Market Sees A Day Of Consolidation

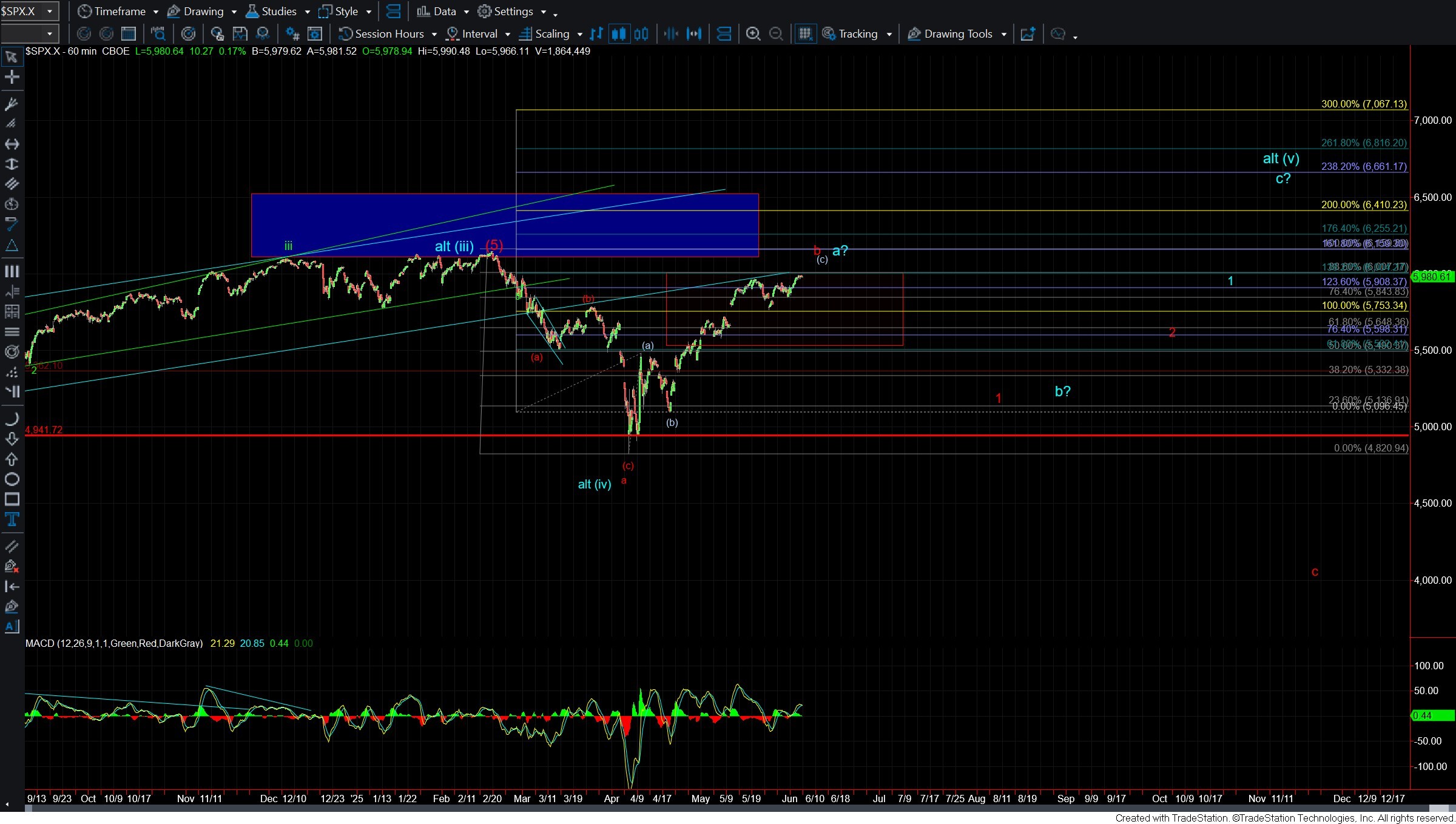

Today, the market consolidated in a tight range near yesterday’s highs. This type of price action often precedes further upside, but confirmation requires a decisive break above the 6007 level. Until that happens, the market remains at an inflection point. On a broader scale, not much has changed since the weekend update. The primary view is that we are in a topping region, likely either in a topping region for the blue wave a or red wave b. The potential for that larger wave b top to develop, as outlined in the red count, will depend on the structure of the next meaningful pullback.

Looking more closely at the ES chart, the move off the 5847 low has been sloppy and lacks a clear wave structure. Because of this, I’m focusing on two key price levels: 6007 as overhead resistance and 5847 as near-term support. A break above 6007 could then trigger a move toward the 6100 level, which marks the 100% extension of the move off the May 23 low. Should we reach that zone, attention will shift to the structure of the pullback from 6100. A five-wave decline would support the red count, suggesting a deeper correction ahead, while a three-wave move would lean toward the blue count, pointing to a more bullish resolution.

If, instead, the market fails to break higher and drops back below 5847 before reclaiming 6007, that would suggest wave 4 is still unfolding. In that case, the 5741–5847 range becomes a key support zone. A break below that would again require us to watch the wave structure of that initial move down. Again, a five-wave move would open the door to the red count, while a three-wave move would support the blue count.

In summary, the market is in a waiting phase. Price action around the 6007 and 5847 pivot levels will be critical in determining whether we've already seen a local top or if there’s still more upside to come before a more significant reversal takes shape.