Market Still Consolidating - Market Analysis for Feb 28th, 2024

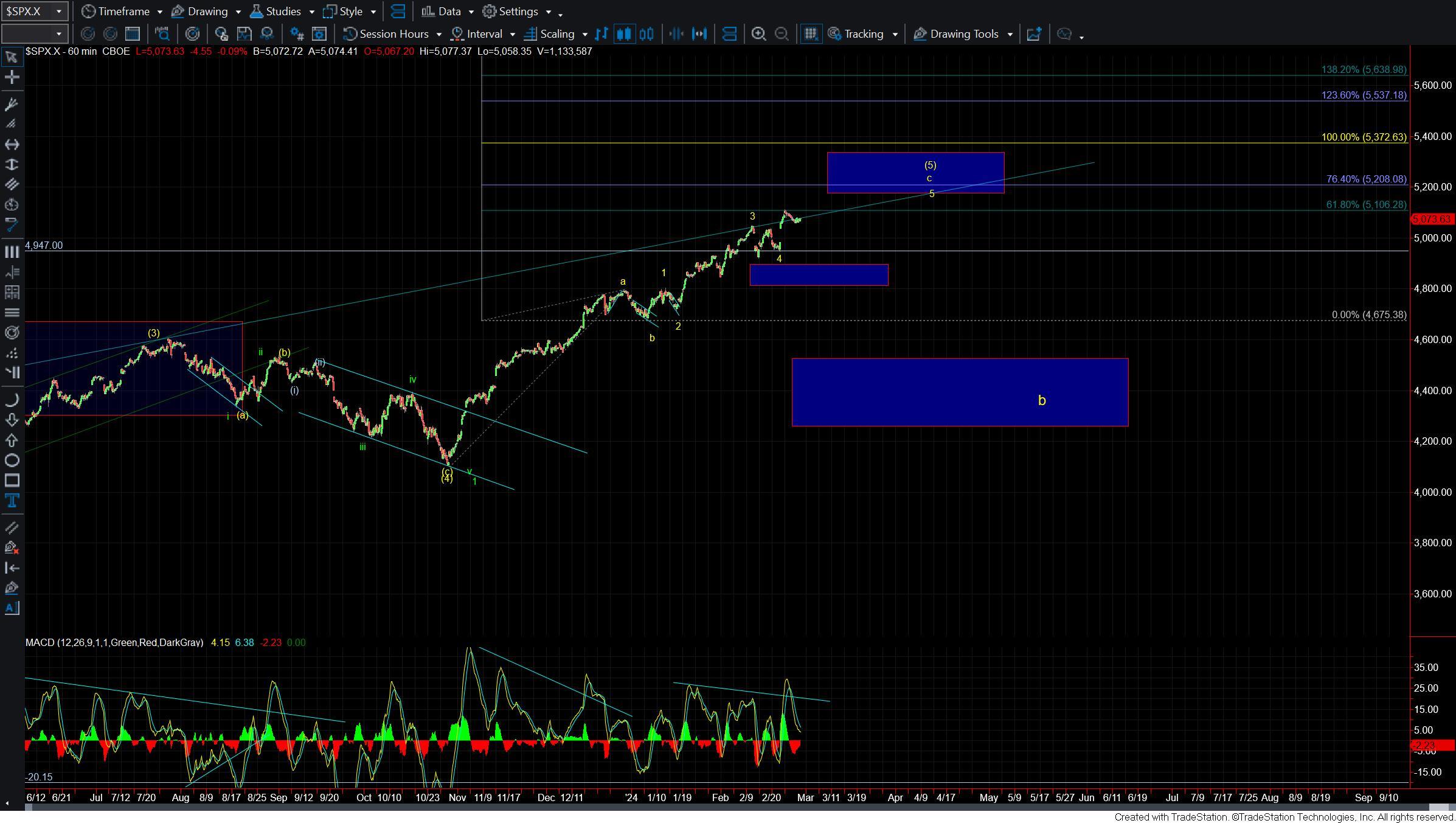

There is very little to add to the analysis today as the market continues to consolidate near the highs on corrective wave action to the downside.

The bottom line on the SPX remains that as long as we hold over the 5044-4985 zone then the wave ii bottoming count remains intact and in play here which I am showing in yellow on the 10min SPX chart. We would need to see a full five up off of one of the support fibs to suggest we are starting the wave iii up.

I do want to note that I have added an alternate count as shown in red. Under this case, I would count the entire move up off of the 2/13 low as an Ending Diagonal. In this case, we would need one more higher high to finish off the pattern. This is still an alternate path at this point in time however if we can hold around the 5000 level and turn higher to new highs on three waves then this path will become more probable.

For now, we need to see how we react as we move lower into the support zone below and what type of reaction we see as we move into those fibs below. The bottom line remains that action to the downside does however look to be corrective in nature and we are over support. This is still suggestive that we still likey have some unfinished business to the upside before a top is seen. With that being said the pattern is getting quite full in this region and caution is certainly warranted.