Market Unwilling To Break Yet

I have said many times over that I have no desire to short this market until it provides a solid set up. Each time the bears have had an opportunity, they have not been able to capitalize on that opportunity, and today may turn out to be no different.

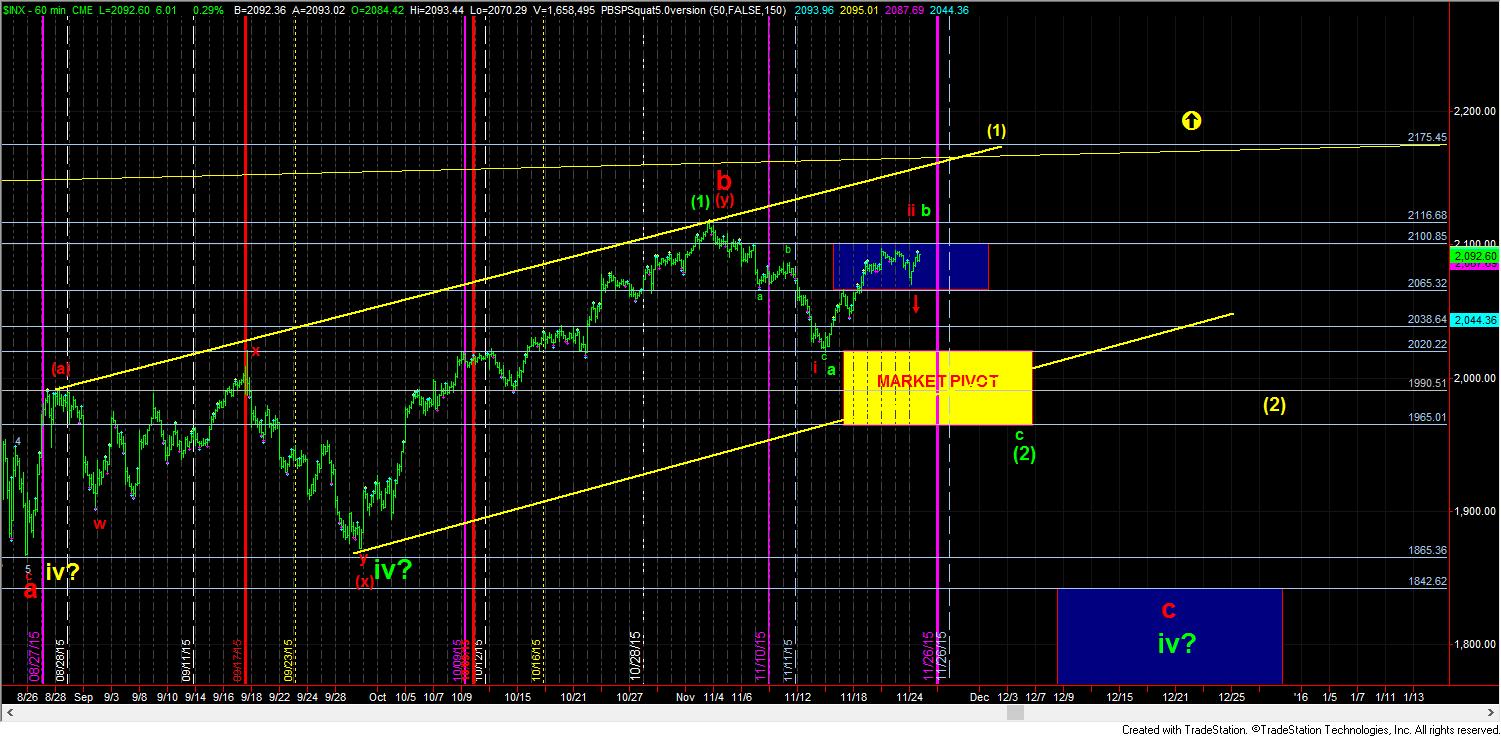

While we had a marginal break of the 2075SPX support, the market did not clearly provide us with a solid impulsive structure down. Rather, the move up looks even more impulsive thus far than the drop. For this reason, I will not be able to consider the downside potential until today’s low is taken out. Until such time, the market can still rally in the yellow count towards the 2140-2175 region.

However, under most circumstances, it does seem as though the market will need a pullback. While we still do not have a strong indication yet which pullback the market will provide us, it does seem likely that we will be revisiting at least the 1990-2020SPX region one more time. The only way I would consider that not to be happening is if the green a-wave on the 60 minute chart was all of green wave (2), which means a strong break out over 2175SPX would have me targeting the 2465 region, minimally. But, right now, that is not my expectation.

For now, I intend to take a bigger picture approach to this market. First, in order to consider any further pullbacks at this time, today’s low must be broken. Furthermore, any break out over 2117SPX would put me clearly in yellow wave (1), with the alternative count being that the green a-wave will be changed to a green wave (2). This would take the red count off the table as the probabilities of it playing out would drop significantly. This also means that a break out over 2117 this week makes this entire market much more bullish, and it becomes quite unlikely that we revisit an 18-handle until all of primary wave 3 completes later into 2016, as you can see from the attached monthly chart.