Market Sees Some Action Before and After The FMOC

Today we came into the day waiting for the FMOC to be released in what had been a topping pattern in most of the index markets. Typically we see some fairly muted action ahead of the FMOC followed by some ugly action as the market participants wait for the news.

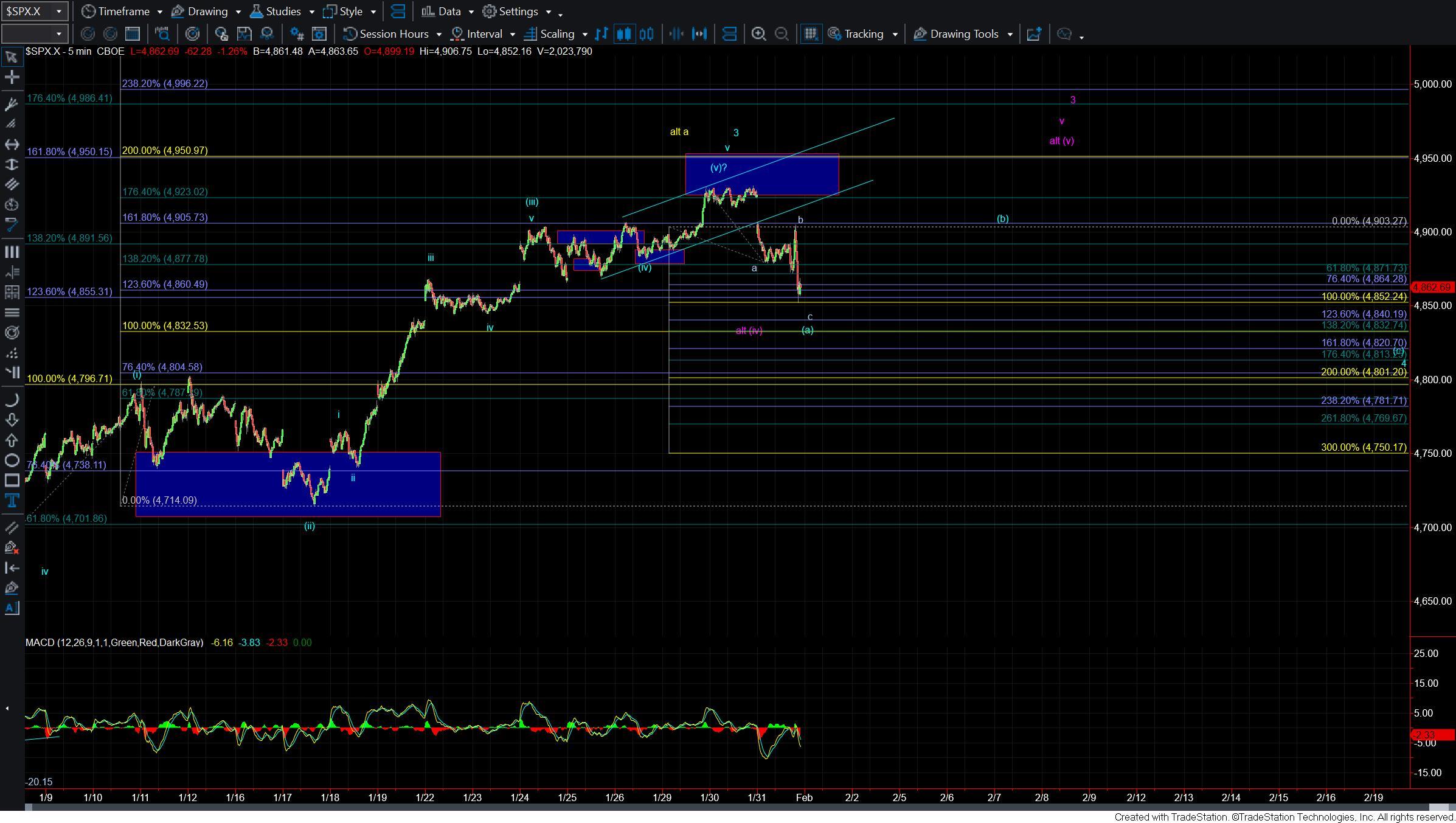

Today we saw the market move lower before the FMOC only to spike higher post-announcement and then move lower into the end of the day. With the move lower we have clearly put in a local top but the question at hand at the moment is a local top of what. I think we will have the answer to that question very soon as we are now sitting at some very key support levels.

We tagged the 100ext of the initial move down so if we can hold there and turn back up over the 4903 level then we would have a local bottom in place. If we did indeed top in the larger wave 3 per the blue count then I would be looking for a corrective move up off of the lows to fill out a wave (b) which should then be followed by a wave (c) of 4 down.

If we move up impulsively then it would open the door for this to have bottomed in the wave (iv) of one smaller degree per the purple count. While this purple count is less than ideal if we can manage to hold the 4852 low I will still allow for it but moving top much beyond that level and I think we would firmly be in the blue count.

If we do continue to move lower per the blue count then I will be watching the 4862-4804 zone below as key support for that blue wave 4 and as long as that zone holds then I would still be looking for a move higher to finish off the wave 5 of the larger wave c of (5) into the 4984-5138 zone.

If we break under that 4862-4804 zone then it would open the door for a larger top to be in place but as of right now, the pattern does look a bit incomplete into current levels so as long as support holds I will be looking higher to finish off this move.