Market Sees Another Sloppy Day But Upside Setup Remains Intact

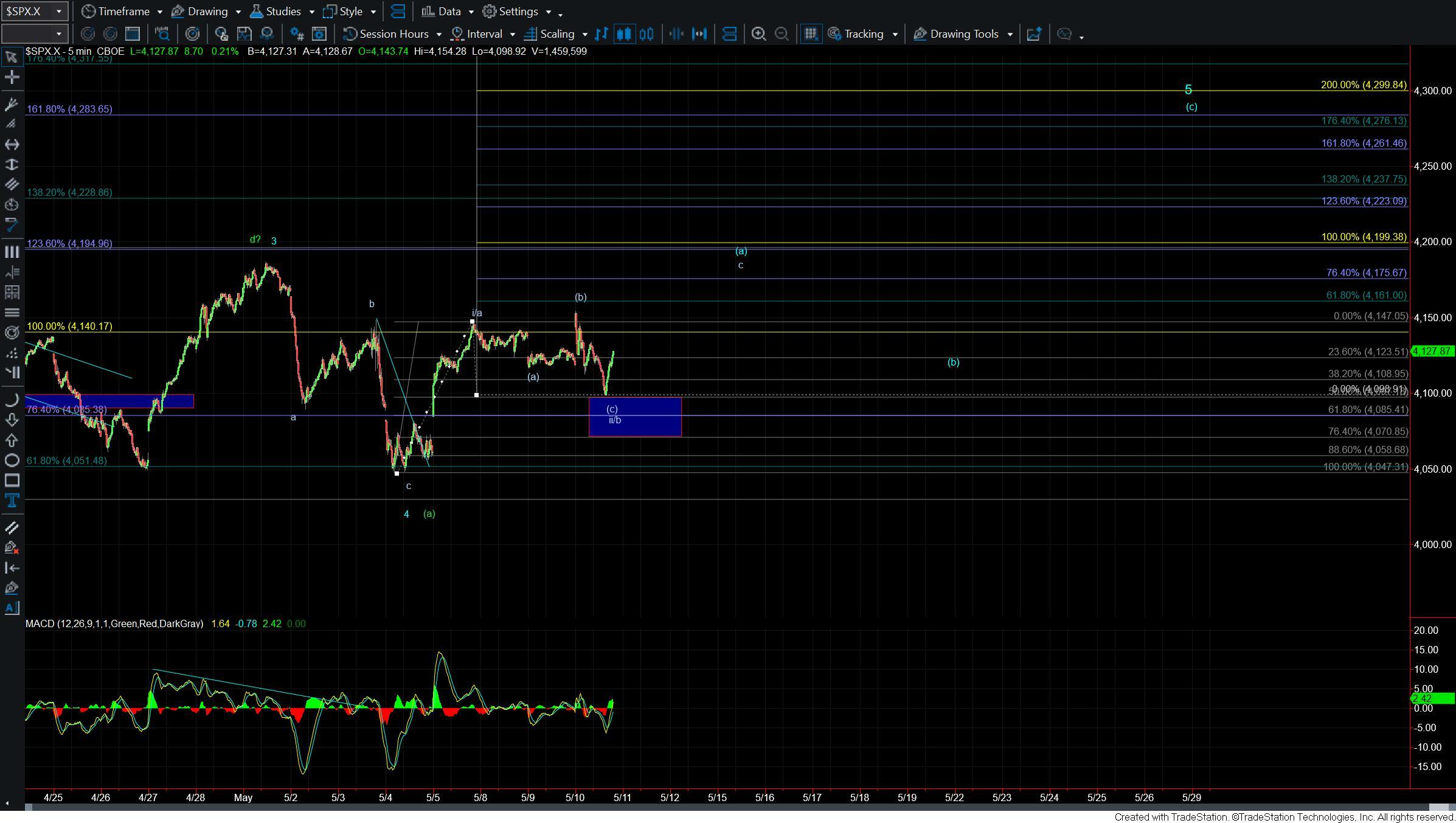

Today the market attempted to make an early breakout at the open but failed to see follow-through and turned back lower shortly after the open. The structure of this move up off of the low and over the highs that were struck last week took the form of a fairly clear three-wave move. This is suggestive that the high today was simply a wave (b) within a larger wave ii as shown on the five-minute chart. So while the false breakout and sloppy pattern is certainly far from an ideal pattern the action today has not broken any support that had been previously laid out thus keeping the near-term upside pattern very much in play here.

The bigger picture there is really nothing new to add here as today's action has neither broken the low struck on 5/4 nor the high struck on 5/5.

From a smaller degree perspective because we can count a fairly clean five up off of the 5/4 low and into the 5/5 high this is still the pattern we are working with. Support for that five-wave move remains in the 4097-4070 zone as shown on the five-minute chart. As of the time of this writing, we have bounced right off of the 50% retrace of the move up off of the 5/4 low. This is supportive of the market attempting to find a near-term bottom in the wave b. From here we need to see this continue to follow through higher and break back up over the HOD at the 4154 level. If we can break that 4154 level the 4175 becomes the next key pivot level to break at which point we should be targeting the 4200 level.

If we are unable to hold over the 4070 level then it would open the door for this to see a break back under the 4047 level which would be an early signal that we may be following the larger degree triangle count. For now however and as long as we hold over support my base case will remain that this resolves up to finish off the larger degree pattern before moving lower.