More Appropriate 4th Wave

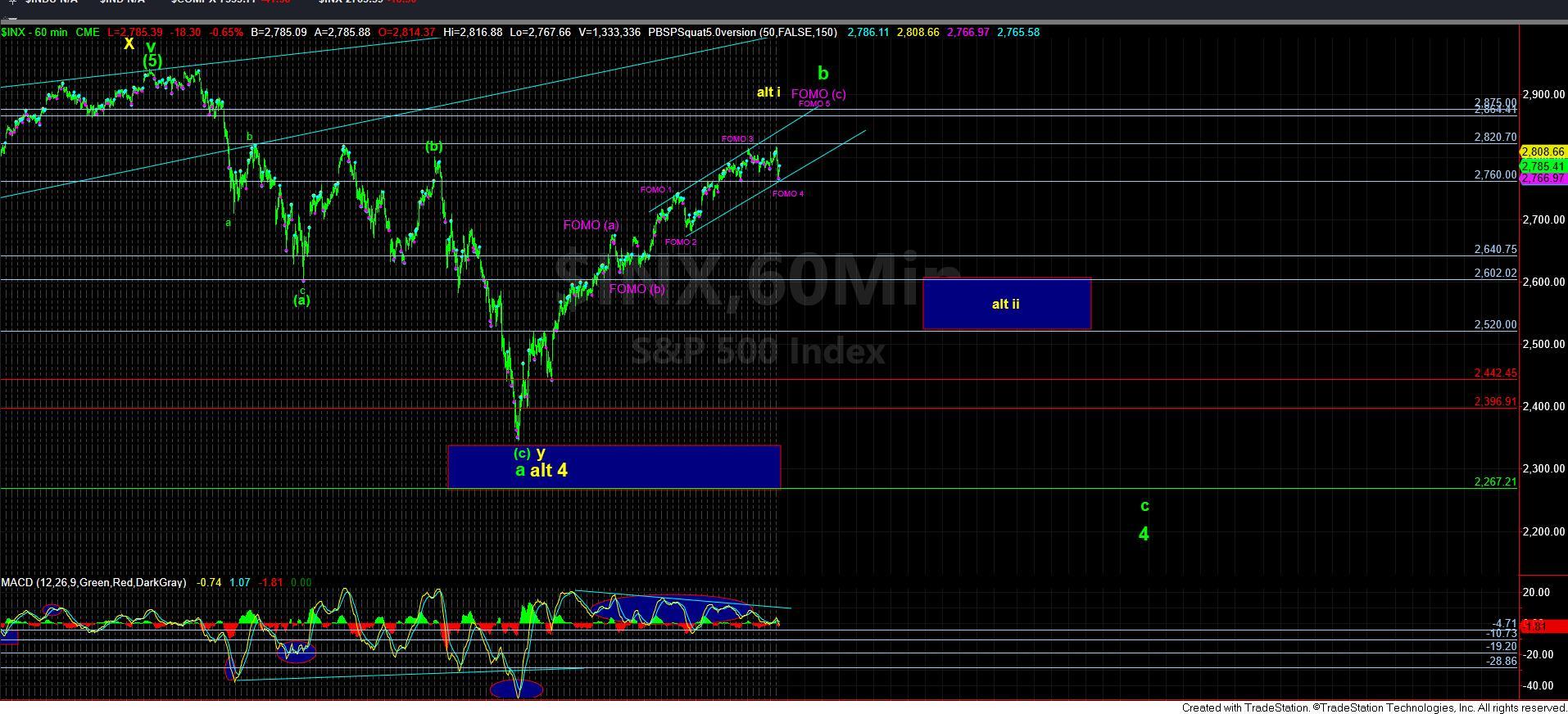

Until today, I have been struggling with the potential that all of the FOMO wave 4 had completed last week. As I had noted many times, it really seemed too small, with the IWM suggesting it had not completed.

With today’s downside follow through, we now have a much more appropriately sized 4th wave for this [c] wave structure. And, as long as any further weakness does not break us down below 2755SPX (in fact, we really should not even break 2760SPX), then I am still looking for a 5th wave pointing towards the 2875SPX region.

Other than that, there really is nothing more for me to add to the weekend update. In the bigger perspective, as long as we do not see a sustained break of 2750SPX, we still can fill out a 5th wave to our target box overhead.

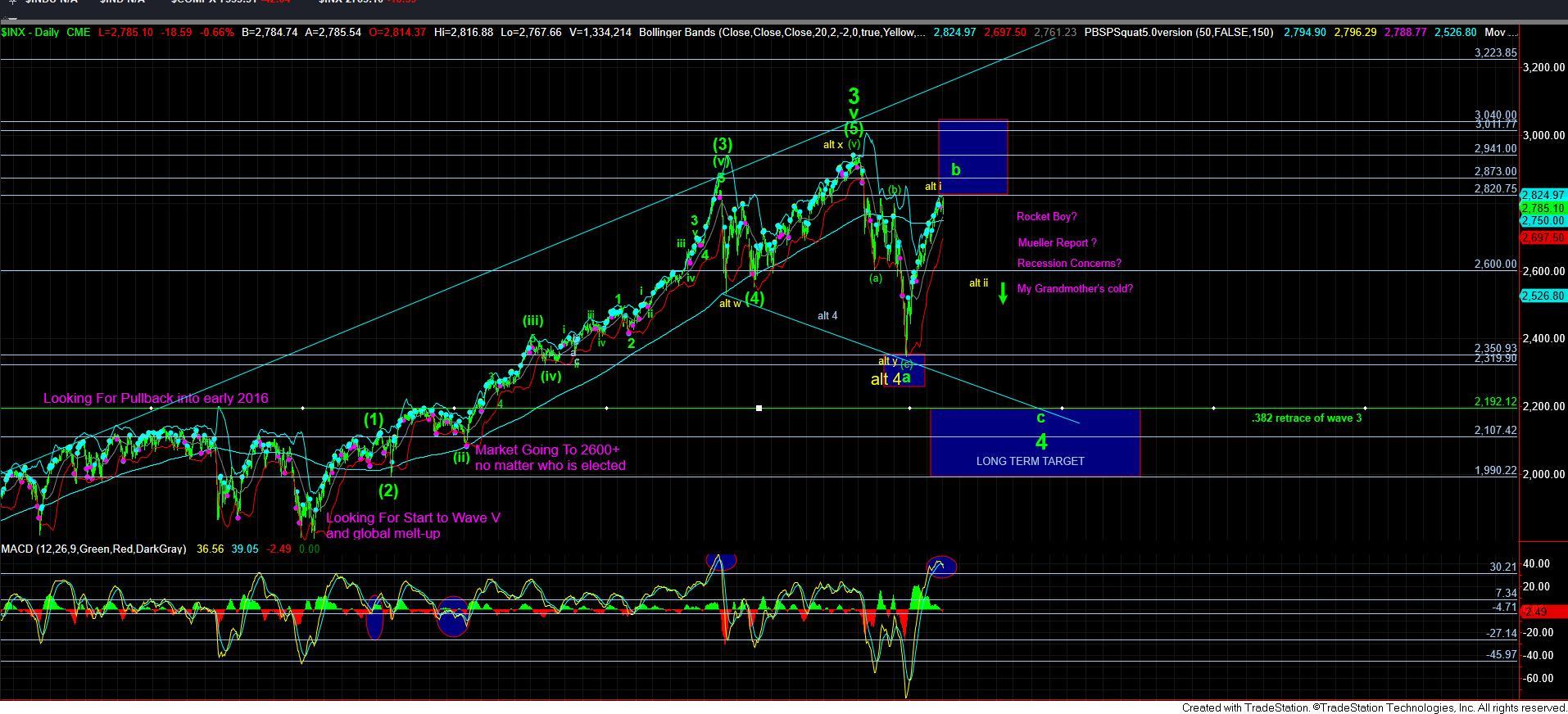

There is one thing I would like to note though. Similar to what was seen in the rally which topped out in January of 2018, it seems that short traders have now been appropriately punished by this rally, to the extent that shorts are quite scarce at this time, especially relative to what we have seen over the last several months. That suggests that we have a vacuum below the market right now, which could see us repeat the action seen in February of 2018 once the market strikes its top. That supports the premise that we are completing an ending diagonal for the [c] wave of the b-wave, which then points us back down to the 2600-2640SPX region in a rapid descent once the [c] wave completes.

But, for now, we have no indications that a top has been struck as long as we remain over 2750/60SPX support, which still leaves the path open to the 2875SPX region in the coming weeks.