Market Still Hovering Over Support

Today we saw the market pull back slightly but we are still trading over even the most upper support level. This inability to break down under support still leaves us without confirmation that we have indeed put in a top thus still leaving the door open to seeing yet another higher high before a top is struck.

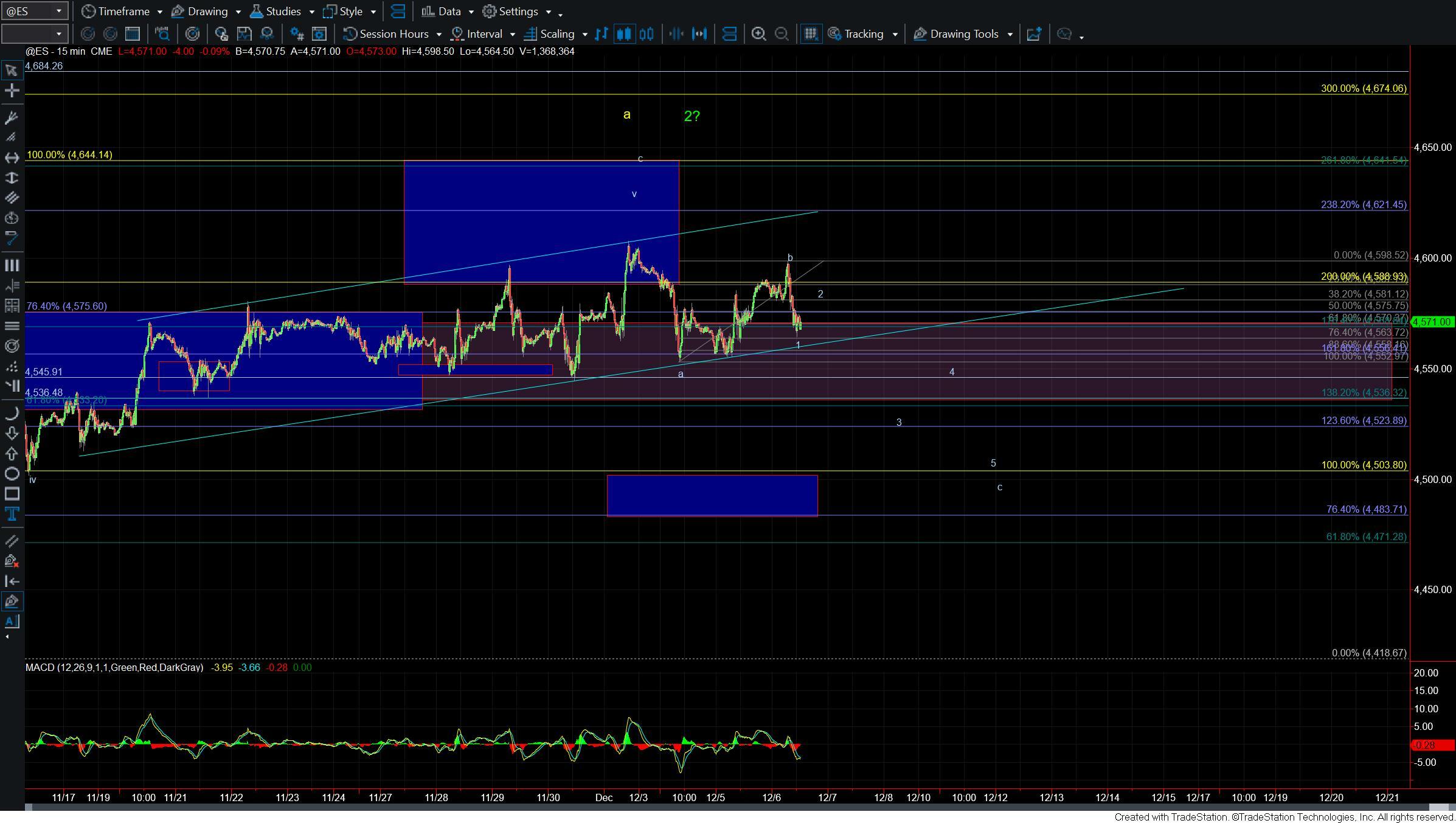

Now I do want to note that from a very micro perspective, the case can be made that we have five down off of the highs. That potential five down is however far from ideal and thus until we see a break below support we still do not have initial confirmation that a top has indeed been struck.

The bigger picture there is really nothing to add to the previous analysis as has been laid out previously. We are still tracking both the green and yellow counts and the structure of the next larger degree move down will help give us guidance as to which path we are indeed following.

From a more micro perspective I still am looking for a break under the 4535 level on the ES followed by a break under the 4503 level to give us initial confirmation that we have indeed topped. Until we see a break of those levels I can't rule out that we will continue to grind a bit higher towards the next key overhead fib at the 4621-4641 region on the ES chart. If we do indeed move higher I think we will be taking the form of an Ending Diaognal for the final wave v of c. This would likely result in a sharp reversal back towards the 4500 level on the ES. Of course, we still have to make a higher high before that pattern can even be considered.

So for now I am simply going to continue to watch for a break of the support levels noted above. Until those levels are broken there really is not too much to add to the analysis, nor too much to do from a trading perspective. I simply will wait for the market to tip its hand as we grind through what has been quite an uneventful month.