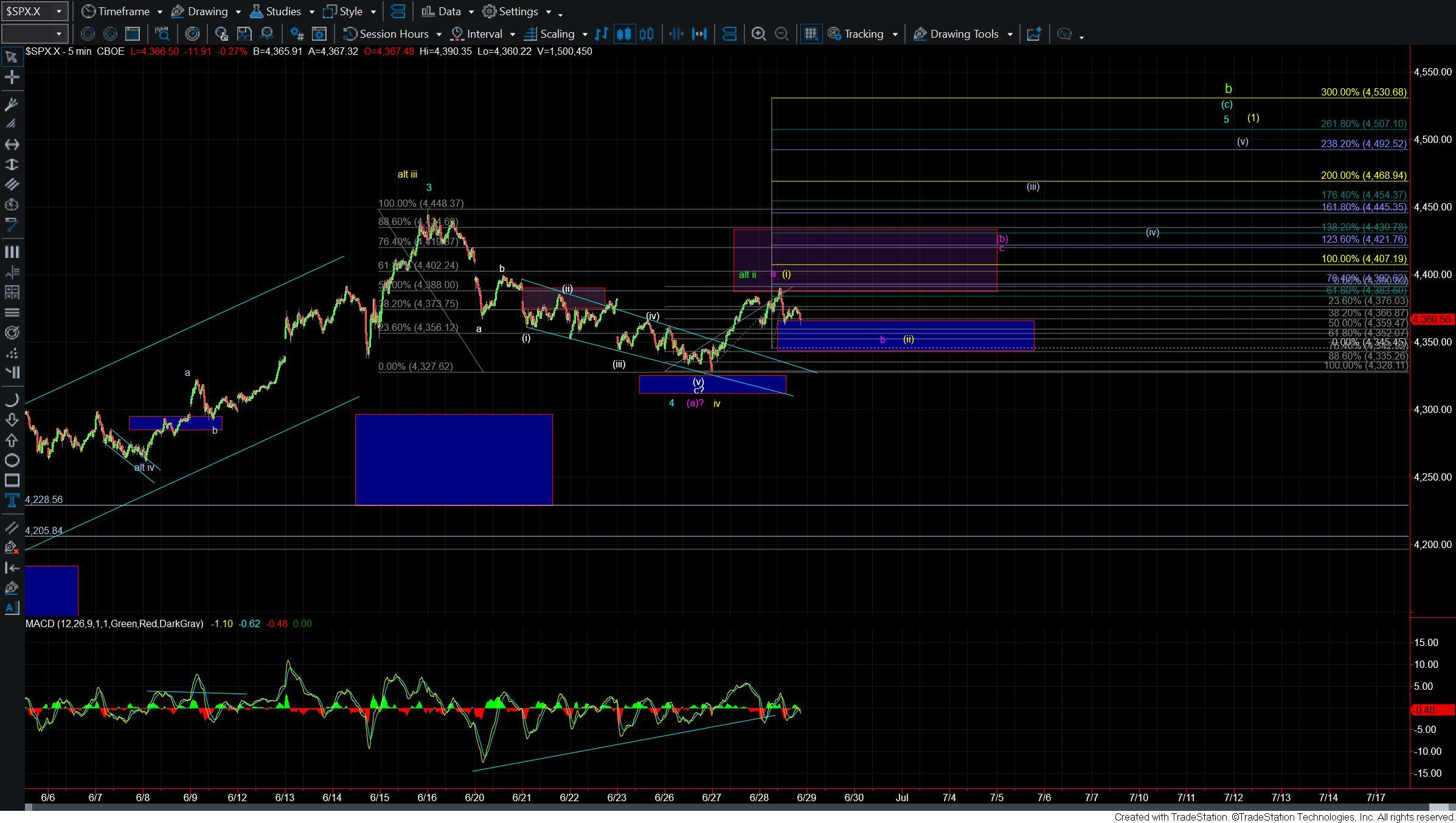

Market Still Likely Has Unfinished Business To The Upside But Resistance Overhead Is Still Looming

Today we saw the market push to new highs giving us what can count as a fairly clean five up off of yesterday's low. This pattern is suggestive that we will see a move back over today's high before breaking back down under yesterday's low and is keeping the door open to this even seeing a breakout to a push back up over the 4448 level. There are however several keep resistance levels that will need to be taken out to the upside before we can confirm that we are indeed ready to see a push to a new high over the 4448 level, however as long as the pullbacks remain corrective and we hold over micro support the market is setting up to push higher as we move into the long weekend.

I am still watching a number of different paths as I noted in yesterday's update and the big picture on those counts has remained for the most part unchanged. Today's potential five up off of the lows has given us some more parameters to work with on the smaller degree timeframes however which I will layout below.

GREEN COUNT

As I noted yesterday because the sharp move higher off of yesterday's low gave us what counts best as a three-wave move down off of the highs it is much less probable that we have already topped in the green wave b. With that if we are going to see a top under that green count it is more like that we will need another push higher into the larger degree overhead resistance zone and back over the 4450 high before we can call a confident top in that green wave b. The potential five up off of yesterday's low has this move project into the 4468-4510 region which also has good confluence with the 76.4 retrace level of the entire move down off of the 4831 high that was struck back in 2022.

We still would need to move through the overhead resistance zone at the 4388-4432 zone overhead to give us further confirmation that we are indeed heading to new highs and filling out the five up off of yesterday's low to finish off the green wave b into the 4468-4510 region. After topping in that region we would then need to see a full five down of off of those highs to give us the initial signal that we have begun the wave c down and that would then need to be followed up with a break back under yesterday's low at the 4327 level.

If we break out to new highs but only see a clearly corrective retrace that holds over yesterday's low then it would be the initial signal that we are following through with the yellow count.

YELLOW COUNT

Today's five up after holding support is keeping the door open to the yellow count and this path will likely be very similar to that of the green count even with a push to new highs. So it is important that we remain vigilant if we do see a push back up over the 4448 level we will likely begin to see many calling for a push to new all-time-highs and many feeling a large degree of FOMO.

The structure of the next pullback upon a full five up of one larger degree and push to new highs is going to be critically important and something that we need to be watching very closely. Again IF that move down after a push to new highs is clearly corrective then it would keep the door open to the yellow count and a push to new highs. IF however that move lower is five waves down the risk that we are beginning the larger wave C down is greatly increased. That C wave down will not be pretty so again even if we push to new highs the structure of the pullback after that push will be critically important.

PURPLE COUNT

Finally, the purple count is still in play here and under this count, we would need to hold under the 4387-4434 resistance zone and see a five-wave move to the downside that ultimately breaks back under today's LOD. This is the more sloppy of the paths that I am watching and would likey to take the SPX grinding lower before finding a larger degree bottom in the 4200-4100 region but it is certainly on my radar as I do think it fits fairly well with what I am watching on the Nasdaq charts.

With the five up I still would expect to see a push higher and deeper into that resistance zone even under this path. Stalling at one of the key overhead fib resistance levels and seeing a five-wave move lower would be the initial signal that we are following this purple count. Moving through the overhead resistance at the 4387-4434 would however give us the initial signal that we are indeed following the yellow or green paths.

So while the action over the last couple of sessions has certainly given us a fairly clean micro setup for a push higher we are a long way from being out of the woods. The market remains treacherous in this region. We do have fairly clear parameters to work with however but remaining nimble and open to adjusting as the market provides us with more information is going to be key as we move through the days and weeks ahead.