Market Takes A Breather But Bulls Still In Control

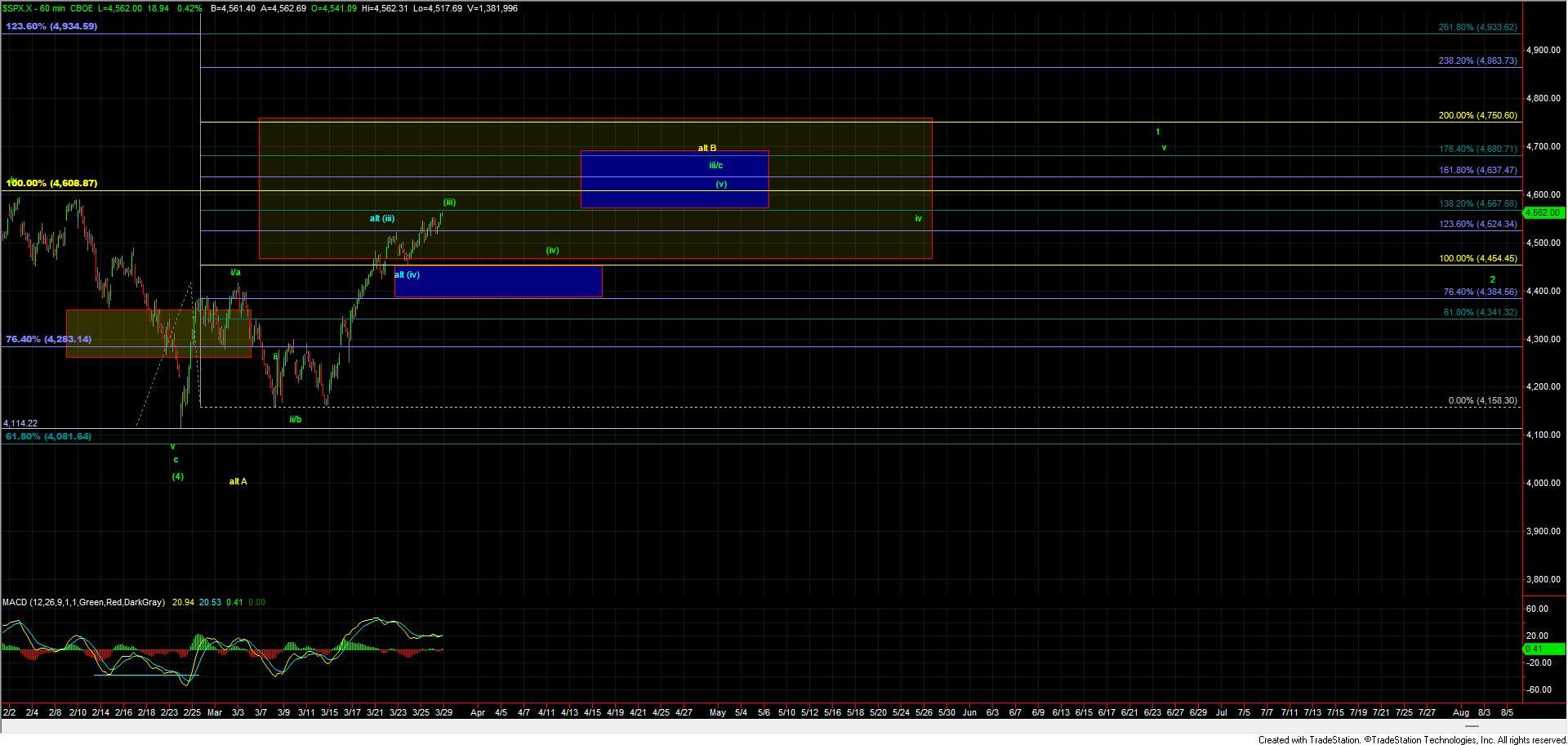

Today we saw the SPX take a bit of a breather from its relentless grind higher, in the form of a retracement, since the lows that were stuck earlier in the month. The retracement however has so far been fairly shallow and shows no sign at the moment of developing into anything other than a correcting within what we are still counting as part of the initial five-wave move up off of the lows struck in late February. In fact, as we move into the final hour of trading the market has already pushed to new highs signaling that the bulls still remain firmly in control as the trend higher continues. This bullish trend will continue to remain the case as long as the market can continue to hold over support over the coming days and weeks as we have laid out per the green path on the charts.

Under the green path, I would prefer to still see a pullback/consolidation as part of the wave (iv) of iii as shown on the charts. This pullback however may not be very deep and consolidate through time rather than price or may simply be very small in both. This type of action is not terribly uncommon when we are in the heart of a third wave and when we are coming out of very oversold market conditions as we were at the February lows. Overhead resistance for the wave (iii) currently sits at the 4565 level on the SPX chart and I will note that if we do see a breakout towards that 4635 level directly without a consolidation or pullback first it would open the door for this to already be in the wave (v) of the wave iii vs still being in just the wave (iii) of iii. Assuming we do see that consolidation however then larger support still resides at the 4455-4385 zone as shown on the SPX chart and as long as that zone holds the near term pressure will remain up as this continues to fill out its impulsive wave pattern.

If we are unable to hold the 4385 level but rather break down below that level AND see a full five down off of the highs then it would open the door for this to be forming a larger wave B top in which case I would count the entire move down into the 4115 low as a large wave A and this move up a large wave B. Reisntace for this wave B comes in at the 4470-4744 zone. Again I am not viewing this as a highly probable count at this point in time but I do have to allow for it until the market is able to fill out a full five up off of the lows that were struck in late February.

As I noted last week this consolidation is quite healthy for a more sustained bullish trend and is quite typical for where we are in the smaller degree count. With that, I still do not see anything to suggest that this is ready to make a larger degree breakdown just yet and this will remain my base case as long as the support levels noted above hold. If support begins to fail then I will adjust those expectations but for now, the bullish count continues.