Never Count The Bulls Out Until They Prove It

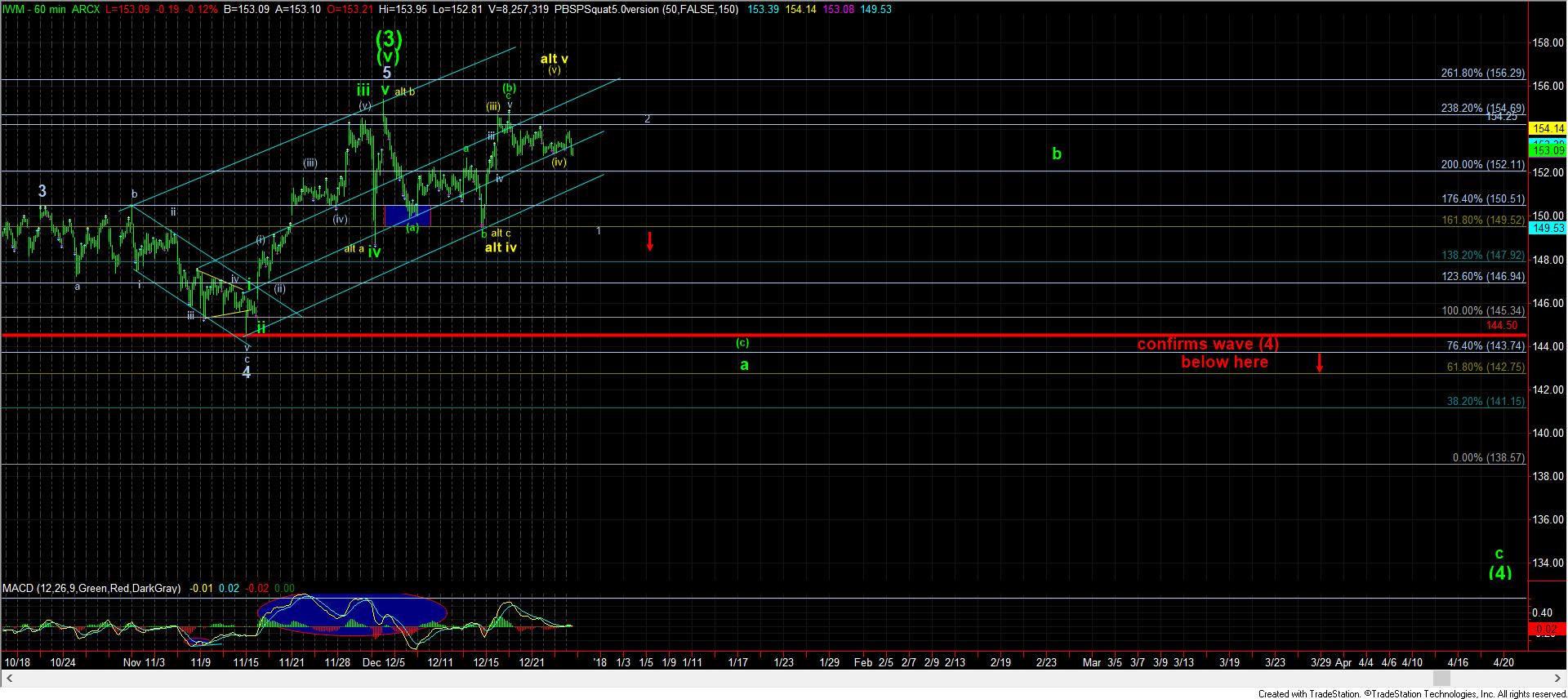

With today’s action, I am seeing many more impulsive structures to the downside on the RTY/IWM than I am on the upside. That makes me question how long this market can continue to levitate.

But, for anyone who has been involved in this market for the last two years, the one thing you cannot do is count the bulls out as long as we remain over support. And, as long as we remain over support, the bulls have been able to follow through to higher highs. Will this time be different? Well, I am an analyst and not a prophet. But, I can tell you what levels need to break to suggest the bulls will be resting for a bit.

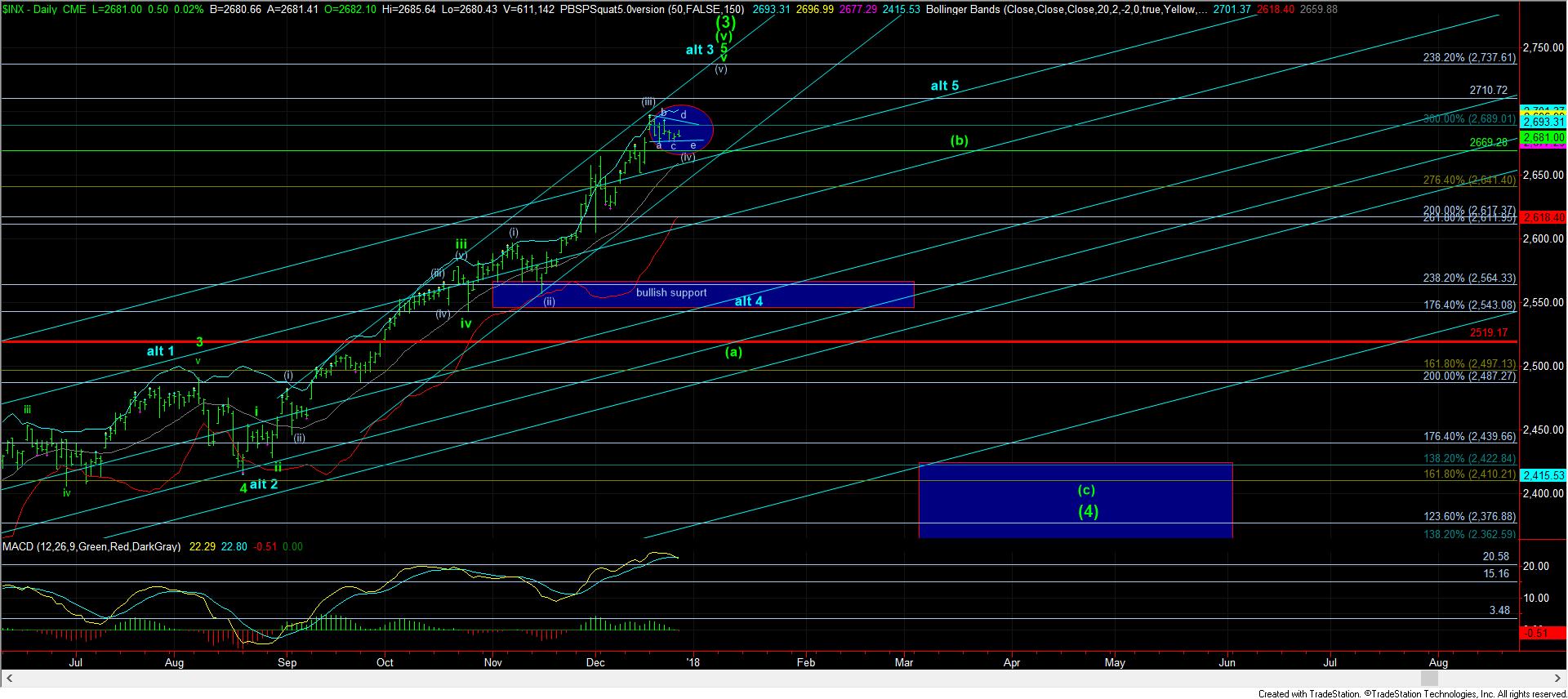

As I have been posting, support has not yet been broken, so the market has the opportunity for one more swing higher into year end, or early next year, before support much lower will be tested. But, I still question whether the IWM will join in that rally to new highs based upon the recent action we have been seeing.

For now, upper support is 2667-74SPX. We will need to see a sustained break of that support to open the door for the SPX to drop back down to the bullish support in the 2545-65SPX region.

In the IWM, the relevant supports reside first at 152, and then 149.50. A sustained break of 149.50 opens the door to dropping back to the November lows in the 145 region to complete the (a) wave of wave (4).

In the XLF, we still need to break below the 27.63 to suggest that its wave 4 of (v) of (3) is in progress. And, if you may remember, the XLF is the one chart that strongly suggests that the market may continue to levitate until March before the bigger drop for wave (4) is seen later this spring.

So, not much has really changed today. The market continues to levitate over upper support, and until such time as it breaks such support, it leaves the door open to one more push higher into early January before any pullback of note may be seen. But, should support break sooner, which seems to be what the IWM is telegraphing of late, then please make sure you know the game plan and the levels to watch.

And, lastly, remember that this is a bull market and will likely continue to be such for several more years. While we will certainly have pullbacks along the way (despite the common disbelief right now), the market is likely heading over 3000 in the coming years so know where you want to be buying those BIGGER dips for the next major rally we will likely set up later into 2018.