Markets See A Rangebound Day

Today we opened relatively flat after moving down in a corrective three-wave fashion last week. Since the open, we have moved higher but are still trading under last week's high leaving the analysis from last week and what Avi noted in his weekend update unchanged on the bigger picture perspective.

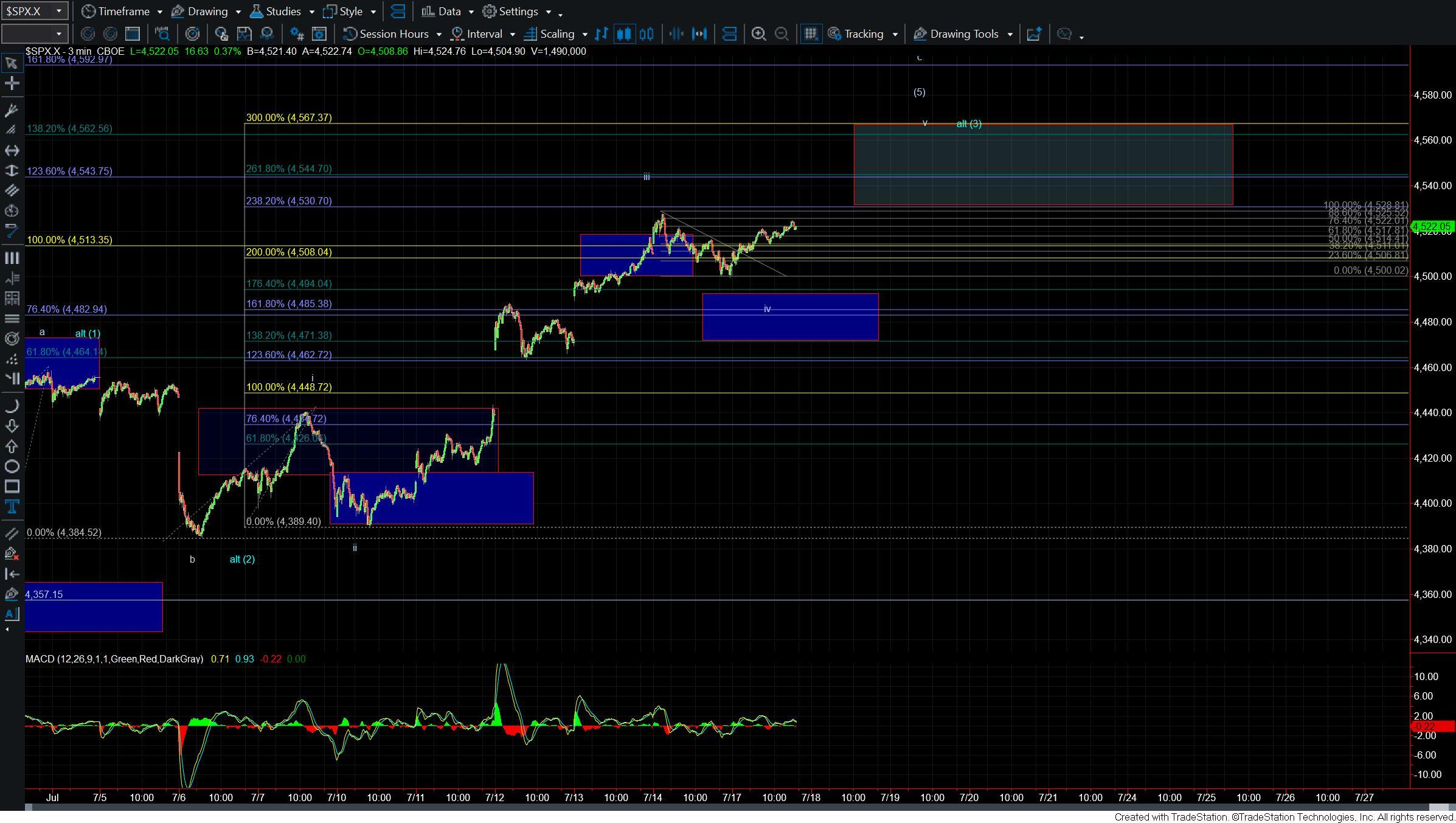

From a more micro level as long as we remain over the 4494-4471 zone the near-term pressure emails up and we have no signal of even a local top just yet. Furthermore, we are now through the 76.4 retrace of the move down off of the highs at the 4522 level which is giving us an initial signal that we are heading higher in the fifth wave up off of the 4384 low which should have the next overhead target zone in the 4530-4567 zone.

Again bigger picture there is really not too much to add to the weekend analysis and the bottom line remains that we will need to see a full five wave move down off of the highs to suggest that we have topped in the green wave b. Unless and until that occurs we simply have no signal of a top in place just yet.