Market Still Holding Over Micro Support

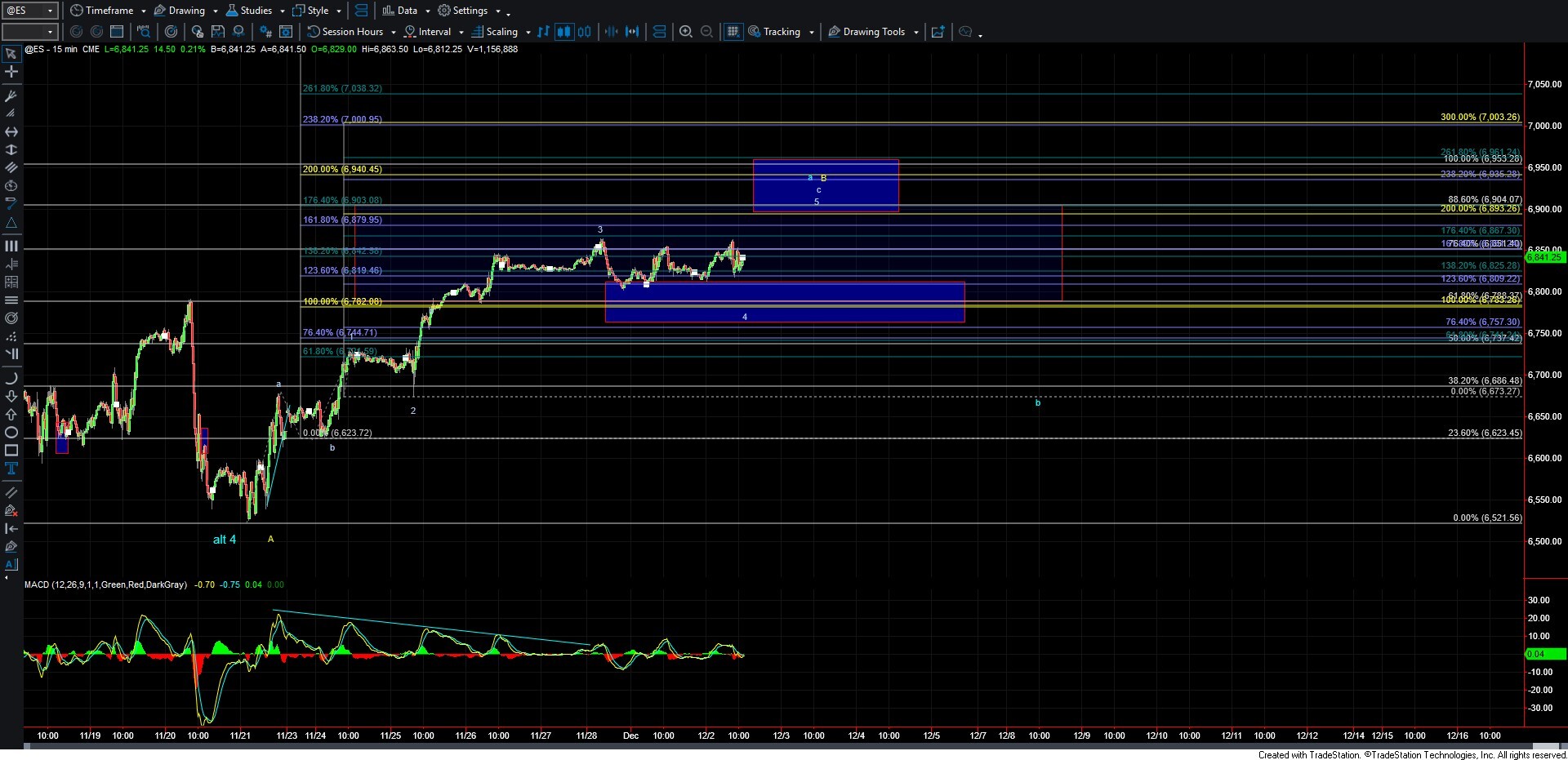

Today we saw another day of a fairly flat consolidation pattern as the market continued to move sideways since the high that was struck on 11/28. So far, this is acting like fairly typical fourth wave price action, so as long as we remain over micro support, I have to lean toward this seeing another push higher to finish off at least a wave 5 of c as laid out on the ES chart. Furthermore, because the wave 2 of the same degree was fairly sharp and quick, a more prolonged and flat wave 4 in this region actually fits the Elliott Wave guideline of alternation. So if this is indeed playing out, we may not see a very deep retrace for the wave 4 before pushing higher. With that being said, this is a guideline and not a rule, so the more important factor in determining if this is indeed a wave 4 will be whether we can hold over micro support.

I currently have micro support at the 6809-6757 zone as shown on the ES chart, and again, as long as we hold that zone, I would expect to see another push higher toward the 6893-6981 region overhead. From there, the next move lower will still be key in determining whether we are topping in a wave a per the blue count as part of a larger ending diagonal that would take us back to new highs or whether we may still find a larger wave B top per the yellow count. Should we see a corrective move lower, then we are likely following the blue count, whereas a five-wave move to the downside would open the door to this seeing a larger top per the yellow count. Furthermore, a break over the 6904 level would make it more likely that we are following the blue count rather than the yellow count.

For now, we simply need to wait for the market to give us a bit more price action to have a better idea as to which of these paths we are indeed following, but for now, the door does still remain open to either.