Market in the Resistance Zone

Today, we saw the market continue to push higher after bottoming on Friday, with the ES trading up over 1.5% at the time of this writing. The price action off Friday’s lows has produced very shallow retracements, making it difficult to get a clean read on the smaller-degree structure. Because of that, I’m going to rely more heavily on the larger-degree support and resistance zones to guide us until we get more clarity on the short-term wave action.

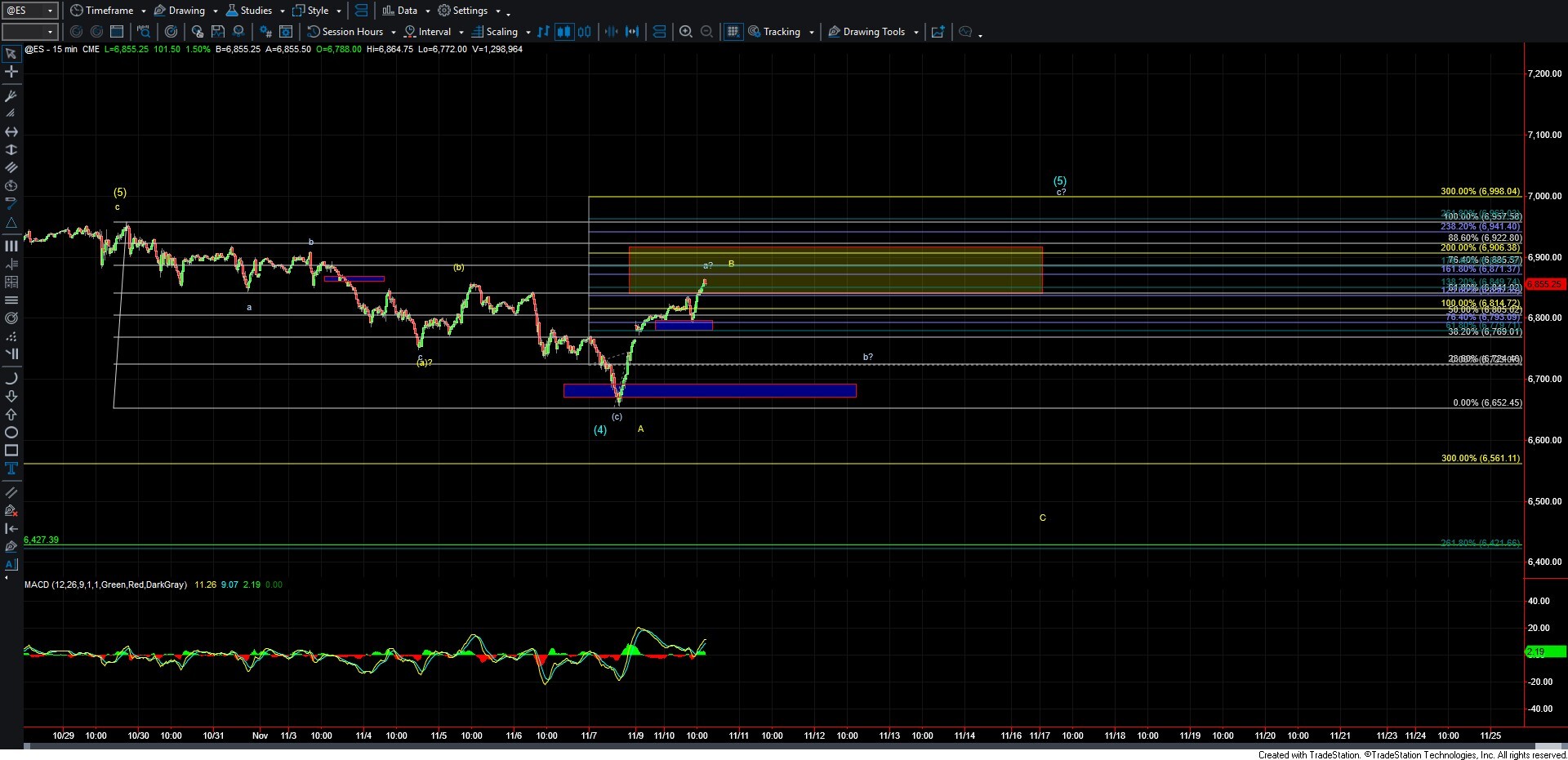

We are currently trading within the larger B-wave resistance zone, which still leaves the door open for a potential top in that B wave. The structure of the next downside move will be key in helping us determine which path we’re following in the weeks ahead, as both the blue and yellow counts remain viable at this point.

As shown on the ES chart, the current resistance zone for the yellow wave B sits in the 6841–6922 region, and we’re currently right in the middle of that range. If we continue to push higher and move through the upper end of this region, it would likely suggest that we’re on our way to new highs as part of the blue wave (5).

Now, we can certainly see a pullback as part of a wave b under that larger wave (5) before moving directly higher. If that pullback unfolds as three-wave price action, it would support the case for another move up in wave c of (5) in the days and weeks ahead. However, if we see a five-wave start to the downside, that would open the door to a direct break lower as part of the yellow wave C down.

We would still need further confirmation that the C wave has indeed begun, which would only come with a break of key support. That support can only be defined once a wave a top is confirmed, as an initial five-wave move by itself only opens the door to that possibility, it’s not confirmation on its own.

So for now, I’ll remain patient with the pattern and allow it to fill out further. We’ll continue to watch how the price reacts as we move through these larger support and resistance zones and pay close attention to the structure of any downside move that develops in the days ahead.