Market Still Sitting Over Support

Today we saw the market open up relatively flat today followed by a move lower that tested last week's low only to move slightly higher in the afternoon session leaving us relatively flat at the time of this writing. As we have yet to break last week's low and we are still sitting over even the upper support zone we still do not have confirmation of a top in place just yet. So while the pattern still remains full and I still remain quite cautious in this region until we actually see a break of support and/or a full five down I have to still allow for the possibility to see another higher high as an alternate count. Once we do break support we can further lay out the near-term downside targets but for now and until we see a break of upper support no confirmation of a top is in place just yet.

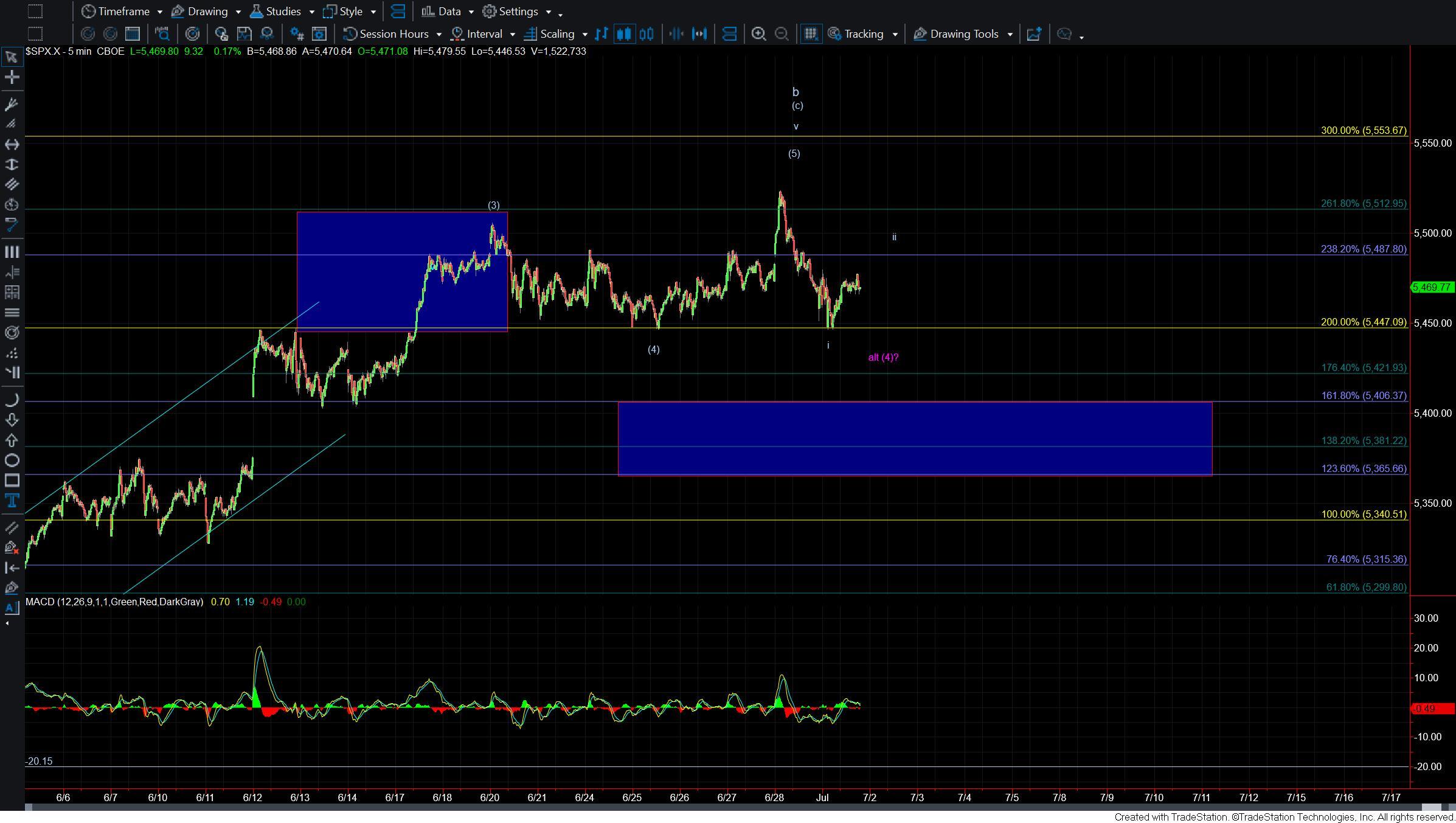

Drilling down to the five-minute chart the primary count is that we have topped and that the move down off of last week's high was a wave i. So assuming we can hold under the high struck last week and break today's LOD at the 5447 level then we will have initial confirmation that a top is indeed in place. Once we break that level then upper support comes in at the 5406-5365 zone below and moving through that zone would give us further confirmation that a larger degree top has been struck.

If we are unable to break down below support but rather turn back higher on five waves then it would leave the door open to see another higher high before a larger degree top is in place. At that point, I would watch the 5553 level as the next key overhead fib/target zone to reach.

Again the pattern remains quite full but we still do not have confirmation that a top is indeed in place just yet. Once we do see that confirmation we will have plenty of time to trade the short side of this market but for now and until that does occur further sloppy action in the very near term may indeed be the name of the game.