Moving Support Up Again

With the market continuing to grind higher, it makes me more and more cautious the higher we go. But, I assume you have gathered that from my analysis over these last few weeks.

Yet, as the market goes higher, it raises the support below us. And, until that support is broken, we have no indication that any top has been struck, despite recognizing how stretched this rally has indeed become.

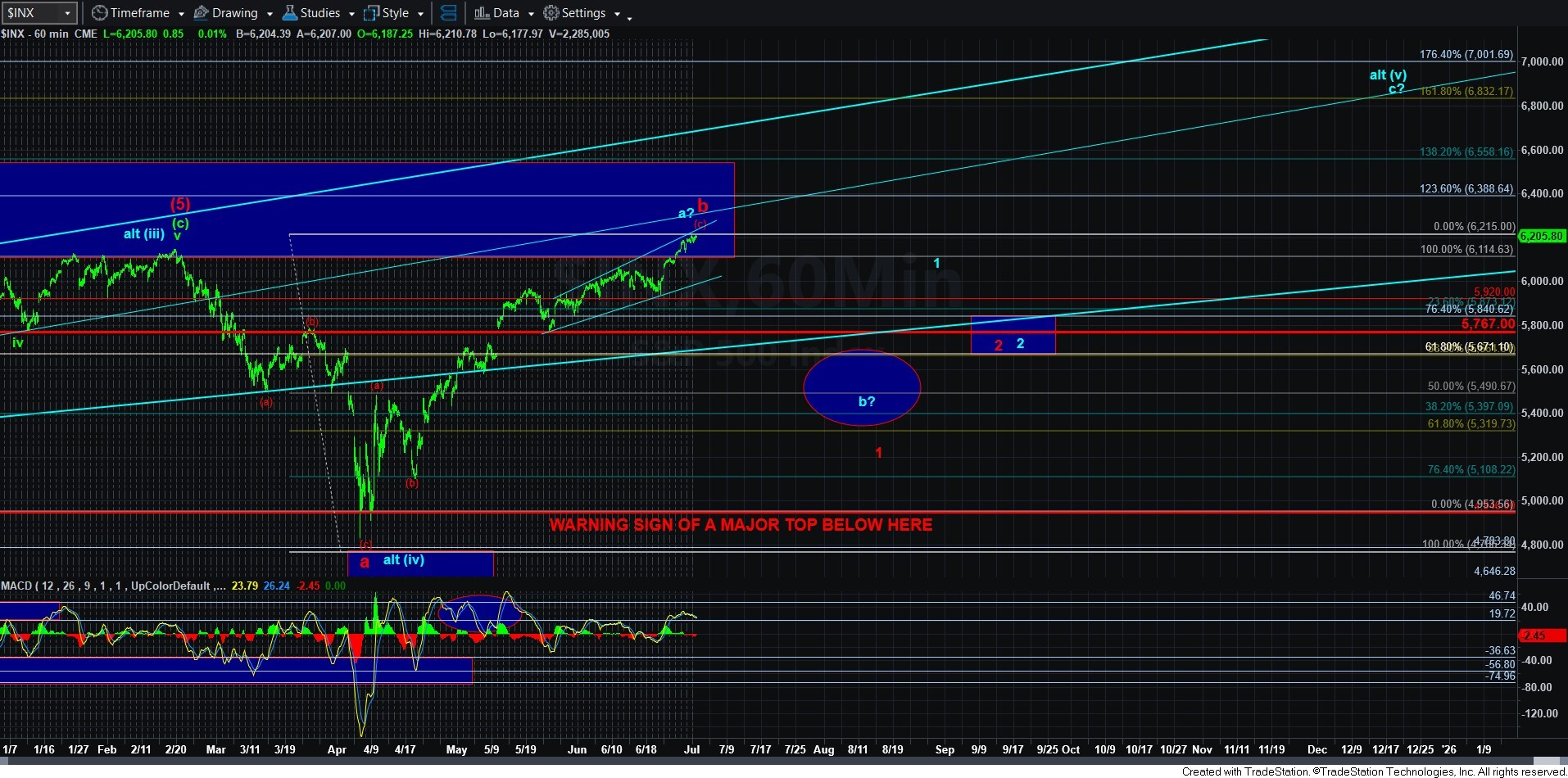

So, with the action over the last 24 hours, I am moving our support up to the 6110SPX level. We would need to break that support and follow through below 6080SPX to suggest a top has indeed finally been struck. But, as I have been saying many times, we will need to wait until we see a break of 5920SPX before we can really assess the nature of that decline in a more reliable manner in order to make a reasonable determination as to how we should treat the last half year in 2025.

Just to reiterate once again, should that next decline be clearly corrective, then we will apply the blue wave count path, and prepare for a rally that takes us into the end of 2025 for the c-wave. However, if that decline is clearly impulsive, then I will be preparing for what can be a sizeable decline into the end of the year. For now, I cannot add more insight than that.

There is one more point I would like to make. I am getting a number of questions about "what if we go directly to 7000?" Well, of course, that is certainly "possible." But, I want to reiterate that our focus should be on what is most probable, and I do not see that potential as anywhere near a reasonable probability at this time. The more probable path towards 7000 still likely provides us with a sizeable pullback, and that is even assuming that that market is going to choose the blue count path. But, we won't have an answer to that question until we analyze the structure of the probable pullback.