Morning Update - Market Analysis for Dec 14th, 2023

We are just about out of room on this yellow count we have been tracking. And, to be honest, I do not ever recall a move of this magnitude that did not have AT LEAST a .236 retracement. This one has not even had that. In fact, even the rally off the 2020 low approached .382 retracements, and certainly had .236 retracements. So, this is considered a major outlier which is completely unforeseeable at initiation.

You see, when we track markets we use objective standards which apply the great majority of the time. Yet, sometimes the market chooses to move outside those standards in the minority of the time. And, sometimes it causes us to miss some market moves. Yet, the other side of that coin is that those standards keep us safe and provide appropriate risk management, which is what is most important in keeping us in this game.

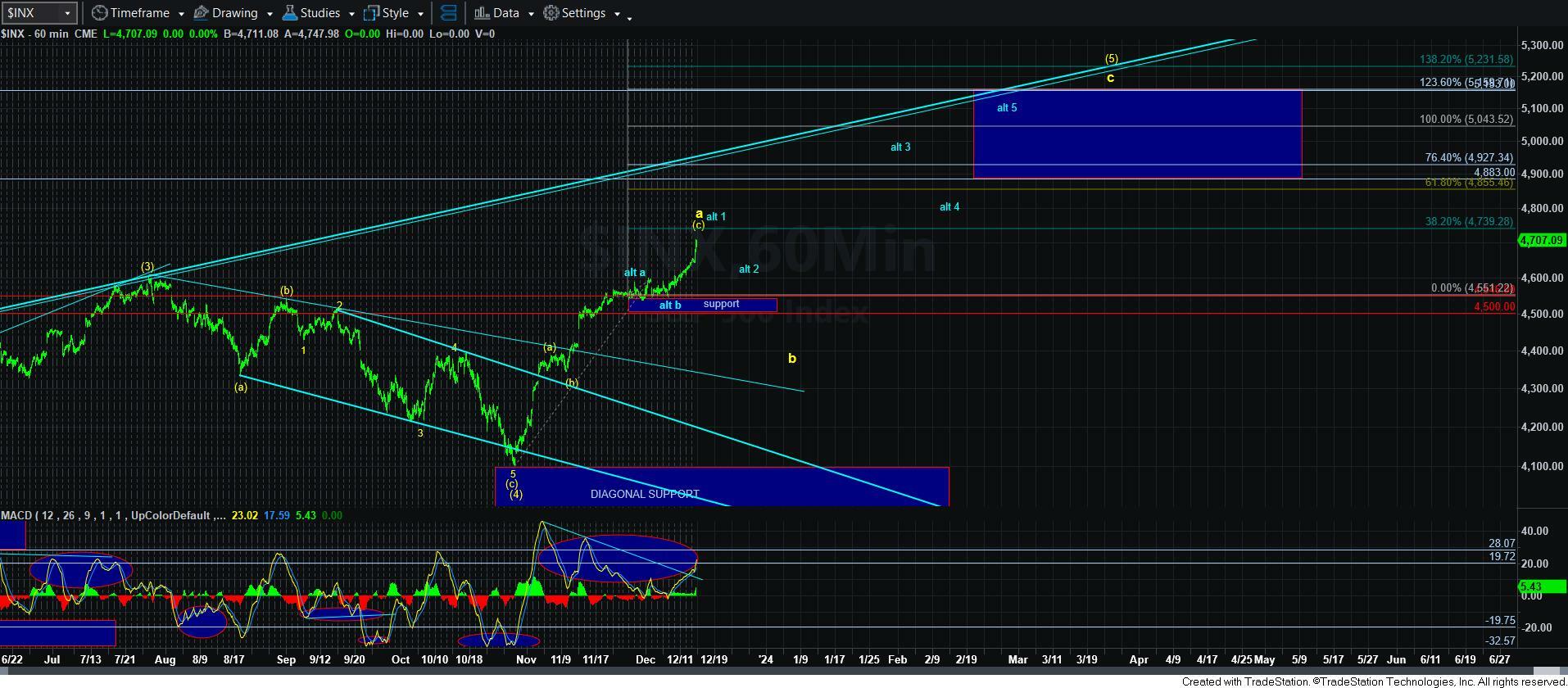

So, as it stands today, I am viewing this move up as a VERY extended 5th wave to complete the a-wave, as shown on the ES chart. However, due to how high we have come, I am going to have to track the alternative noted in blue on the 60-minute chart. And, both of these scenarios strongly suggest some pullback should be seen.

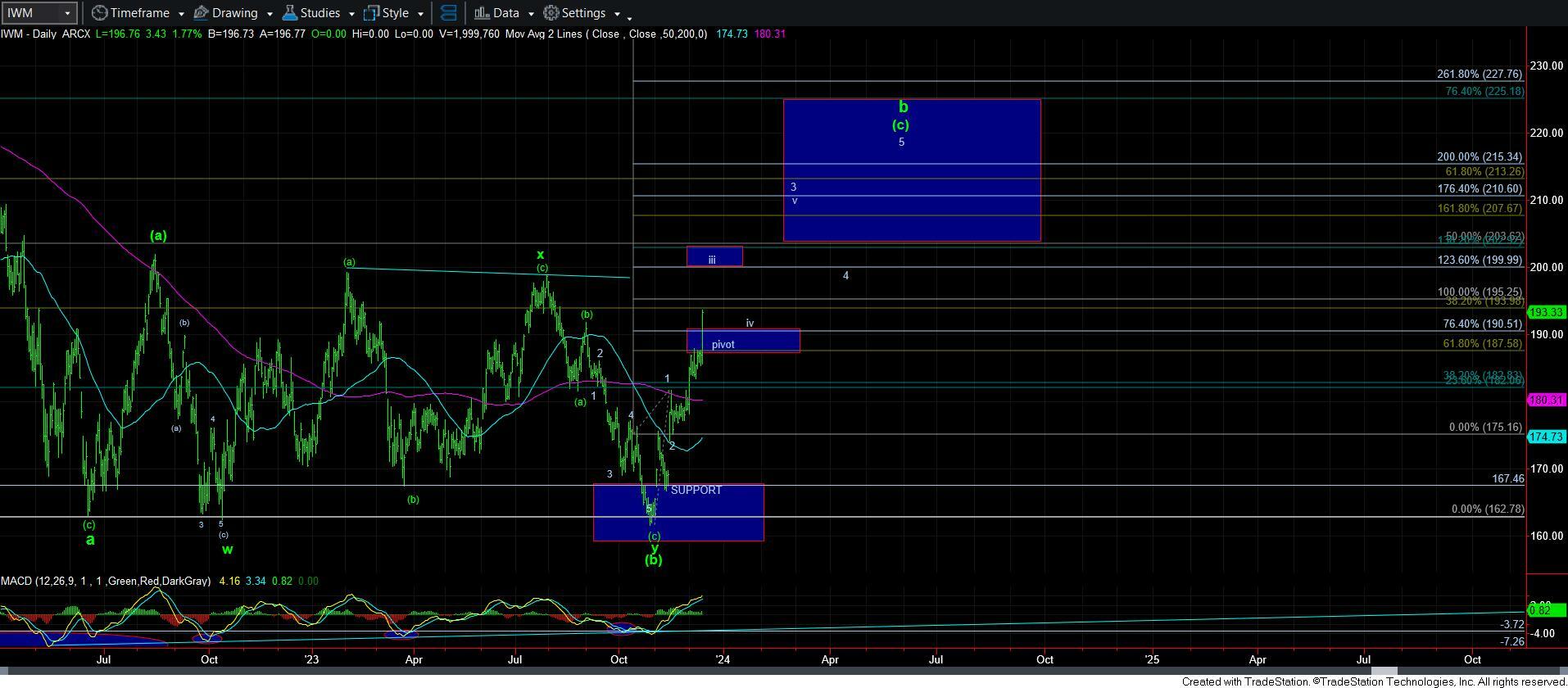

Moreover, I have also begun to track IWM again in order to see if it can give me further guidance. So, I am looking for a pullback towards the pivot in the coming week or two. Assuming the pivot holds, then you can attempt a trade with a stop at the bottom of the pivot, and look for a rally in wave v of 3. If the pivot breaks and you stop out, then the rally to the box overhead will likely take shape as an a-b-c more complex structure and you can buy a long from a lower level.

So, I still think it is reasonable to expect a pullback. The nature of that pullback is yet to be determined. Unfortunately, we are dealing with an outlier type of move thus far.