Market Testing Key Support

Today the market opened lower and continued to trend lower throughout the session. As we move into the close, price is trading near the lows of the day while testing a key support zone. How the market responds to this area should provide important clues regarding direction as we move through the rest of the week and beyond.

Given how stretched the market has become over the past several months, there is certainly a risk that a larger-degree top may already be in place. That said, we still need to see a few key downside hurdles cleared before we can have confirmation that such a top has been struck.

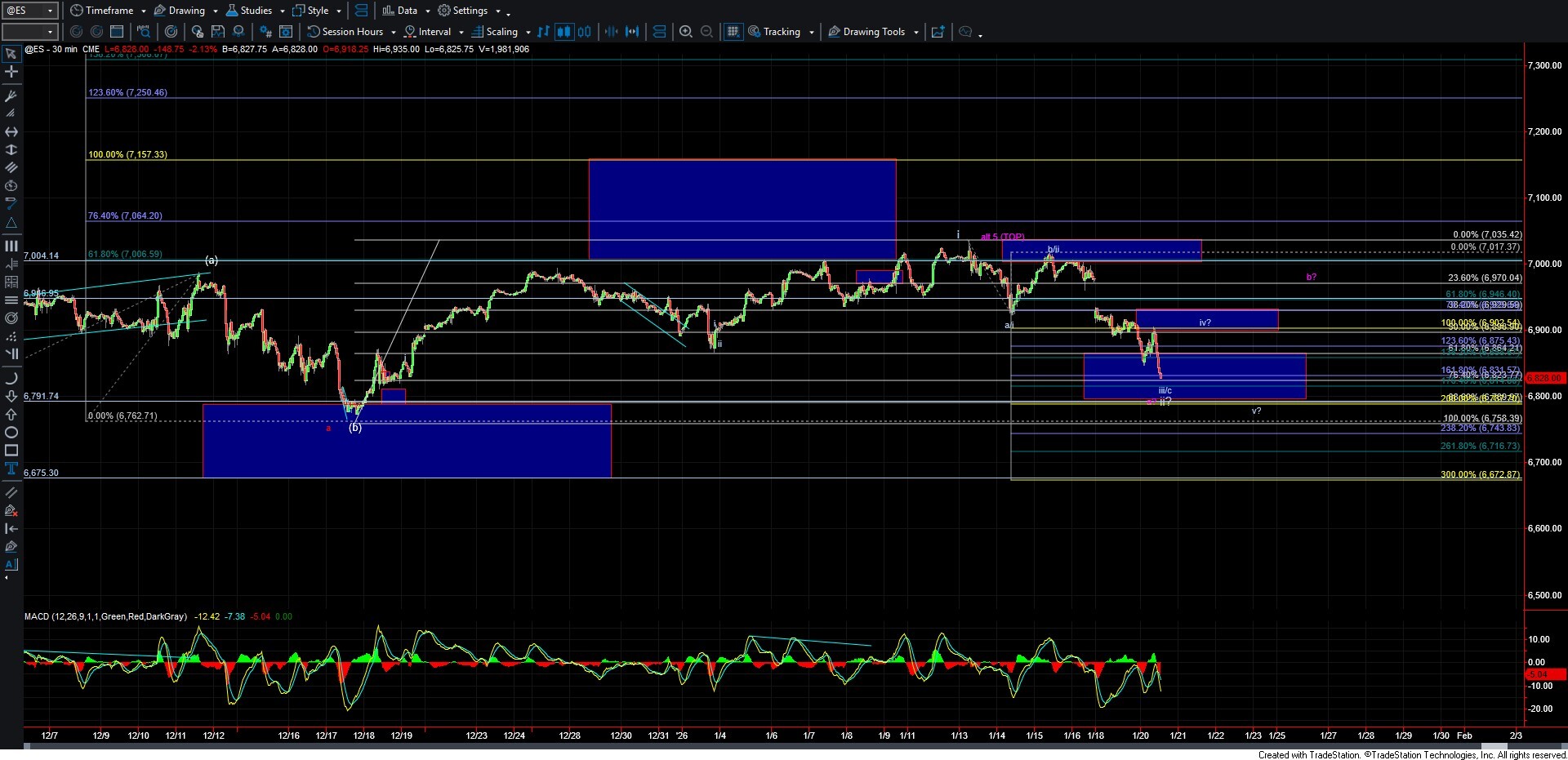

As shown on the ES chart, I currently have price entering an important support zone between 6823 and 6792. This region represents the 76.4%–88.6% retracement of the rally off the December 17th low. If the market can hold this zone and subsequently push back above the 6929 level, it would provide an initial signal that at least a local bottom may be in place. Should that occur, we would then need to closely monitor the structure of the next pullback after a local high to determine whether the market has enough strength to make another higher high before potentially forming a larger-degree top.

Conversely, if the market fails to reclaim the 6929 level and instead makes another lower low, it would open the door to a potential five-wave decline off the highs. That would be an early indication that a larger-degree top may already be in place. From a pure price perspective, a clean break below the support zone noted above, followed by a break under the 6762 level, would also serve as a strong indication that a larger-degree top has been struck.

For now, we simply need to wait and see how the market reacts at this key support zone and how it responds to the scenarios outlined above. That reaction should give us a much clearer picture of the market’s intent in the days and weeks ahead.