Need Turn Down For (c) Wave

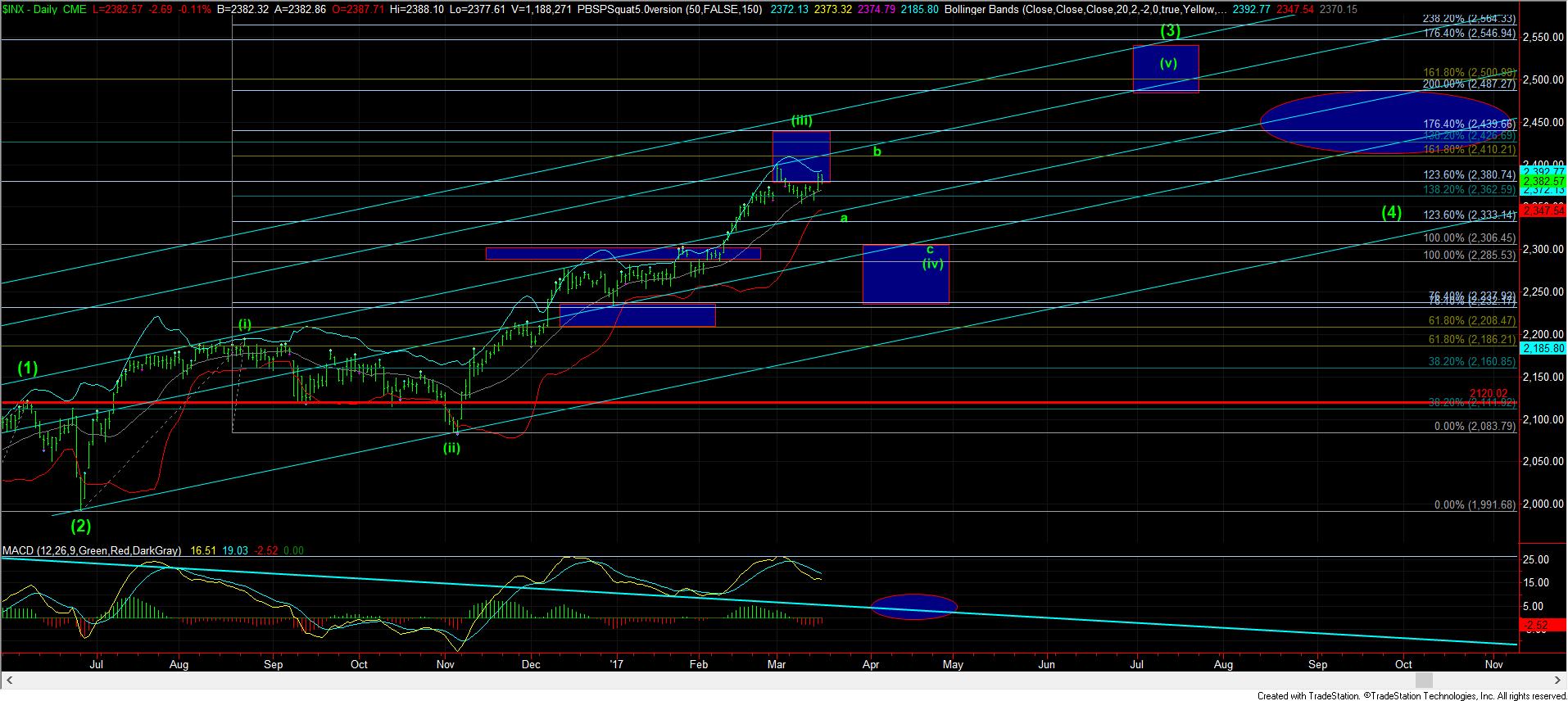

While we have certainly come up to the target we had for a (b) wave this week, if this is the appropriate way to count this correction then we will need to see an impulsive turn down in a (c) wave beginning quite soon. That is how our primary green count is presented on the 60 minute chart.

However, in the alternative, if the market has the intention of heading higher to complete the b-wave sooner rather than later, as presented in the yellow count, then we will not likely break below the 2367SPX level, which is the .618 retracement of the recent rally. This potential is presented on the attached 5 minute chart.

While my primary is still the green count, if we do not see evidence of an impulsive decline beginning shortly, then I may have to move into the yellow count, and will present an alternative at that point which would suggest that the new all-time high we make is actually the wave (iii) high, and it would add complication in where to buy for the wave (v) rally into the summer. But, we will cross that bridge if we come to it.

For now, I am going to be patient in allowing the market to show us the direction lower, or telling us we are heading to higher highs first. And, again, remember, we are likely in a 4th wave, which is the most variable of all the Elliott Wave structures.