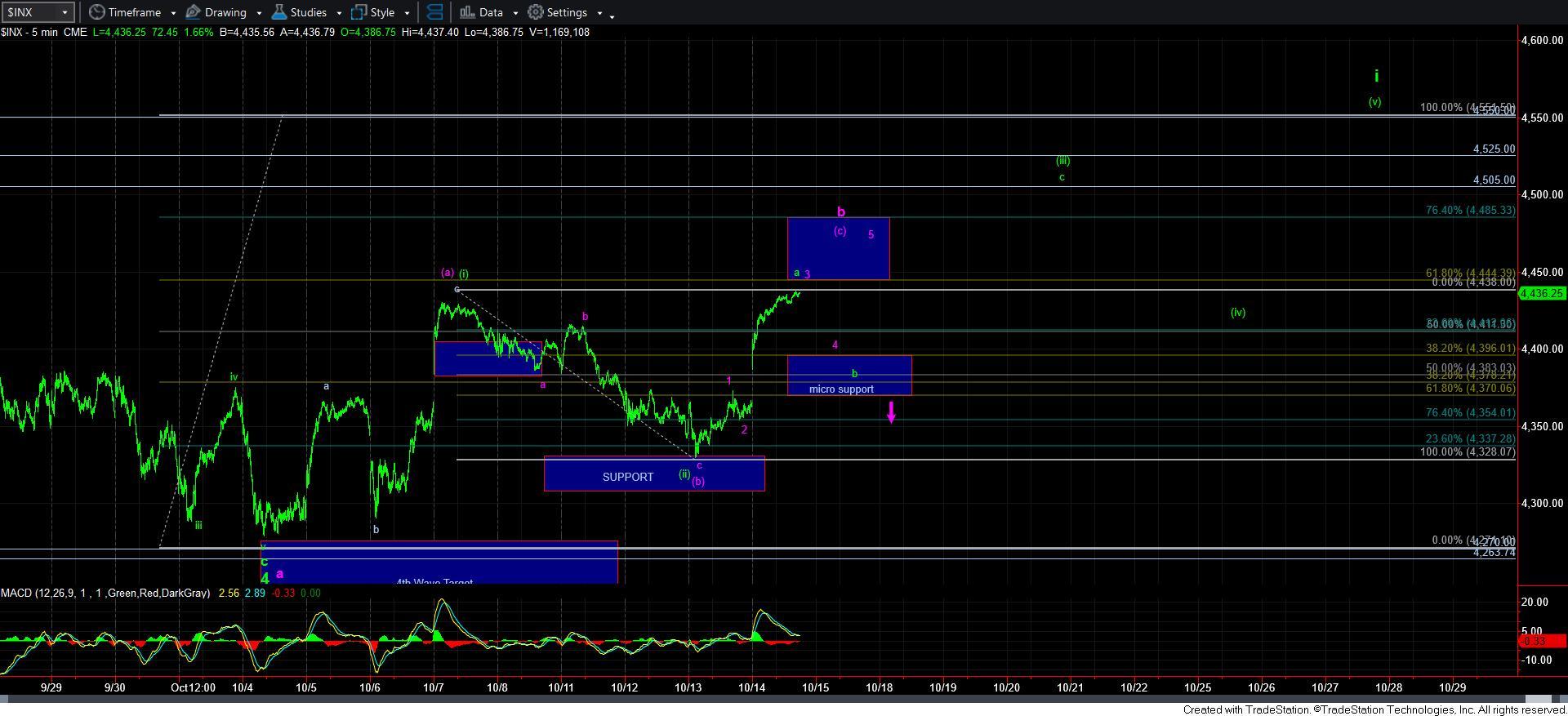

With the gap up and rally today, the market has now taken us to a minimum target I would expect we can see in a b-wave. The current ratio in this rally is b=.764*a, as you can see that we have almost struck the .764 extension on the ES chart. Moreover, we are also approaching the .618 retracement of the a-wave, which is also a standard target for a b-wave rally.

But, to be honest, the rally today counts as a massive 3rd wave within the [c] wave of b, if that is what the market intends up here. Therefore, as long as we hold over the 4400SPX region, I am going to be looking for a 4-5 to complete this [c] wave, as outlined on the 5-minute SPX chart. A break down below 4400SPX would suggest one of two things: 1 - Either the b-wave has concluded at the .764 extension and .618 retracement of the a-wave; or 2 – the market intends to trace out the leading diagonal outlined in green.

Let’s discuss the leading diagonal for a moment. If you remember, the only “impulsive” structure that breaks down into 3-wave substructures in all 5-waves is a leading diagonal. Therefore, wave [i] was comprised of an a-b-c structure, and now wave [iii] should also be comprised of an a-b-c structure. Therefore, a break down below 4400SPX would have me watching the micro support box on the 5-minute chart quite carefully. A corrective pullback into that support will suggest we can begin a rally to the 4515-20SPX region, since a 3rd wave in a diagonal often targets the 1.236 extension of waves [i] and [ii]. However, an impulsive break down below that support box tells me that the b-wave has concluded and we have begun the c-wave, with a target in the 4165SPX region, wherein a=c.

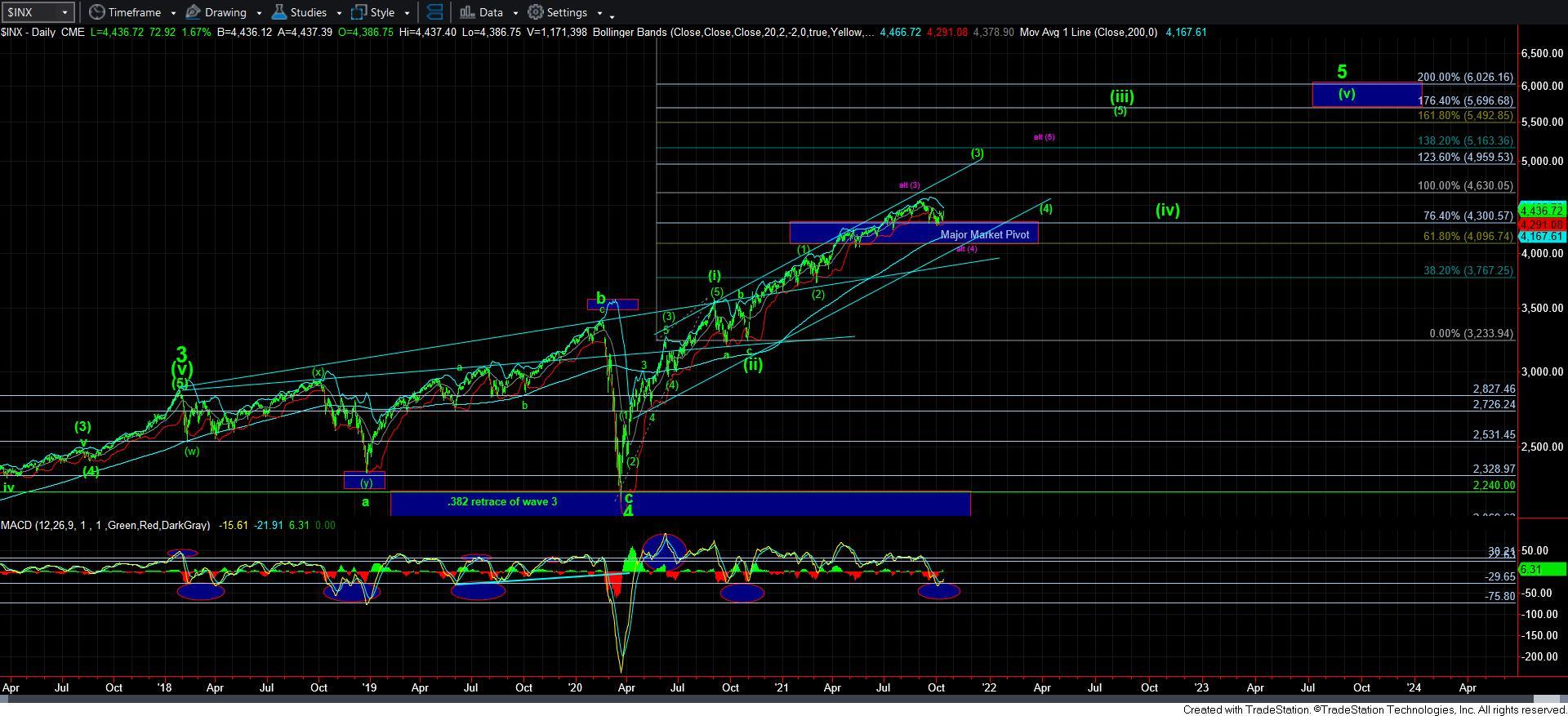

The commonality between the various counts we are tracking now is the micro support box on the chart. Therefore, it will now take an impulsive break down below 4370SPX to suggest the market is dropping in a c-wave pointing us to the 4165SPX region. And, until such time that we see such a break down, there remains a bullish potential on the chart. I intend to give the bulls some room here to prove themselves. After all, wave 4 did strike the minimum target we outlined even before this pullback began, and the market went into an extreme oversold condition which can support a rally of 600 points.

But, I am not going to give the bulls a lot of rope on this one, since I do not trust leading diagonals, especially at this point in the structure. The reason is that they look exactly like a corrective rally at this point in the structure, which makes them very hard to trust. But, since we have a very objective support point upon which we can focus our analysis, I think I can afford them that much leeway.

Should this current rally push a bit higher into tomorrow, then the micro support box will also rise commensurately, as it is based upon percentage retracements of the current rally.

For now, I am going to give the bulls some room to work their magic. But, an impulsive drop below 4370SPX will have me looking 200 points lower.