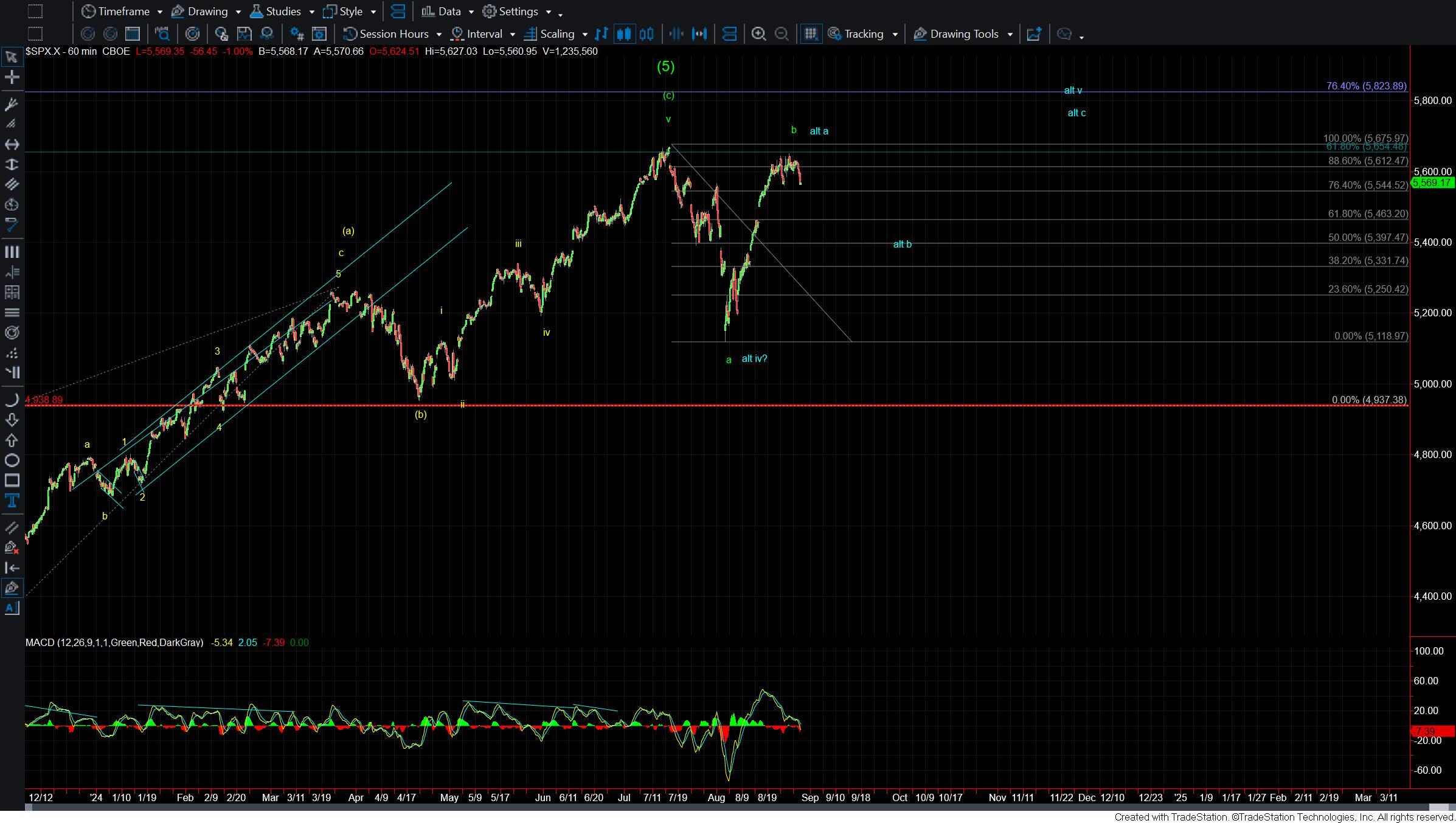

Market Turns Down But Still Over Support For Now

Today we saw the market turn lower and poke under the low that was struck on 8/22. This is giving us enough waves to consider the wave 4 completed ready to push to another higher high to finish off the larger degree pattern. Support still resides a bit lower from here so we still can see a move a bit deeper into that support zone before a bottom is seen. As long as we are over that support zone however another higher high would look best on to finish off this move. Should we see a sustained break of that zone below it would however open the door for a larger top to be in place.

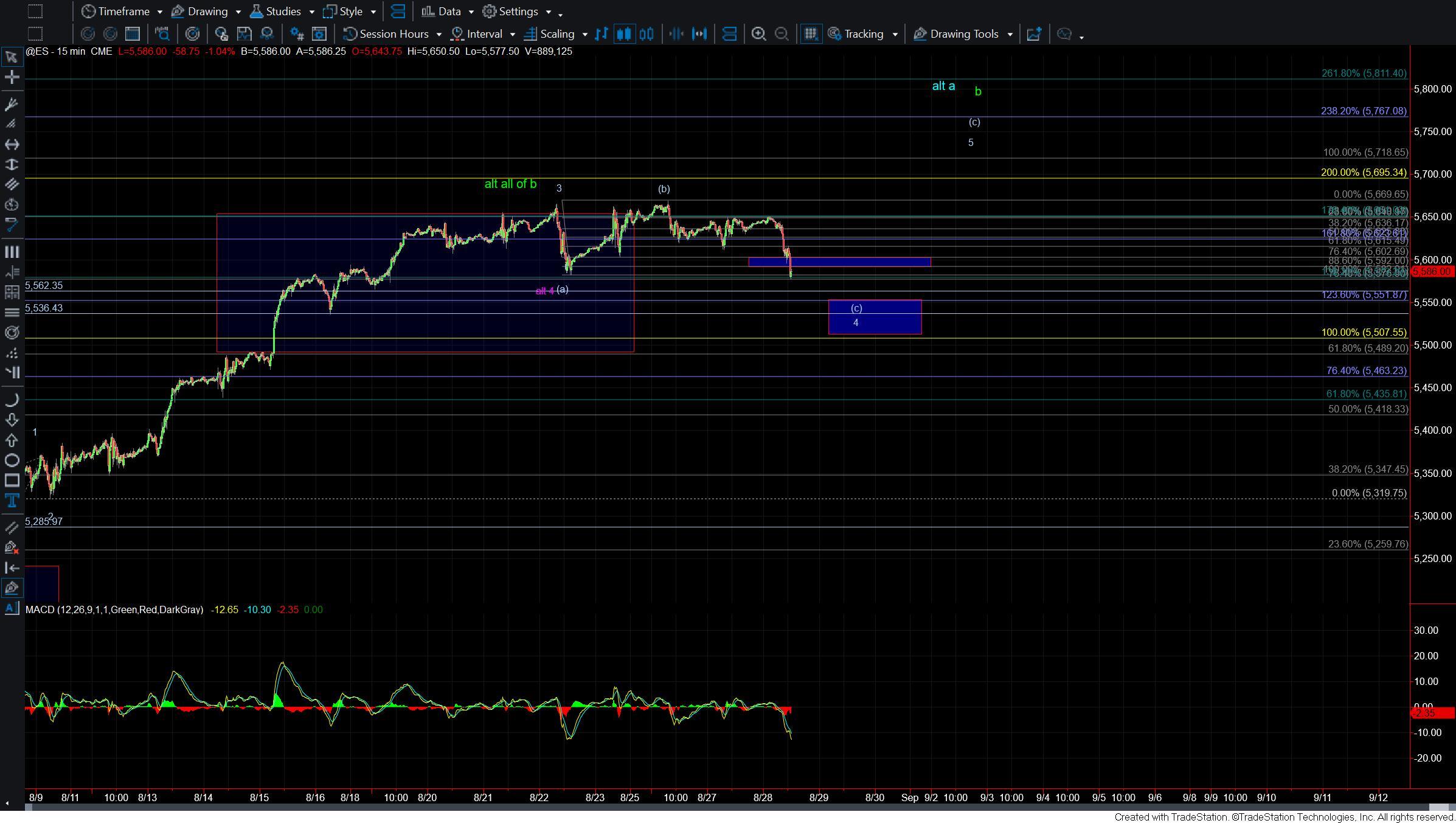

Drilling down to the 15min ES chart support still resides at the 5551-5507 zone. As long as we can hold over that zone the count would look better to see a higher high toward the 5767-5811 zone overhead. We would need to see this break over the 5650 level to give us initial confirmation that we have indeed bottomed and are in the wave 5 up.

If we are unable to hold over support then it will open the door for this to have already topped in all of the wave b but I still would want to see further confirmation of a top with a full five down off of the highs and a break under the 5435 level below.

Bigger picture nothing has changed from the previous updates and we are still looking for either this to be topping in the larger degree wave b or blue wave a. The structure of the next move down will help determine which of those paths we are indeed following.