Market Pushing Higher, But Small Caps Are Flashing a Warning Signal

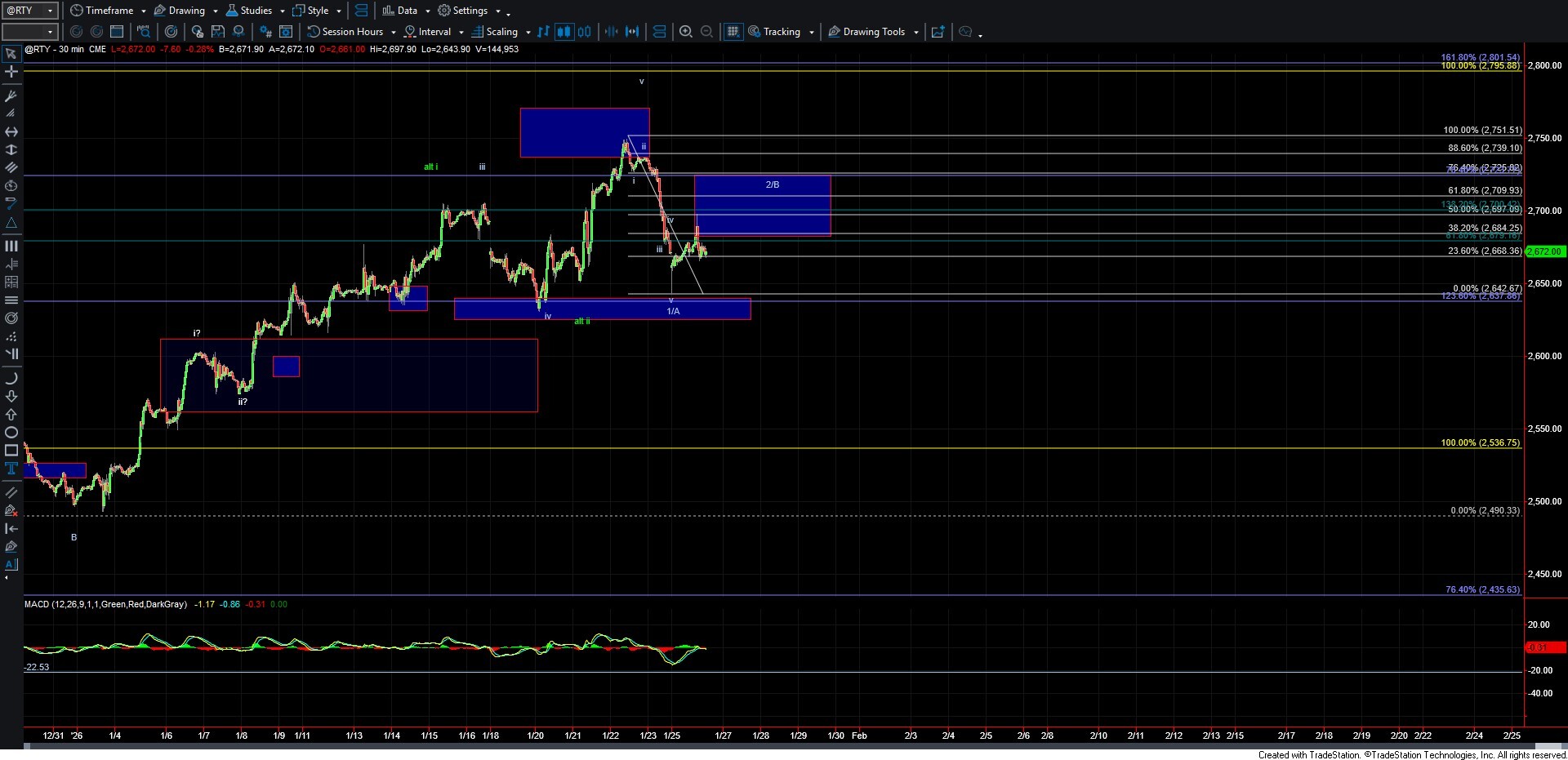

After moving lower overnight and hitting the c wave down I was looking for last week, we saw the SPX and Nasdaq push higher today, so far following the primary path higher. That said, the Russell 2000 is not looking nearly as strong today. In fact, I can make the case that we have five waves down off the highs into the overnight low, followed by only a very weak three-wave retrace higher so far.

So while I will continue to give the benefit of the doubt to the bullish count on the SPX and Nasdaq as long as we can remain over support, I am certainly going to keep a very close eye on the Russell 2000 in the days ahead, as this chart will often lead the other indexes when forming larger-degree tops.

We saw the ES gap down over the weekend into the 61.8% retrace at the 6872 level before quickly recovering and pushing higher into current levels. We are currently sitting at the 100% extension of the initial overnight low, which comes in at the 6991 level. So far, we have simply seen high-level consolidation around this region, which is usually indicative of further upside follow-through. With that said, as long as the ES can hold over the 6962 level, I am going to give the benefit of the doubt that we will indeed see higher levels, with wave (iii) targets coming in at the 7018–7045 zone and the ultimate wave (v) targets coming in at the 7062–7195 region overhead.

If we begin to break down under the 6962 level, it would open the door for at least a local top to be in place, with further confirmation coming on a break under the 6920 level.

As noted above, with what I can count as five down and three up on the RTY, I will be keeping a close eye on the 2697–2725 retracement zone overhead. If that zone holds and we see another five-wave move to the downside develop, it may be an early warning that the equity markets have put in some sort of larger top. Unless and until that occurs, however, I will continue to give the bullish resolution the benefit of the doubt for now—but I am certainly becoming more cautious in this region, as the market remains very extended and we now have a potential five down on the RTY