Market Ready To Breakout Or Is A Deeper Pullback Underway?

Today we initially moved lower but quickly reversed those losses and have since been trading mostly flat on the day. This is leaving us in between two of the smaller degree counts which we are showing in blue and green on the smaller degree timeframe charts. Until we actually see a break down under support of back over resistance this could still break in either direction on the smaller timeframes. So while the path is not terribly clear at the moment we do have some fairly clear parameters which we can lay out to help give us guidance as to which direction this may be heading in the near term.

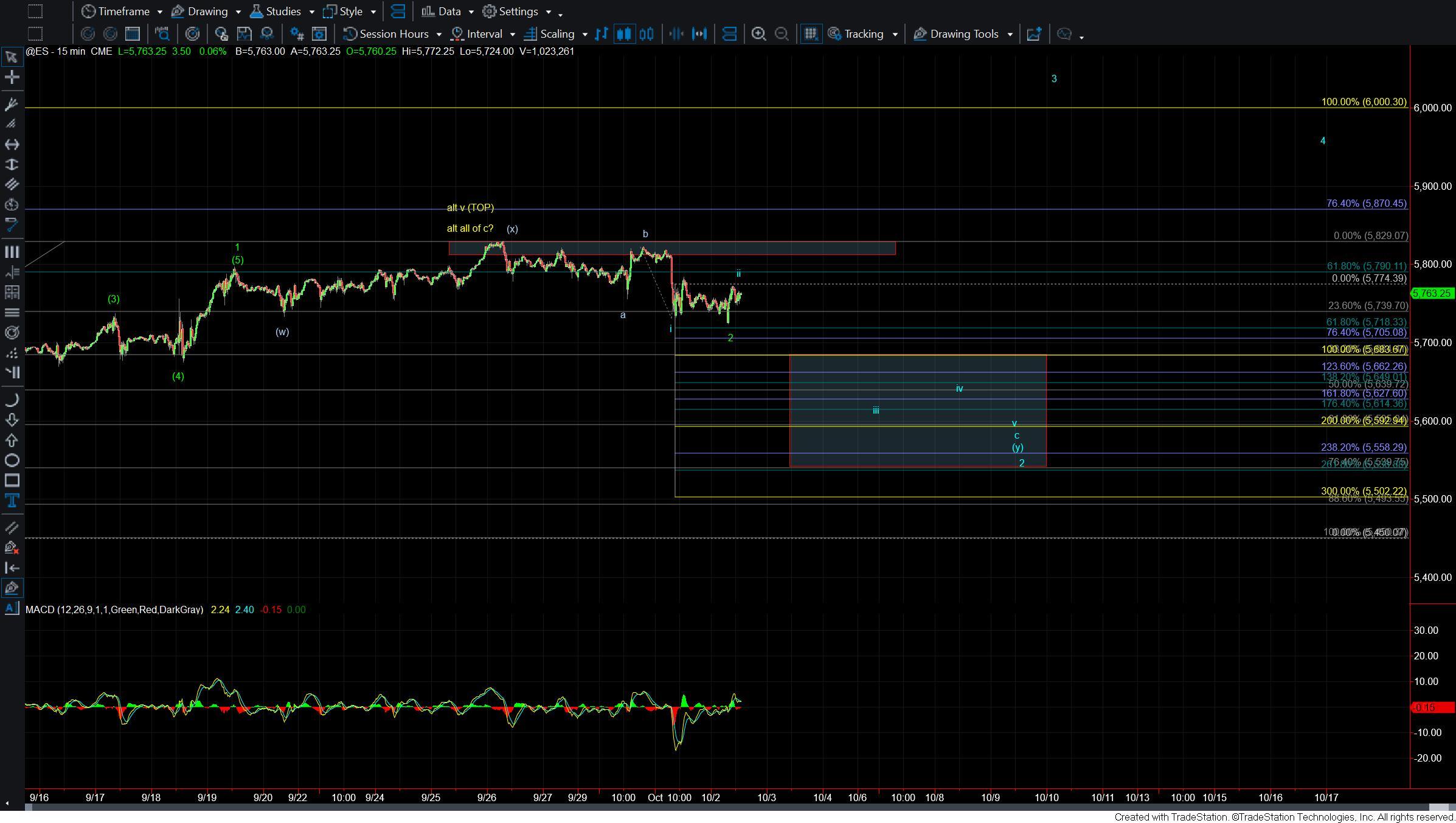

Drilling down to the 15min ES chart I can count the move down off of the 5829 high as potentially a completed corrective pattern for all of the wave 2 shown in green. The issue with counting it in this manner is the depth of the overall pullback for that wave 2 as it would be very shallow. With that being said if we are able to move higher and break back over the 5829 level then it opens the door for all of the wave 2 in green to be in place. From there, I would want to see further confirmation with a break over the 5870 level followed by a break over the 6000 level on the ES.

If we are unable to break higher but rather see a move back under today's LOD at the 5724 level followed by a break under the 5705 level then it would give us initial confirmation that we are indeed going to see a deeper pullback per the blue count. Under that case I would be looking for a move to ultimately target the 5683-5540 zone below to finish off the wave 2 as shown in blue.

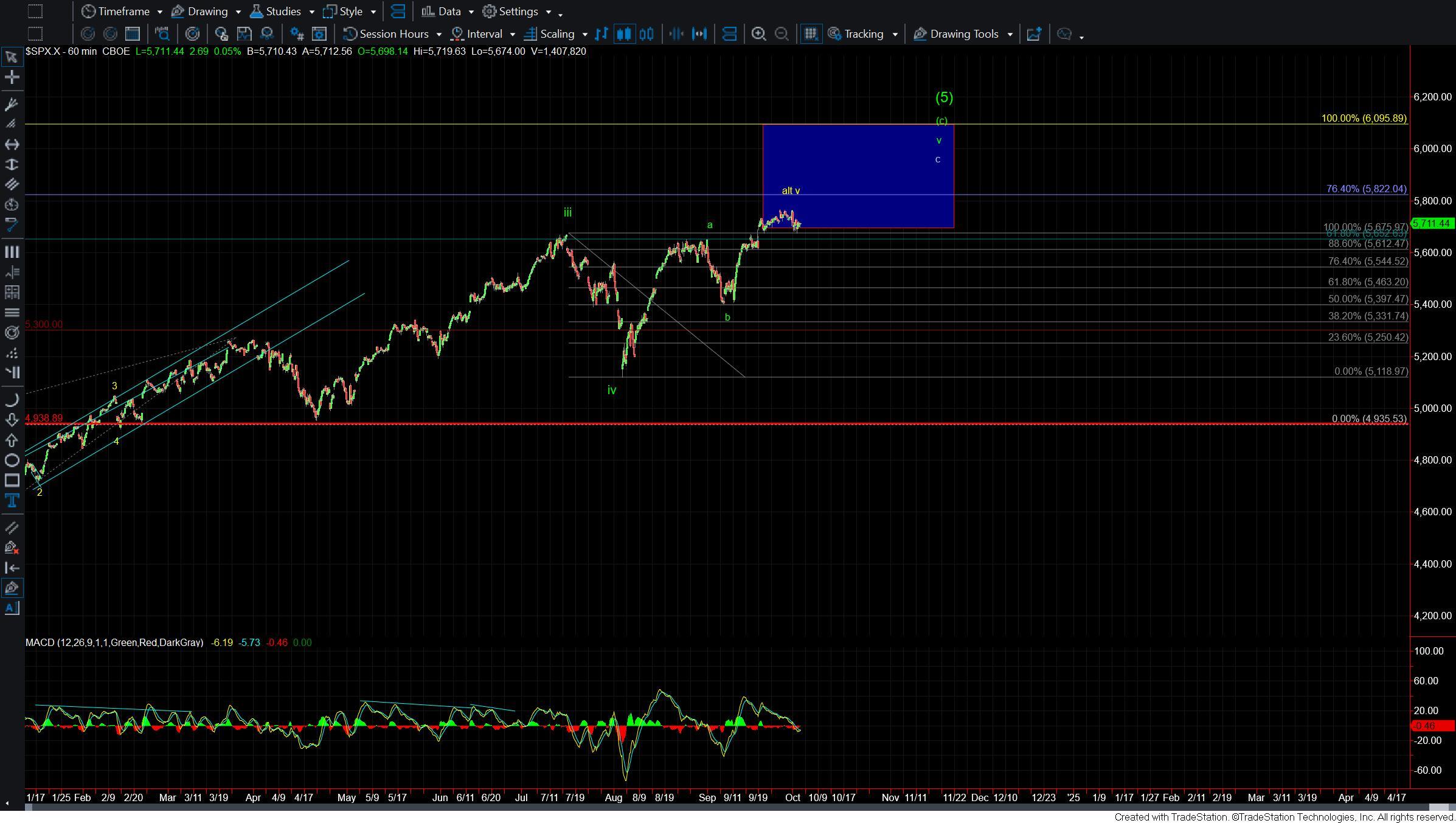

Bigger picture not much has changed and unless and until we were to see the ES/SPX break down below the support zone as laid out above we still do not have any confirmation of a larger degree top being in place just yet.