Market Trying to Make a Decision

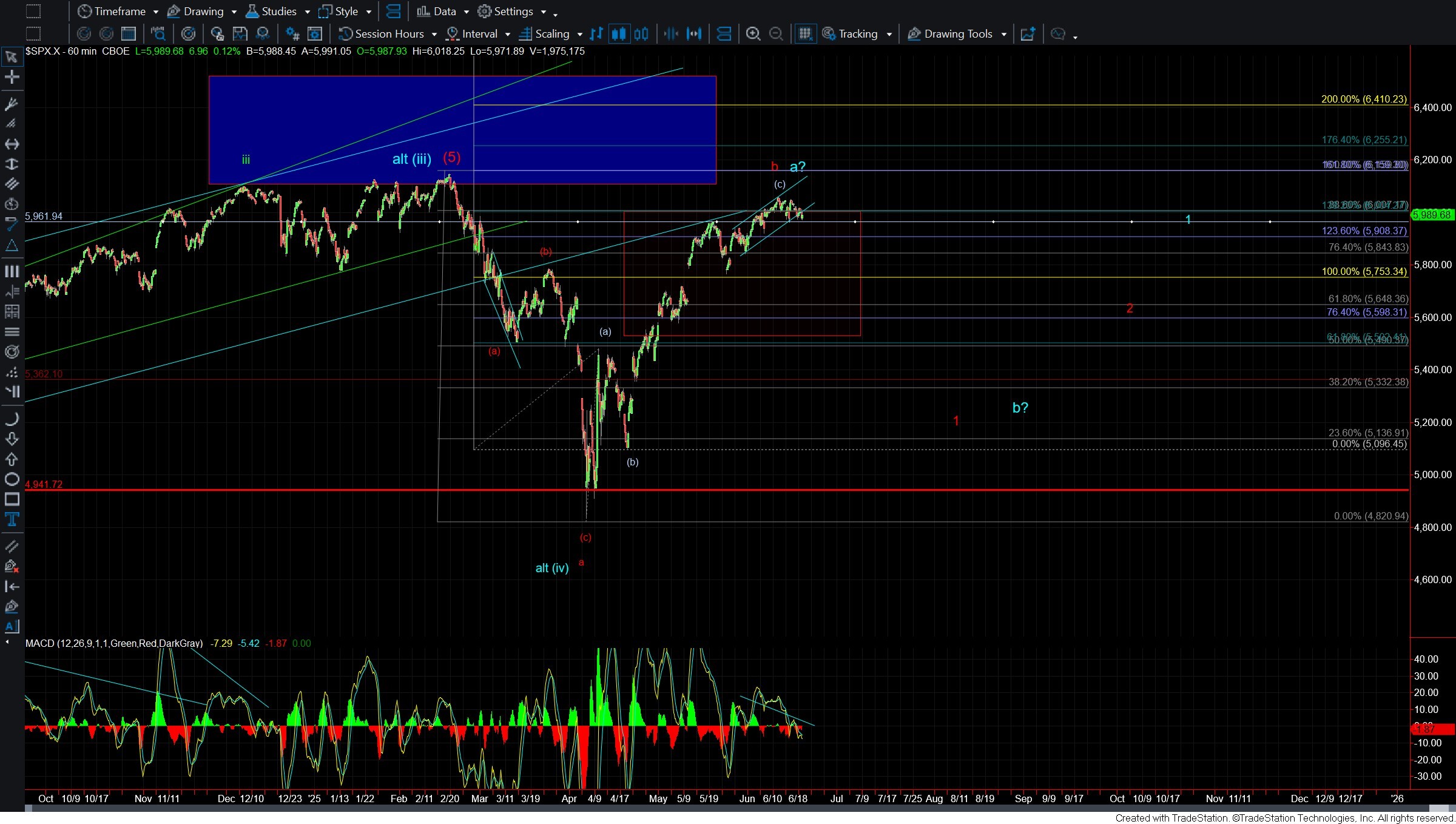

The price action over the past several days has been quite sloppy, and as of the time of this writing, it has yet to make a decision as to whether we are going to head directly lower toward our ultimate Ending Diagonal target at the 5902 level, or if we are going to see yet another higher high before finding a significant top. These paths have been outlined over the past several days and have, for the most part, remained unchanged. Until we see a break of support below or resistance overhead, we will not have confirmation as to which path the market will ultimately take in the near term.

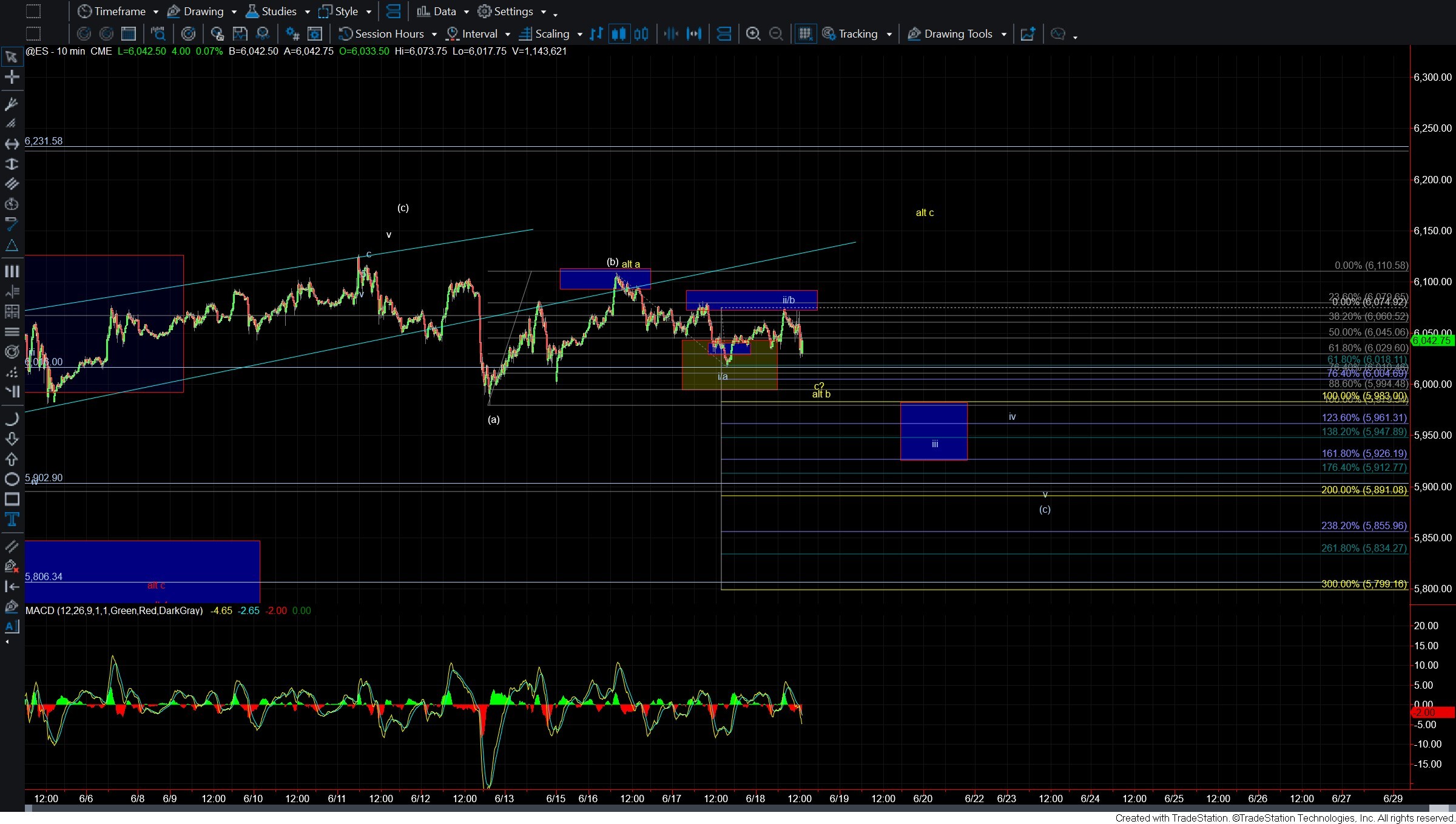

As shown on the ES chart, I am tracing two paths on the smaller timeframes, shown in yellow and white. Under the white count, we would be looking for the market to break back under the 6018 level, followed by a break under the 5994 level, and then ultimately under the 5897 low to give us confirmation that we are going to head in a fairly direct path down toward the 5902 level, which is where the potential Ending Diagonal originated on May 30th.

If we are unable to break those levels but instead break back up over the 6075 and then the 6110 level, then we are likely going to see that higher high as laid out per the yellow count. As long as we remain within those price levels, we are in a bit of no-man’s land on the smaller timeframes, with what again is very sloppy price action on these smaller timeframe charts.

Bigger picture, nothing has changed from the previous updates, as we are still likely approaching at least a local top in the larger degree wave a, as shown in blue, or wave b, as shown in red.