Market Testing Key Resistance

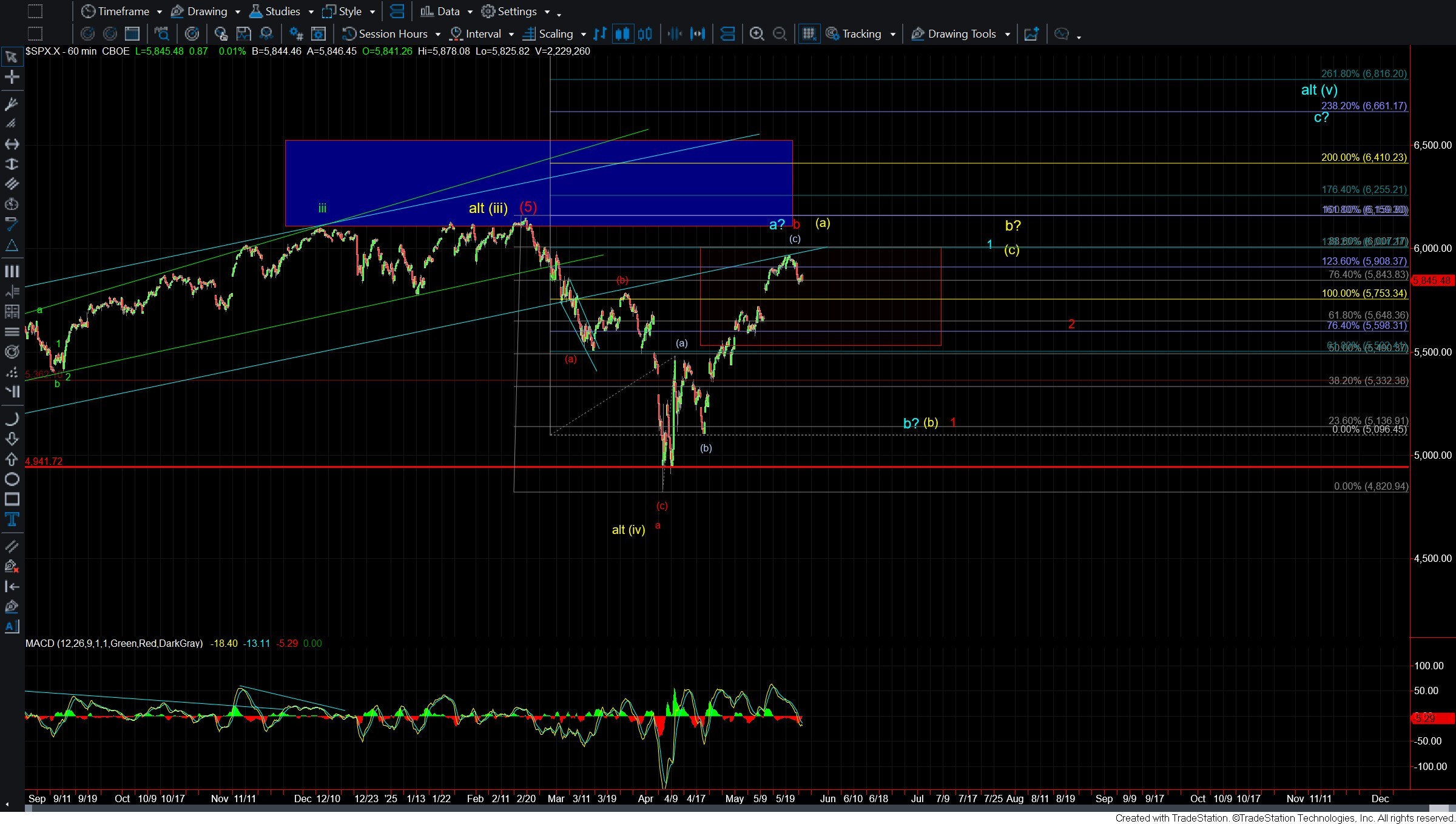

We opened lower today, only to see a retrace higher into the afternoon session. At this point, the move off Monday’s high into this morning’s low still counts best as a three-wave decline, but the market remains capped beneath a key resistance level. As such, we cannot yet rule out the potential for this structure to develop into a full five-wave decline, opening the door to a more significant top having been struck.

As I’ve been noting in prior updates, the resolution of this initial structure off the high is critical. If we do see a five-wave move develop, it would lend support to the idea that a larger-degree top is in place, thus opening the door for a drop back below the April lows. On the other hand, if resistance breaks, it would suggest the initial decline was corrective (i.e., three waves), potentially pointing to a more complex pattern or even the potential for a push to new all-time highs.

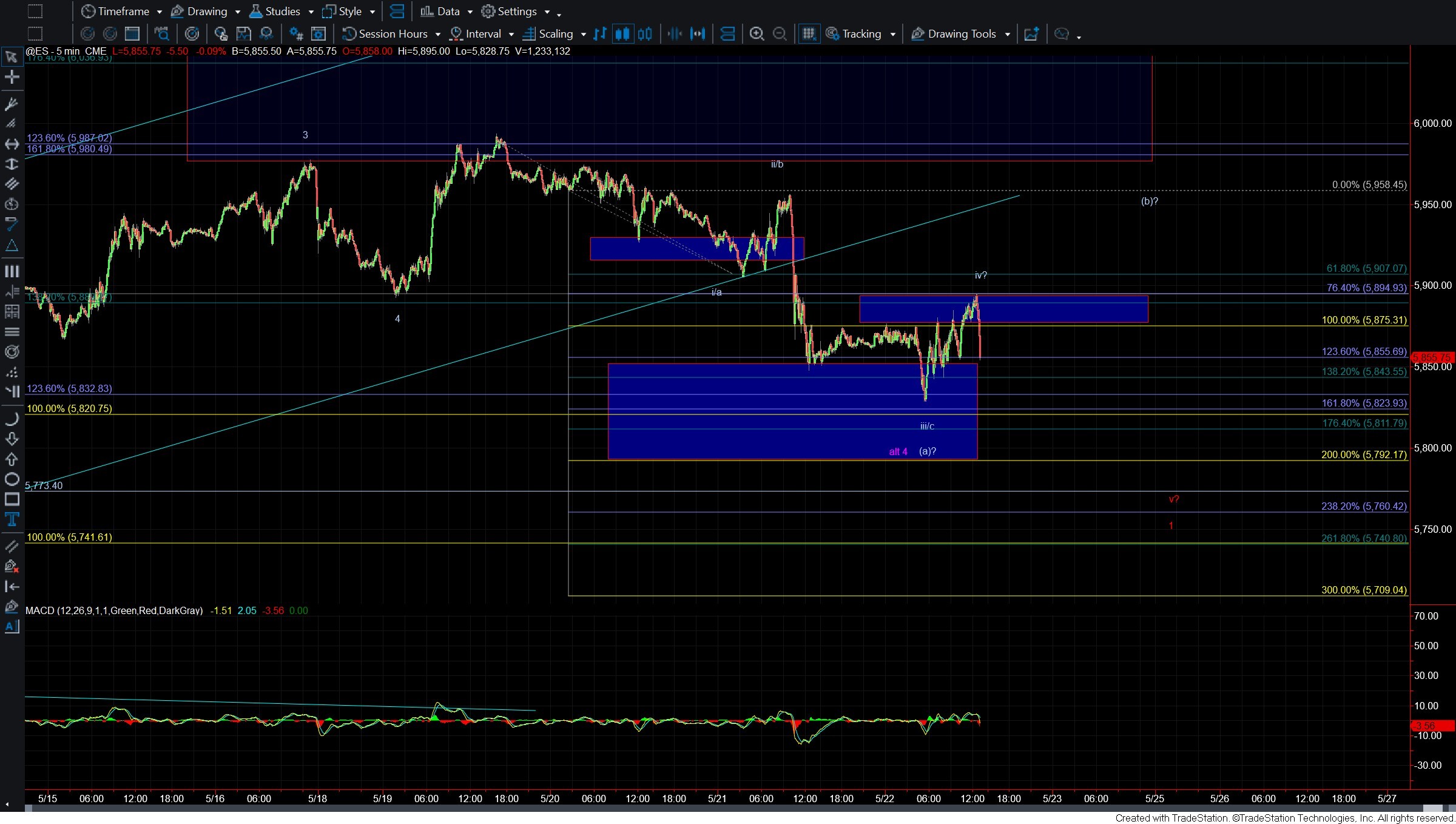

So far, this morning’s low came in just above the 161.8% extension of wave a, supporting the count that labels it as wave iii/c. The subsequent bounce has stalled beneath resistance at 5894, keeping the door open for this to be a wave iv bounce. Should the market hold below that resistance and break beneath 5823, then we would have a potential five-wave move to the downside in place. That would imply that red wave b may have already topped, and we would then be tracking red wave c down, with risk to the downside increasing.

Conversely, a sustained break above 5894 would favor the view that we only have three waves down from the high, supporting either a completed purple wave iv as shown on the ES chart, or setting up a more complex correction per the blue or yellow alternate counts on SPX.

In sum, patience remains key. We do not yet have confirmation of a larger-degree top, but we are approaching an inflection point. The next few sessions should provide important clarity on whether the recent high marks a more meaningful pivot, or if further upside remains in play within a more complex corrective structure.