Market Retraces After Giving An Initial Signs Of A Top

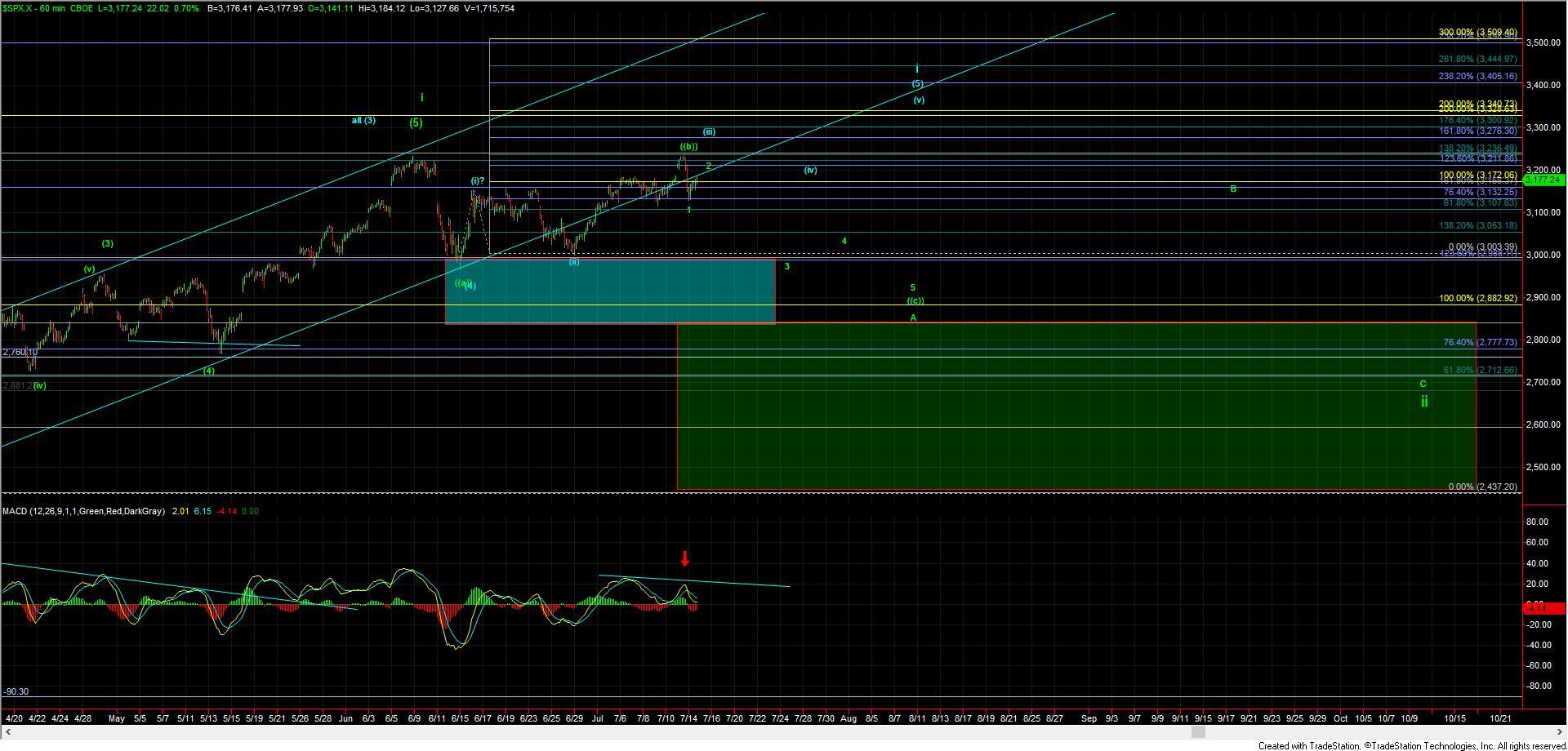

After a sharp sell-off yesterday and a break of some key support levels we were looking for the markets to give us further downside follow-through by completing a full five-wave move down off of the potential green wave ((b)) high. This morning just before the open we did indeed see that follow-through with all of the major indexes giving us what can count as a full five down off of the highs. So with that and the break of support that we saw yesterday, we now have an initial signal that we have indeed struck a top in the green wave ((b)).

After bottoming into the 3117 level today we saw what is so far a three-wave move back up off of those lows into our expected retracement zone which sits at the 3159-3201 zone. This is the ideal zone that should hold for our potential wave 2 retrace as part of a larger wave c to the downside.

On a more micro perspective looking at the ES chart our a=c currently comes in at the 3192 level which is right in the middle of the 61.8 retrace and the 76.4 retrace. I certainly would have prefers this level to have a bit better confluence with one of these key price resistance levels but it is still well within our standard retrace zone for the potential wave 2.

So from here I will keep an eye on the overhead fibs at 3185 and 3201 and look to see if this can make a turn as we approach these fibs above. If we can do indeed see a turn near these levels then we will look for a five-wave move to the downside followed by a break of the 3143 low to give us further confirmation that we have indeed struck a top in the green wave 2.

Finally, I do want to note that I have not completely eliminated the blue path just yet although I am viewing this path as less probable at this point in time. However, should we see a break through the upper resistance level at the 3201 level it would once again start to become more probable but for now it will remain an alternate on my charts.