Market Rebounds Higher but Still Trading Under Key Pivots

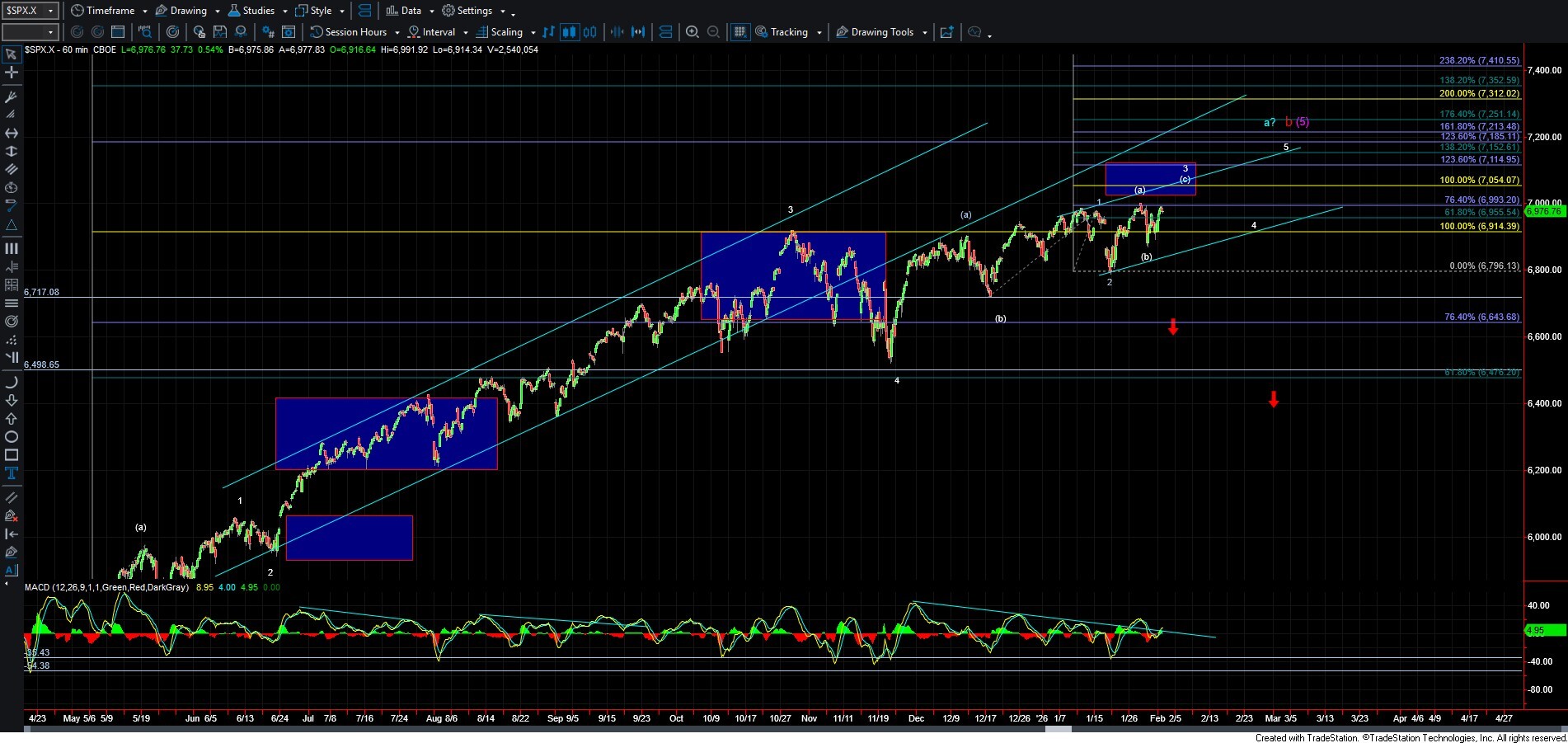

Today we saw the market move sharply higher, retracing much of last week’s pullback. However, we are still trading below the key pivot level that must break to confirm that we are ready to push to new highs. As we move into the close, the market is sitting near the middle of this pivot zone, and if we can break above it over the next couple of sessions, we should indeed be on our way to new highs.

That said, I want to note that the structure of the move up off the December lows remains very overlapping and somewhat sloppy, which continues to suggest that we may be working within an Ending Diagonal. If that is the case, the path higher is likely to be anything but straightforward. For now, I will continue to monitor the overhead pivot and resistance levels and remain cautious in what is still a difficult pattern to analyze.

As shown on the ES chart, the current overhead pivot is the 7006–7040 zone. If we can manage to push through that area, the next key resistance level comes in at the 7080–7094 region. This represents the 100% extension on two separate degrees, and if we stall there and see a pullback, it could mark the top of wave 3 within the larger Ending Diagonal that began with the December low.

If that level breaks, I would simply view it as an extension of wave 3 and then focus on the 7142–7183 region as the next key resistance and target zone. From there, as long as any pullbacks remain corrective in nature, we should still see at least one more higher high to complete the larger-degree pattern.

If we are unable to break above the pivot zone noted above, it remains possible that we are simply forming a b wave within a larger corrective structure. However, at this point in time, the cleanest path forward would be a breakout to new highs. It would take a clear five-wave move to the downside, followed by a break of the 6864 low, to suggest that higher prices are no longer in play. Until then, higher remains my base case.