Market Short Term Rally In Jeopardy

With the market breaking below Friday’s low, we have opened the door to a bigger pullback in the coming week. Allow me to explain my concerns regarding immediate upside follow-through.

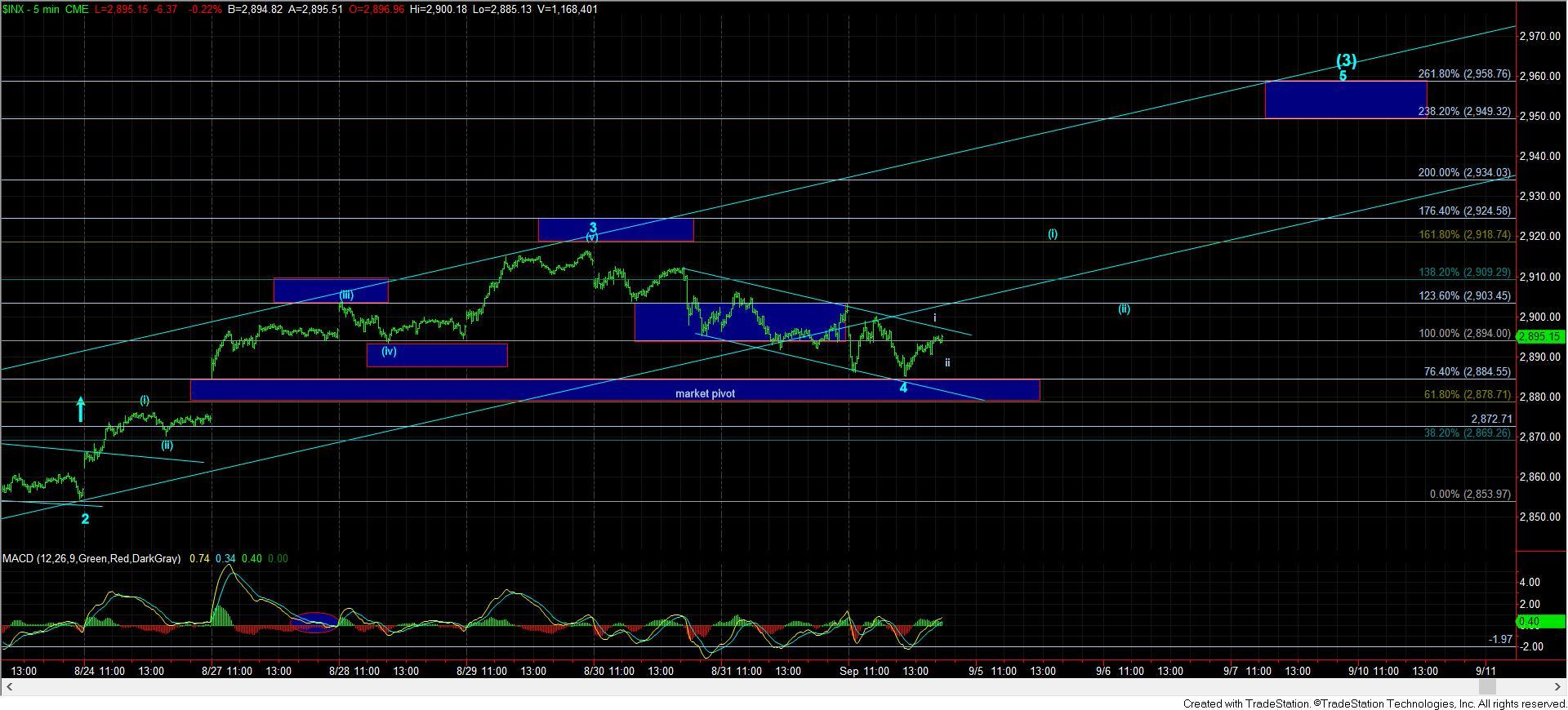

While the market was playing textbook Fibonacci Pinball for several weeks now, the break down below Friday’s low has now provided us a warning as it has gone outside standard Fibonacci Pinball. You see, within our Fibonacci Pinball system (which is a standardized analysis), once the market strikes a 1.618 extension, it USUALLY targets the 1.00 extension for a 4th wave pullback. That 1.00 extension was struck on Friday.

Today, we have broken below that, and have thus far bottomed at the .764 extension, which is not often seen as a target for this degree of 4th wave. Rather, when we break below the 1.00 extension, more often than not, it provides us with an early warning that the market will likely retrace even further.

Yet, the market has still held the pivot I have outlined on the 5-minute chart. This is a smaller degree pivot than presented on the 60 minute chart. In fact, we were unable to break out through the pivot presented on the 60-minute chart.

So, if the market can continue higher in an impulsive structure off today’s low, then we may have just seen one of the more rare circumstances where the break of the 1.00 extension did not result in a bigger decline. After all, this is a bull market, and the bulls certainly deserve the benefit of the doubt, until they prove otherwise.

However, should we continue to see weakness into tomorrow, then it likely means the market is heading down to the 2840-50SPX support region next for a possible larger (1)(2) structure in the SPX. Moreover, this larger (1)(2) actually fits better with the targets we have laid out in the larger degree on the way to target the 3225SPX region into 2019. And the ideal target of support for that wave (2) is actually the 2840SPX level.

Alternatively, should we not hold that 2840SPX region, and should we see a strong break of that support, I may have to begin consideration that we have completed all of wave 3 off the 2009 without reaching our minimal target of 3011, or, the high we struck in the SPX may even be an expanded b-wave in a larger degree wave (4) flat, which we had put to bed a few weeks back. Neither of these potentials are strong contenders right now, but it is something I have to maintain on the radar since we broke below the 1.00 extension today.

Ultimately, I still want to see us rally to AT LEAST the 3011SPX region, and potentially the 3225SPX preferred target. But, if the market is not going to cooperate, I am going to take a more cautious stance, especially since we expect this market to be significantly lower than we reside today within the next 12-18 months.