Market Trades Flat Ahead Of The Mid-Week Holiday

Today we saw the market trade relatively flat in a very tight range ahead of an unusual mid-week market holiday. So with that, there is still very little to add to the analysis that has already been posted over the past several days.

The bigger picture levels that Avi has laid out in the weekend analysis still remain valid and intact here as again we really have not moved much today.

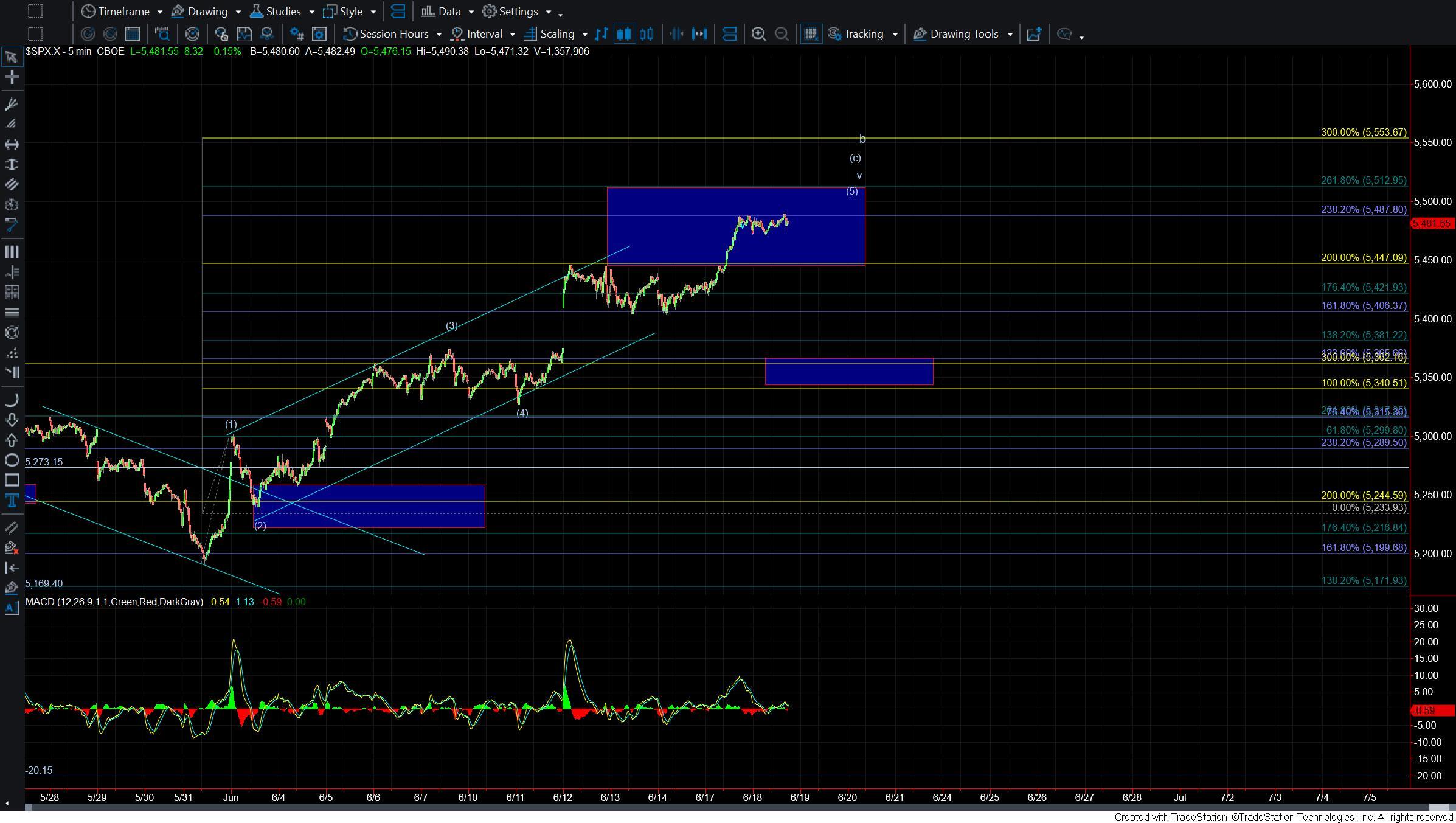

From a smaller degree perspective, I am watching the 5370-5340 region as key upper support and I would want to see a break of that zone to suggest that we may have put in a top in the wave b. We still would need further confirmation of a top with a break under the 5315 level below followed by the larger degree levels that again have been laid previously.

As it seems that we are in a lower volatility environment and the pattern remains quite full we still need to wait for some key support levels to break to suggest that we may have put in a larger degree top. For now, I will remain patient and wait for a break of that support as initial confirmation that the market has indeed turned bearish.