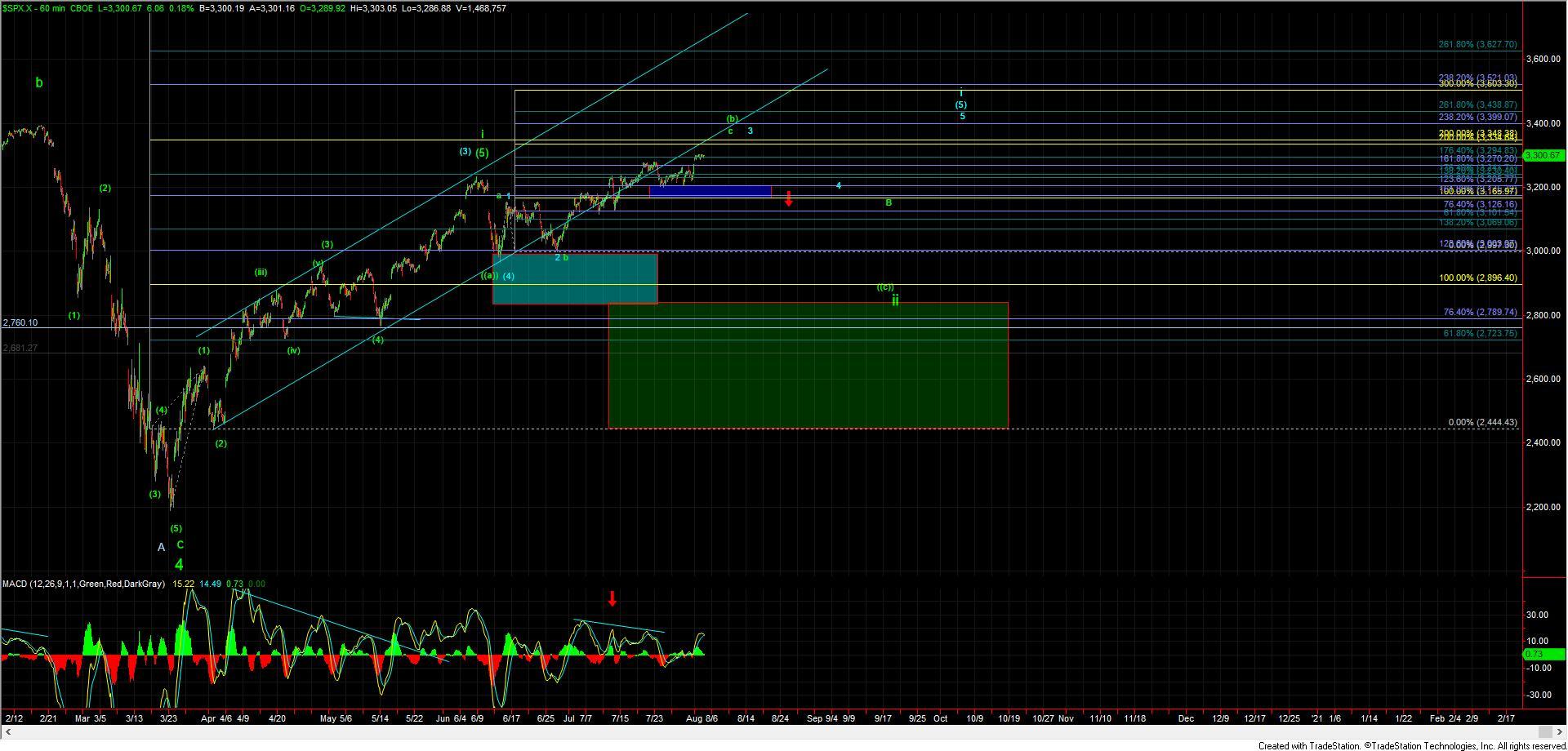

Market Still Over Support, But No Breakout Yet

Today the market opened lower into the middle of the support zone that I laid out yesterday and then pushed higher towards the micro pivot to the upside. At the time of this writing, however, we have yet to break that pivot, which is, therefore, leaving us for the most part in the same spot that we were at yesterday's close.

So, ideally we should hold today's LOD which came in at the 3271 level on the Emini S&P 500 (ES) and continue to push higher through the micro pivot zone just overhead at the 3293-3303 zone. This would give us additional confirmation that we are indeed following the blue path higher targeting the 3340-3397 zone for the blue wave 3.

Should we see a move below today's LOD and then below the 3264 lower support level then that would open the door to this forming at least a local top per that purple wave a. Under this alternate purple count the wave b would likely take a few days to fill out and would certainly add more whipsaw to an already sloppy count.

But as long as we hold over 3186, it should ultimately still point this higher before topping. I am going to try to take things one step at a time however and as long as we are over support will primarily focus on the blue count.

So again overall not too much has changed today and while the market is still not fully broken out yet, the bottom line remains that as long as we are holding over support the near-term pressure does remain up.