Market Sees High Consolidation Over Support

The market has seen a high and flat consolidation over the past several days and today we simply saw a continuation of this. So with that there really is very little to add to what we have laid out over the past several days and in the weekend update and as long as the SPX continues to hold over the key micro support zone I am still looking for at least one more higher high before we see any pullback of any significance.

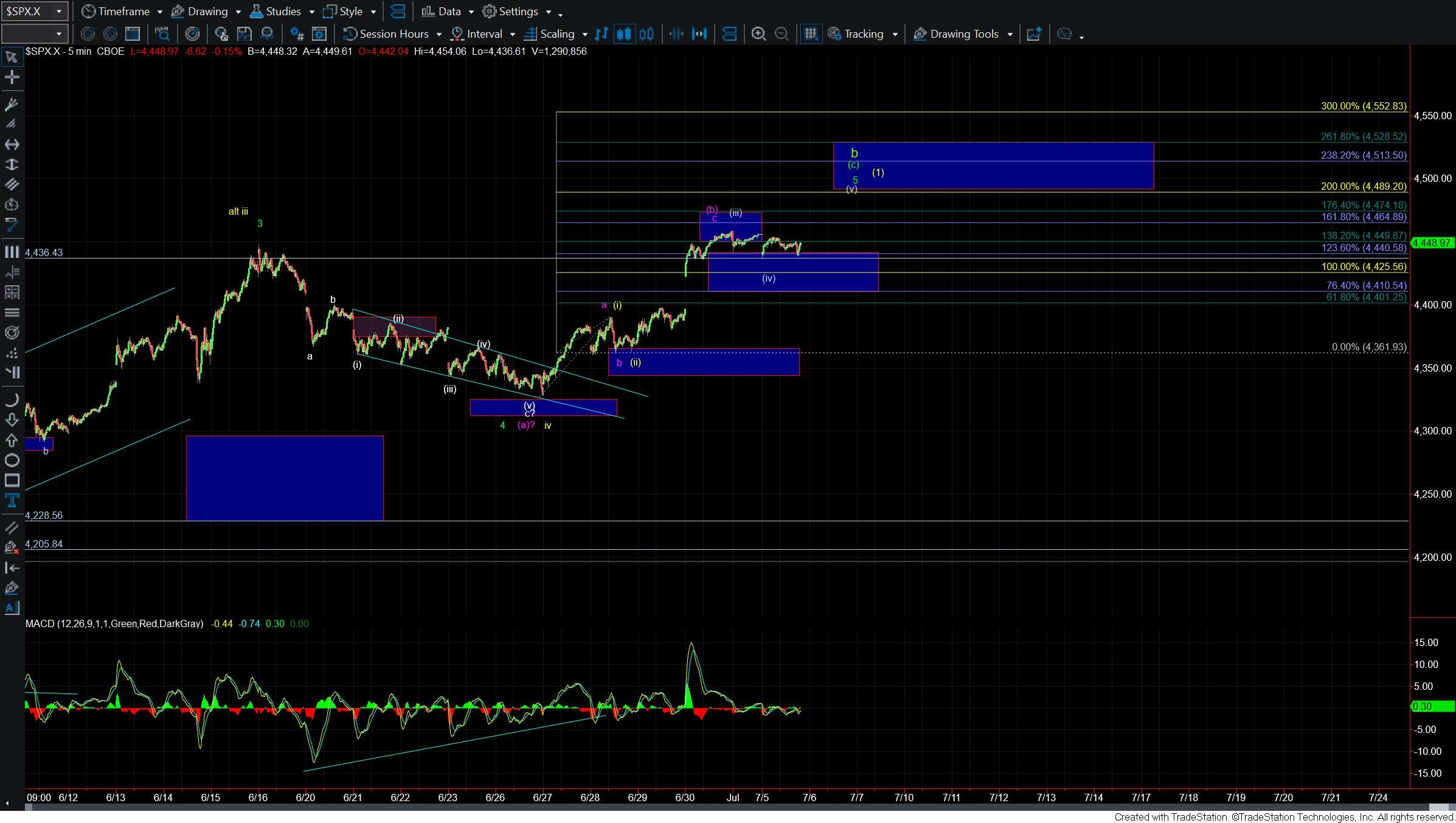

As I am showing on the five minute chart micro support for the potential wave (iv) remains in the 4440-4410 zone just below. This is the key support area that we should hold for this wave (iv) and as long as we can hold this zone the near term pressure will remain up. Assuming we can hold this zone and make the higher high we should then see a pullback for either the yellow wave (2) or the start of the green wave c down. The structure of that next pullback lower is going to be key in determining whether we have indeed begun the larger wave c down or if we are simply seeing a pullback for the yellow wave (2).

For now and as long as we hold over micro support as noted above the near term pressure will remain up but I will note that we should be getting close to a point in which a pullback for at least a corrective wave (2) should be close at hand. For now however and as long as support holds there is simply no signal that this pullback has begun.