Markets Continue To Consolidate

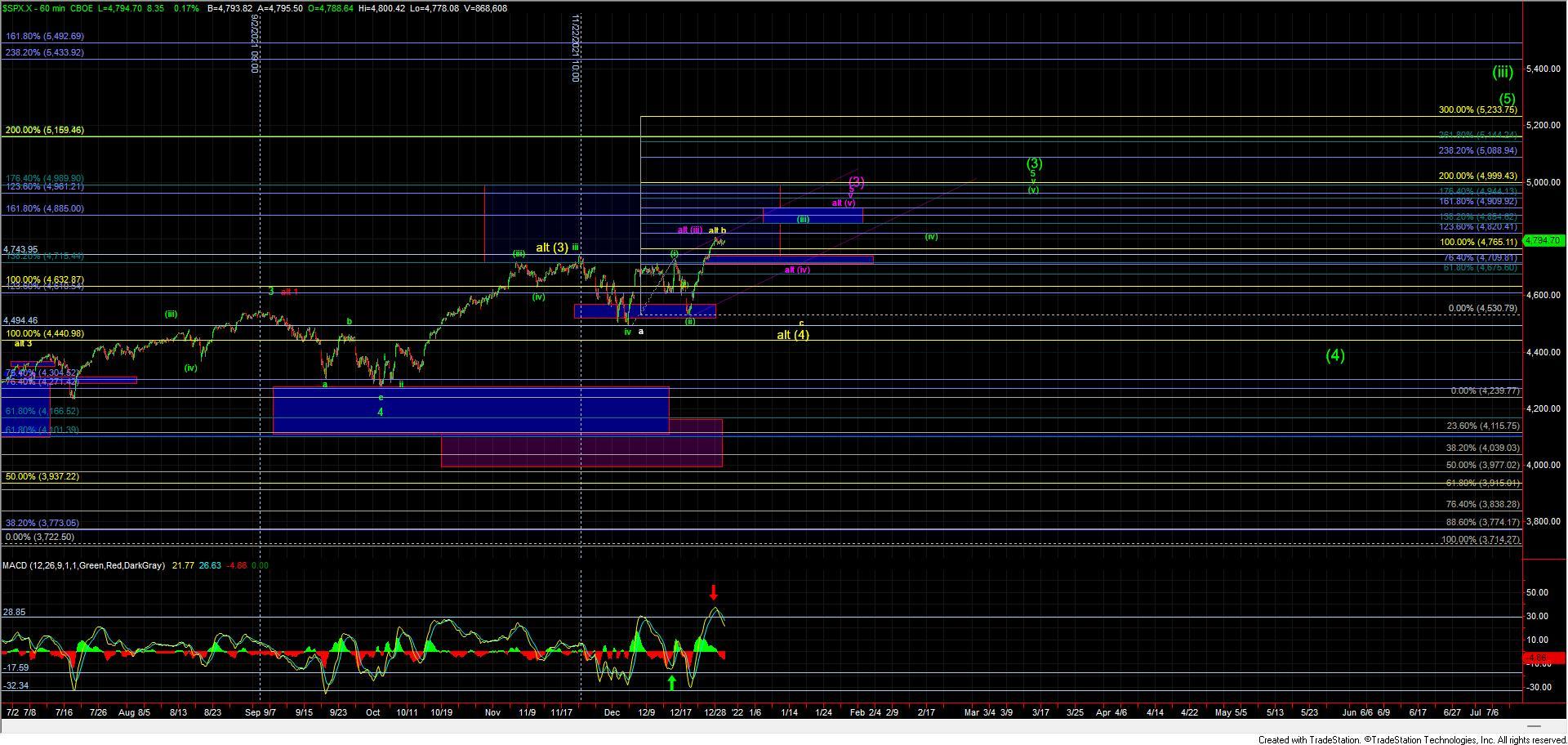

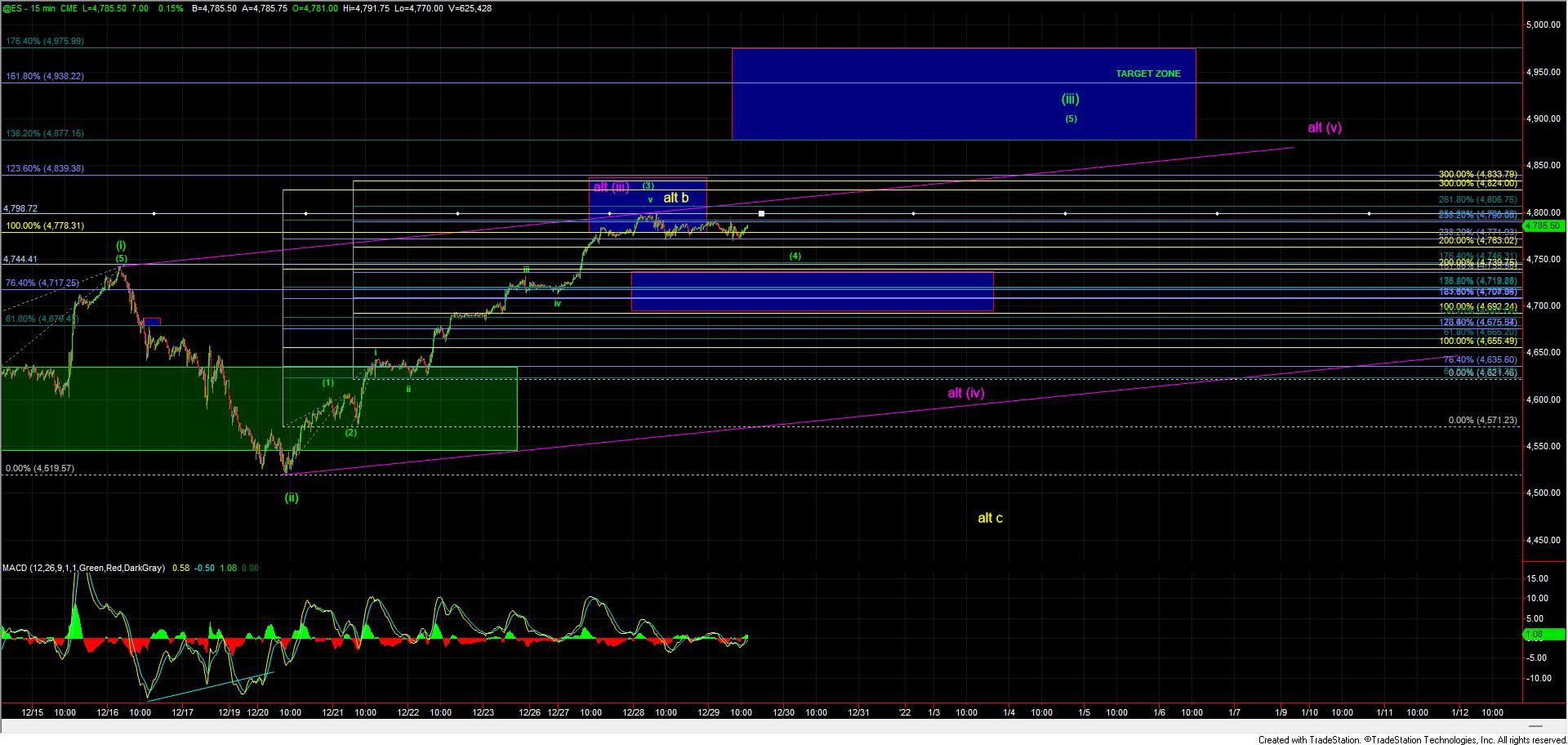

After hitting the target zone for the wave (3) yesterday morning the market has consolidated sideways near the highs for the past two trading sessions. This sideways consolidation and lack of a clear impulsive wave pattern to the downside is quite suggestive that this is indeed part of the green wave (4) rather than either of the two alternate paths that I had laid out in yesterday's update. In fact the flat consolidation is not terribly surprising given where we are within the larger degree context of this move. That being said until we see a full five up off of the lows and/or a break back over the 4798 level on the ES I still can't rule out that we will see another push lower before finishing off the green wave (4). The key for this green count is simply going to be whether we can hold over the 4735-4692 zone. As long as that zone holds then the green count will remain the primary path forward and the near term pressure will remain up.

If that support zone were to break then it would open the door to this having put in a larger degree top as shown in yellow or purple. The yellow path remains unchanged from the previous updates and would suggest that this move to new highs is an expanded or running b wave still needing another push down for a wave c of (4) before finding a larger degree bottom and pushing higher once again. As I noted yesterday, for this yellow path to trigger, we would need to see a full five down off of the highs AND a break of the support zone laid out above. Unless and until we see that occur then it is unlikely that we are following this path. We do not have five down and the action to the downside is clearly corrective in nature. So with that I am not viewing the yellow count as highly probable at this point in time.

The purple path would still need to see the five-wave move up off of the December lows fill out towards the 4900 area however under this case the path would take a more complex ending diagonal pattern vs. that of an impulsive five-wave move. If we were to break the 4692 level but do it on a clearly corrective wave structure then I would likely adopt this purple path as the base case. Again this purple count would still need another push up towards the 4900 area but it would take a more complex and less direct path towards that zone before ultimately topping in that larger degree wave (3). While the corrective push down off of the highs is still leaving the door open to this path the sideways consolidation is not what we typically find in an ending diagonal pattern so I am also not viewing the purple path as highly probable at this point in time either.

So in summary and as noted above the current action since the top that was struck yesterday morning is still very much supportive of the green primary cont. While I have laid out the alternate paths shown in both yellow and purple as of the time of this writing those are just that, alternate paths and I am not viewing them as highly probable at this point in time. So with that, I simply will re-iterate that as long as we are trading over the 4735-4692 support zone the green path will remain the primary path forward and the pressure will remain up.