Market Pushing To Next Target

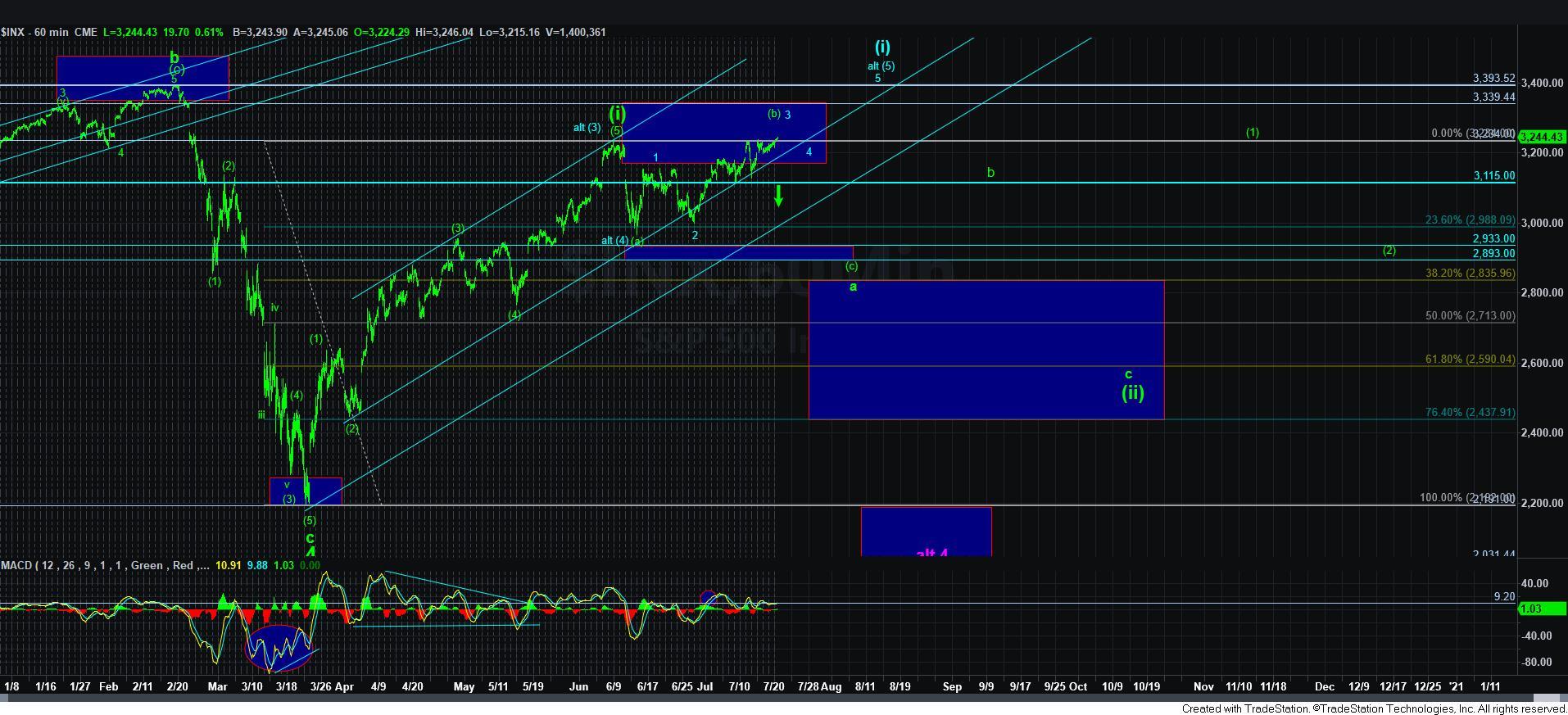

With today’s push through the 3234SPX resistance region, the market is on its way to our next interim target of at least the 3260SPX region. But, the question remains as to what this rally represents, as I outlined over the weekend.

While the blue count still remains on the table, we have had a lot of overlap in both the SPX and the ES over the last week. And, when I see overlap as the market pushes higher, it makes me think “ending diagonal.”

So, at this point in time, I have added a micro count for wave [v] of 3 in blue which suggests we are rallying in the wave 3 of an ending diagonal. Now, the standard target for wave 3 within an ending diagonal is the 1.236 extension of waves 1 and 2. That would suggest that if we are indeed within an ending diagonal, the market should attempt to stretch into the 3270-80SPX region followed by another drop back down to the 3200SPX region in a corrective fashion for wave 4 within wave (v) in blue.

However, if we see an impulsive break down in 5-waves below the 3200SPX region without attaining the 3270-80SPX region, it would more strongly suggest that the green [b] wave has topped, and a break down below 3115SPX would again be pointing us back down towards the 2900SPX region, as I have been highlighting.

There is no question that this market action of late has not been easy to trade or to analyze. So, please take a step back and understand the parameters we are tracking within this region. I am still focusing upon a larger degree wave [ii] pullback as you can see from the 60-minute chart, but the market has not made it clear whether wave [i] has yet topped. So, nothing has changed from the analysis provided over the weekend.