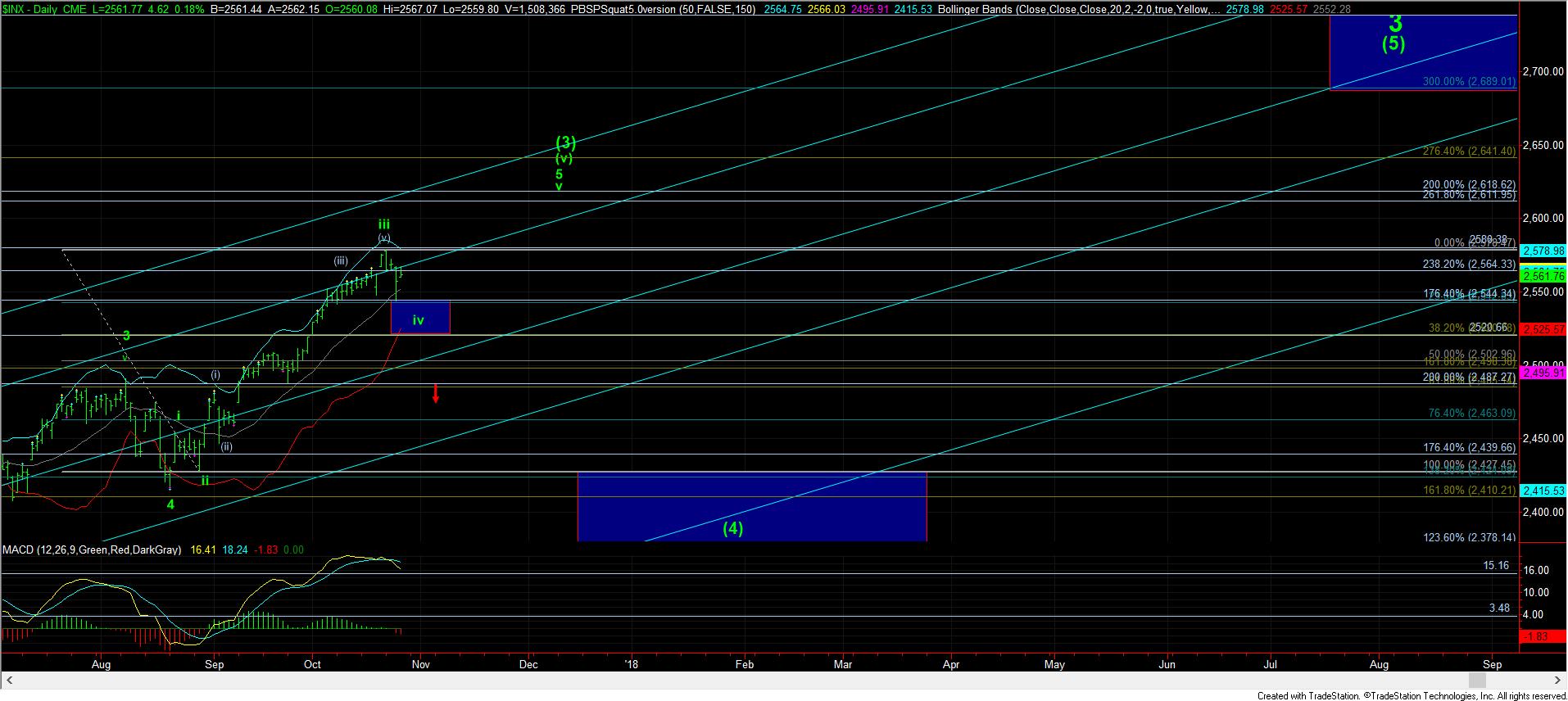

Market Rallied To Target Resistance Region

The market has now rallied right to our resistance target and spent the day hovering at the bottom of it. Now, we are faced with diverging perspectives we must weight.

Let’s start with the bearish analysis, as I noted yesterday, standard 4th waves provide an a-wave pullback to the .236 retracement before dropping again – after a corrective bounce – down to the .382 retracement in the c-wave. And, yesterday, I alerted you to prepare for that bounce as we were striking that .236 retracement.

Moreover, if we count this move up off the lows as an a-b-c as presented in the green count, we struck the exact a=c in that rally, which supports the (b) wave rally count. Lastly, we are still below resistance, with a reasonable count pointing lower towards the 2520SPX region.

As far as the more immediate bullish count, as presented in yellow, a minority of 4th waves will complete at the .236 retracement, which is what we see in strong trending bull markets. And, this clearly has been a strong bull market.

Based upon the micro structure we have seen today, I can even make out a bullish (i)(ii) set up, with a very shallow wave (ii) being in place. I have labeled that in yellow, but have only noted it as an alternative at this time.

Now, the reason the more immediate bullish count is considered the alternative count is because we are still below resistance. Moreover, the consolidation seen in the middle of this uptrend also looks a bit more like a b-wave in a (b) wave rally, that it does a 4th wave in a 3rd wave in wave (i), which is how the impulsive structure off the lows would have to be counted. It is a bit big for what we normally see as a 4th wave within a 3rd wave rally.

Again, I am having to weigh a standard pullback pattern against the strength of the bull market we have been experiencing, and as long as we remain below resistance, then I will give slightly more weight to the standard pattern.

But, PLEASE, do not take this as an opportunity to go aggressively short. At this time, we don’t even have a 1-2 set up to the downside to even suggest a (c) wave down has begun. Rather, you MUST respect that this is still a bull market, and shorts have not been rewarded for their aggressive postures. Should we see a reasonable 1-2 set up to the downside, then maybe we can consider a short-term downside trade. But, until the full set up is in place, trading the short side has not been a profitable endeavor for the last year and a half.

Whereas the market has been rather straight forward since breaking support yesterday, then bottoming at the .236, and rallying right to resistance, we are at another inflection point, where a decision has to be made by Mr. Market.

So, within the next day or so, the market is either going to be providing us with a 1-2 downside set up for the (c) wave down into next week, or it is going to be breaking out over resistance, strongly suggesting we are in the final run for wave v, to complete wave (3) off the February 2016 lows. It’s up to Mr. Market now as to whether it wants to complete wave (3) off the February lows sooner rather than later.