Moving The Pivot Up

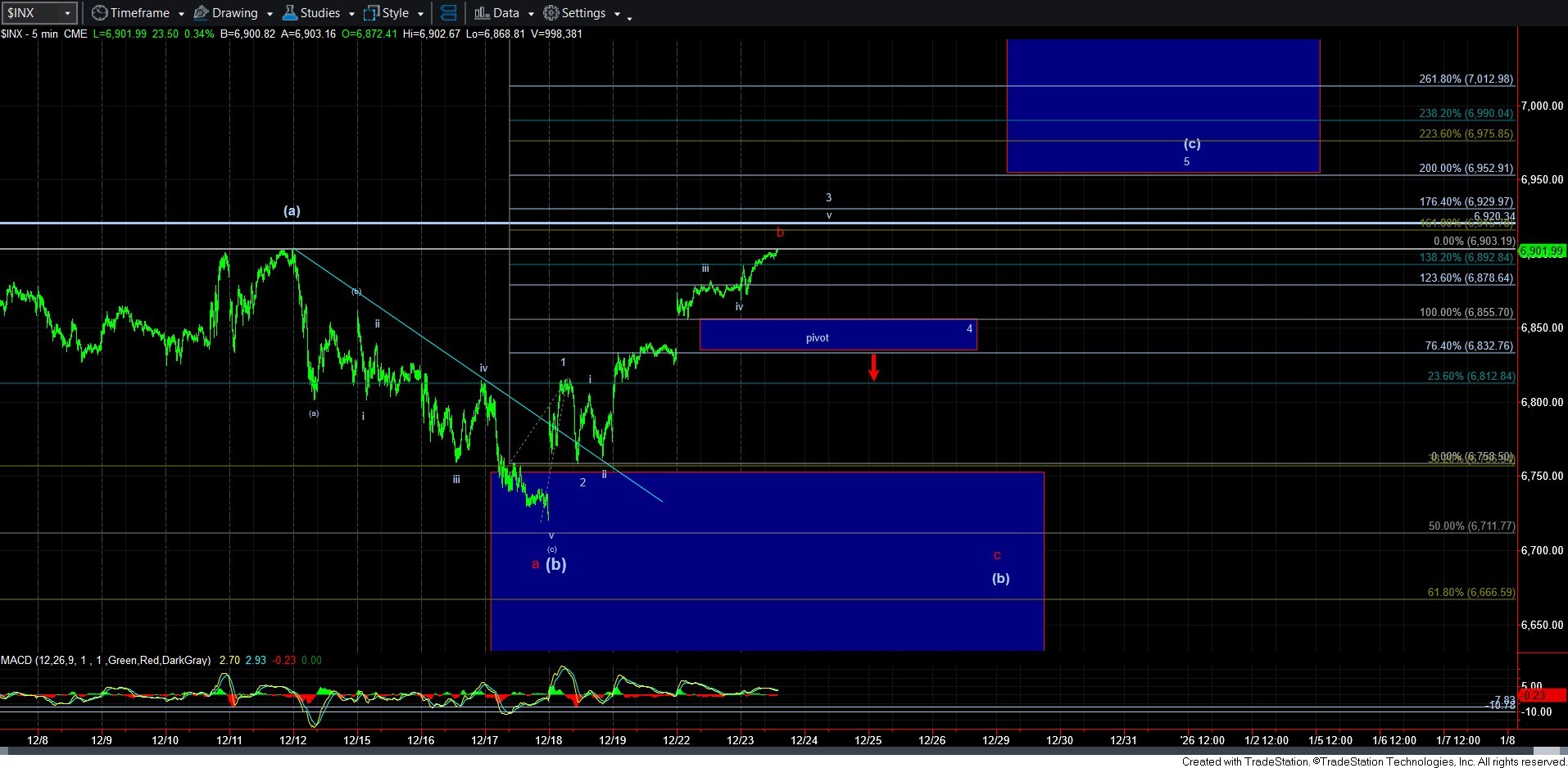

With the market seemingly completing the wave iv of wave 3 in the bullish count with a pullback this morning to the 1.00 extension of waves 1-2, the market seems to be rallying in wave v of 3. The typical target for that wave degree is the 1.618 extension of waves 1-2, which is the 6915SPX region.

However, with wave iv of 3 only pulling back to the 1.00 extension, it does open the door that we can see an extension in wave v of 3. But, even if we do, I am still not seeing much to suggest we will see an appreciable push through the 6950SPX region. But, we will see how extended wave v of 3 becomes before we make any final determinations regarding wave 5.

In the meantime, I have moved the pivot up to the next Fibonacci Pinball levels. If the market were to break down below that pivot in impulsive fashion at any time before we complete 5-waves up, then it can still can suggest that the red c-wave down can take us back towards the .500 retracement region just north of the 6700SPX region to provide us with a (b) wave flat.

So, again, as long as the market maintains to hold over the pivot, I will continue to look higher to new all-time highs, with an ideal target at the 2.00 extension in the 6950SPX region. Should we see further extensions in wave v of 3, this could extend this target a bit closer towards 7000SPX.