Market Stretching For Higher Targets

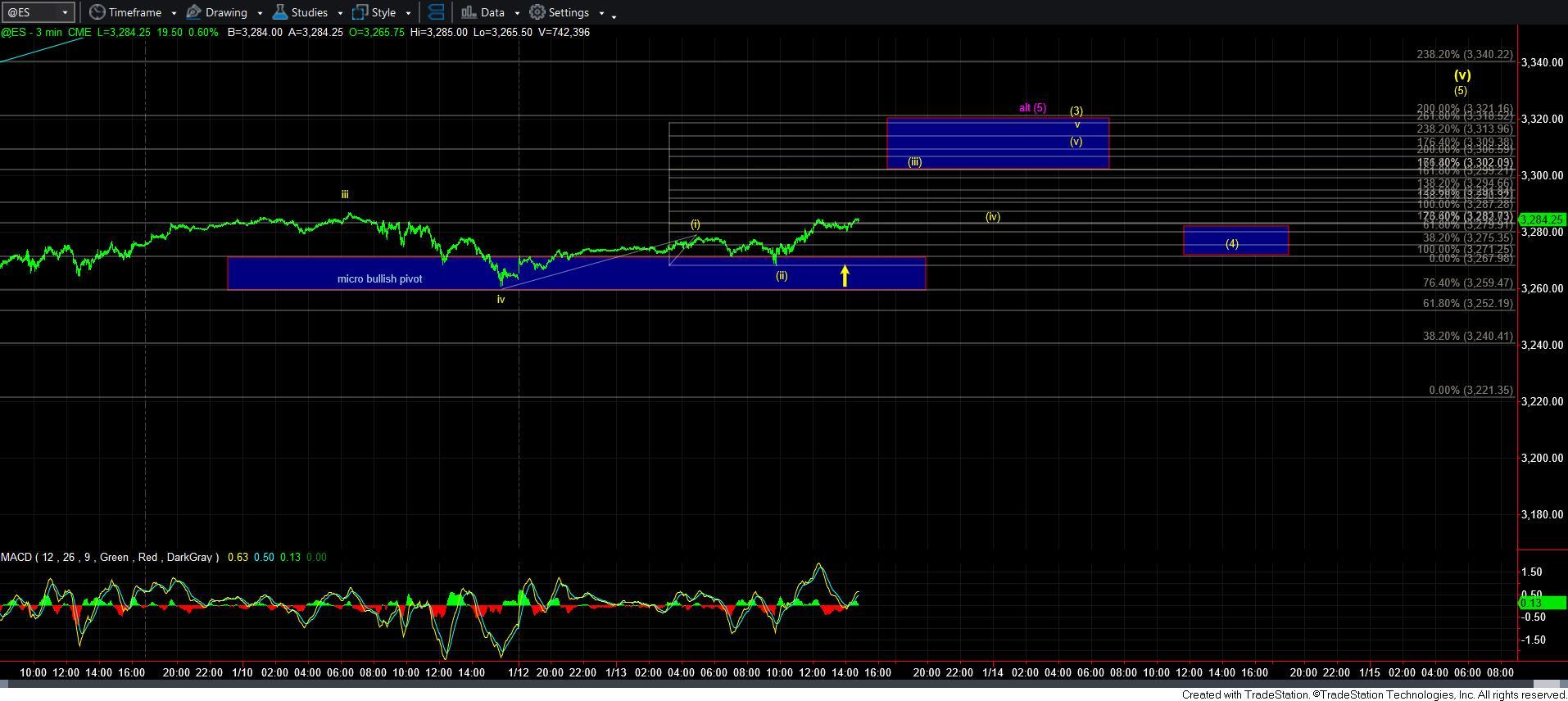

As I outlined over the weekend, the ideal target for the SPX if it is going to retain this bullish structure is the 3338SPX region. And, with the market holding the micro bullish pivot noted on my 3-minute ES chart, it seems we are still trying to stretch for this target.

Now, if you review only the smaller degree SPX chart, you will probably come to the conclusion that this push higher in the SPX that I am counting as yellow wave [3] on the 3-minute ES chart would actually complete this 5-wave rally off the January low. However, since the ES has seen more wave structure than the SPX did, the ES only counts this move higher as concluding wave [3] within wave [v] in the larger degree count. That means that if we are able to strike our blue box target for wave [3] on the 3-minute ES chart, I can still maintain an expectation of a wave [4] and [5] to be seen in the ES as long as the 3270ES region holds as support, as outlined on my 3-minute chart.

So, now that we have dealt with the leaves, let’s move back and look at the trees and the forest.

As you can see on the attached 60-minute chart, I am discussing whether we have one more push higher to complete wave [v], or if we have two more pushes higher to complete wave [v]. But, in either case, it is quite likely that we are finally nearing the completion of wave [v].

Moreover, the completion of wave [v] means we will have likely completed 5-waves up off the early December low, which, in turn, would likely complete 5 waves up off the October low, as shown on the 60minute attached chart. And, once we do complete this structure, then it becomes quite likely that a pullback will be in order. That is the very important pullback to which I referring in my weekend update. If we are able to hold that blue box for wave [4] on our 60-minute chart, and not break down below 3100SPX, then we are likely heading towards the 3700-3800 target for wave [5] of iii in 2020.

However, if we are unable to hold that blue box on the next pullback, that opens the can of worms I outlined in the weekend analysis. So, as I said, the next pullback is going to be of utmost importance for 2020.

In the near term, support still remains as our micro bullish pivot on the 3-minute ES chart, and should we be able to stretch towards the 3300ES region on this push higher, then the 3270ES region becomes upper micro support. As long as that support will then hold, then I can still expect one more push higher towards the 3338SPX region. But, once that support breaks, then it is likely that the larger degree pullback has likely begun.