Market Sees Continuation Lower, but Price Action Remains Sloppy

Today we saw the market continue to work lower, putting Santa’s Rally on hold for now. The price action to the downside remains quite sloppy and increasingly overlapping, which suggests this decline may be unfolding as an ending diagonal, potentially forming the second leg of what is still a corrective move lower. The key question is whether this correction can complete in time for Santa to arrive and push the market higher ahead of the holiday next week.

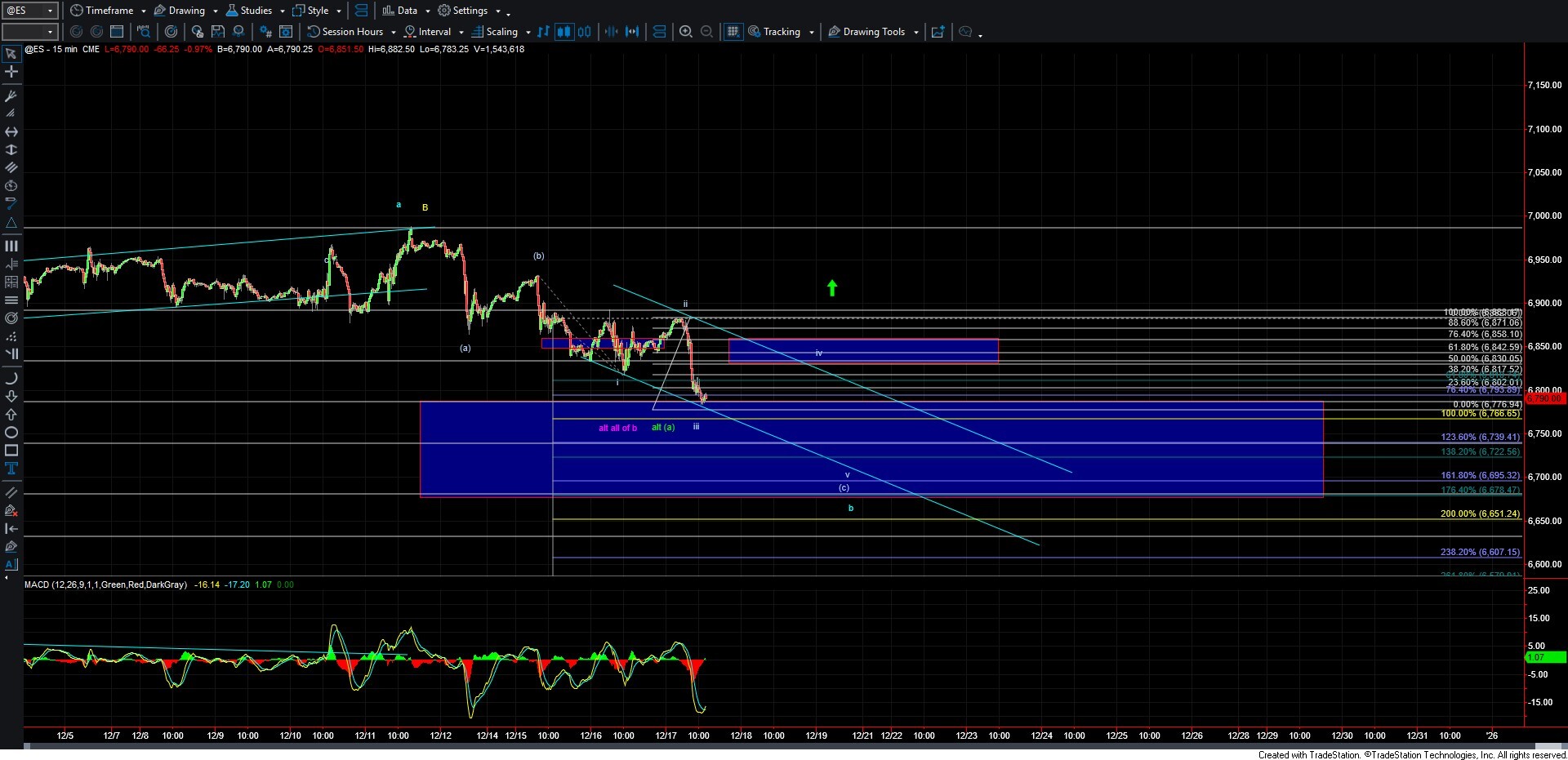

As shown on the ES chart, I am having difficulty identifying a full and complete pattern into today’s low. This suggests we may still have some unfinished business to the downside before seeing any meaningful push higher. If we are indeed trading within an ending diagonal, we would still expect to see another fourth and fifth wave before the pattern is complete. At the moment, it appears we may be nearing the end of the third wave of the ending diagonal I am tracking. Of course, trading and analyzing price action within an ending diagonal before it is complete is notoriously difficult and far from a high-confidence setup, so I would expect additional twists and turns before this process is resolved.

The bottom line for this count is that as long as we remain below the 6,883 level, and ideally below 6,858, I believe we likely have a bit more work to do before this corrective move to the downside is complete.

The structure of the next move higher will be critical. If we see a clearly impulsive advance that breaks through the overhead resistance zone, it would open the door for the larger wave b to have completed, as shown on the charts, and would set the stage for a direct push to new highs. However, that is not my base case at this time. As long as upside action remains corrective in nature, I continue to expect at least some additional downside before a meaningful bottom is established.

For now, I will continue to closely monitor both the overhead resistance levels and the internal structure of price action to help guide us on where this market is likely headed in the days and weeks ahead as we close out the year.