Market Taking A Break From The Breakout

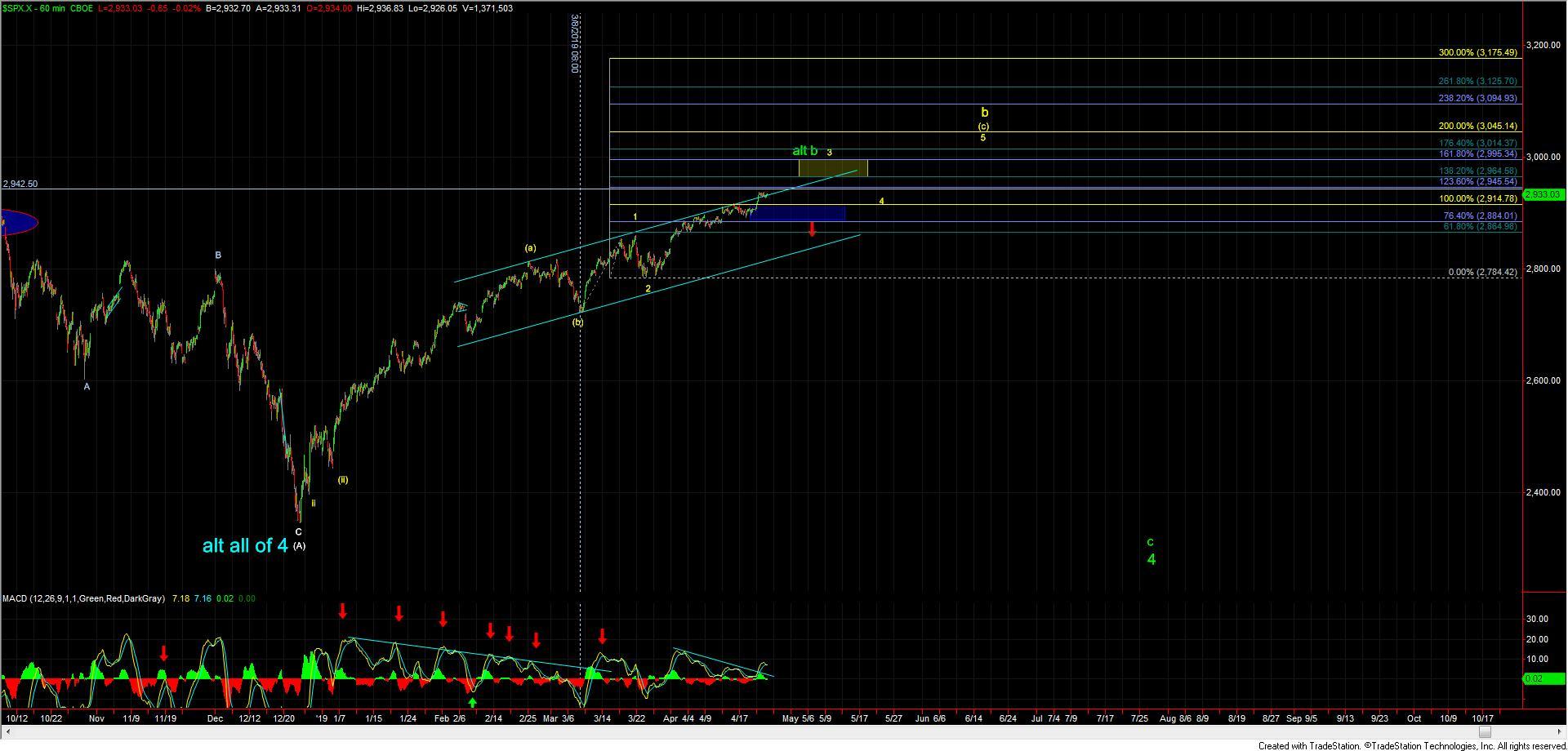

After seeing a strong breakout over a fairly well-defined resistance level, the market took a breather and simply consolidated near yesterday's highs. This high consolidation is supportive of the market continuing to move higher before seeing a top. As noted yesterday the breakout over the 2915 level is now making the yellow count much more likely thus we have an open door to see the SPX continue to move higher up towards the 2964-2995 zone for wave 3 and potentially into the mid 3000s before topping in wave 5 of (c) of the larger degree wave b. Support under this yellow path remains at the 2915-2884 zone. This support level should hold if this is indeed going to follow-through to those higher price targets per this yellow count.

A break down below this 2915-2884 zone support zone would signal that we are not following through on an impulsive path higher and open the door to a top occurring prior to seeing a move up over the 3000 area. We still would need to see further follow-through with a break back below the 2865 level to give us additional confirmation of a top, however, unless and until that were to occur then the pressure will continue to remain up on the SPX in the near term.