Market Still Extending as SPX Approachs New All-Time-Highs

Today we saw the market continue to extend higher and the SPX come within just a few points of the all-time-highs struck back in December. All of the paths that were laid out previously remain intact here but with this continued push higher it is increasing the odds that we may indeed be following the yellow count.

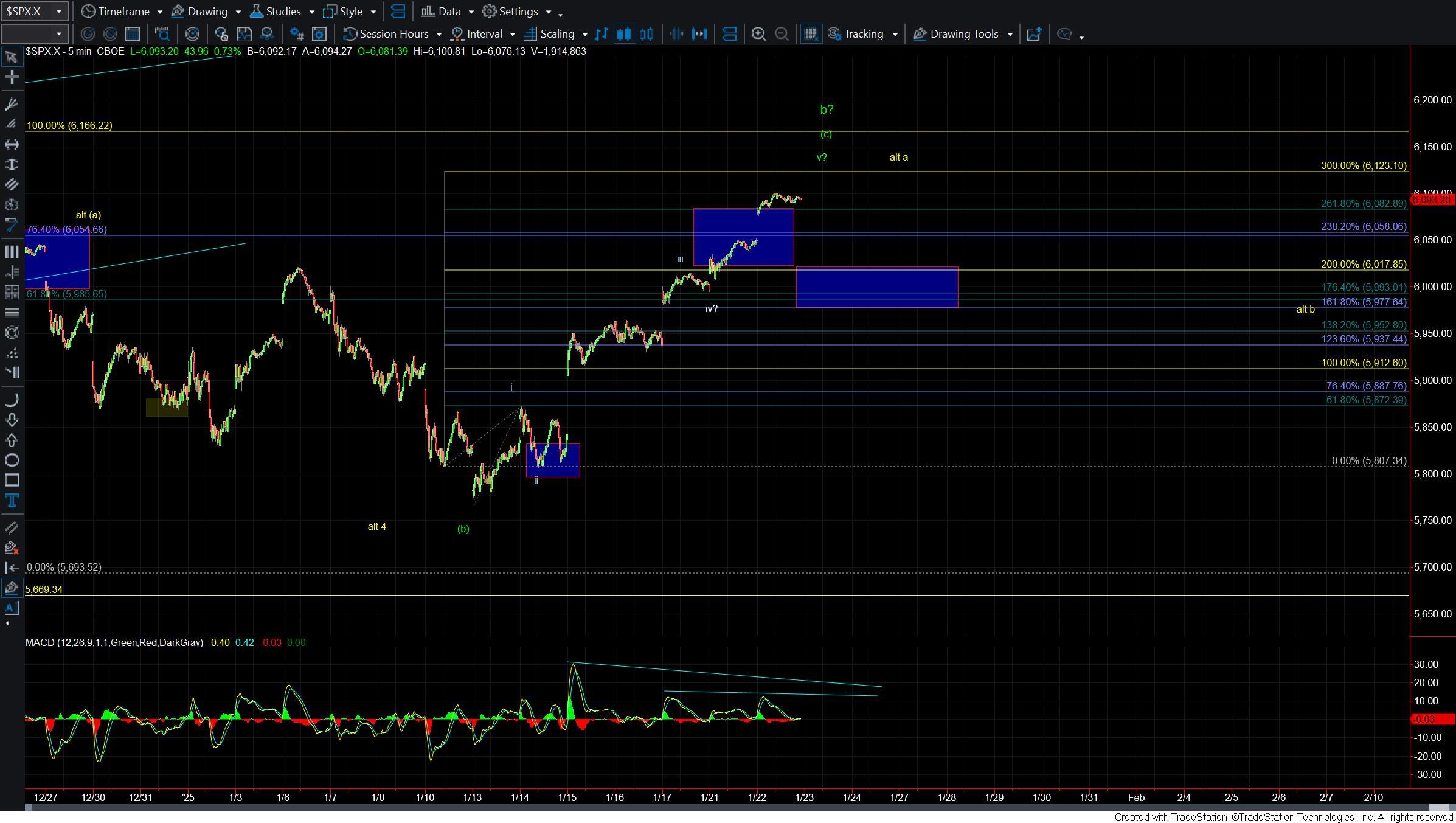

Overall and from a wave count perspective not too much has changed from yesteday's update even though we have continued to push higher towards the all-time-highs. We remain in the topping zone for the potential wave v of (c) as shown on the five minute chart. We will now need to move under the 6017-5977 zone on the SPX to give us an initial signal that we may have put in a top in that five wave move up off of the 1/13 low.

The structure of the next pullback remains important and is going to help guide us as to where this is heading in the weeks ahead. Should we see a corrective retrace lower then we are likely following the yellow count and will see new highs in the weeks ahead, whereas should we see a five wave move to the downside then it will open the door for this to be topping in the green wave b.

So for now we will simply wait for a pullback and see what the structure of that pullback looks like. From there we will have a better idea as to which path we are likely going to be following. Until then we need to let the market tell us what it's intentions are in the very near term.