Market Pushes to New Highs on Sloppy Wave Action

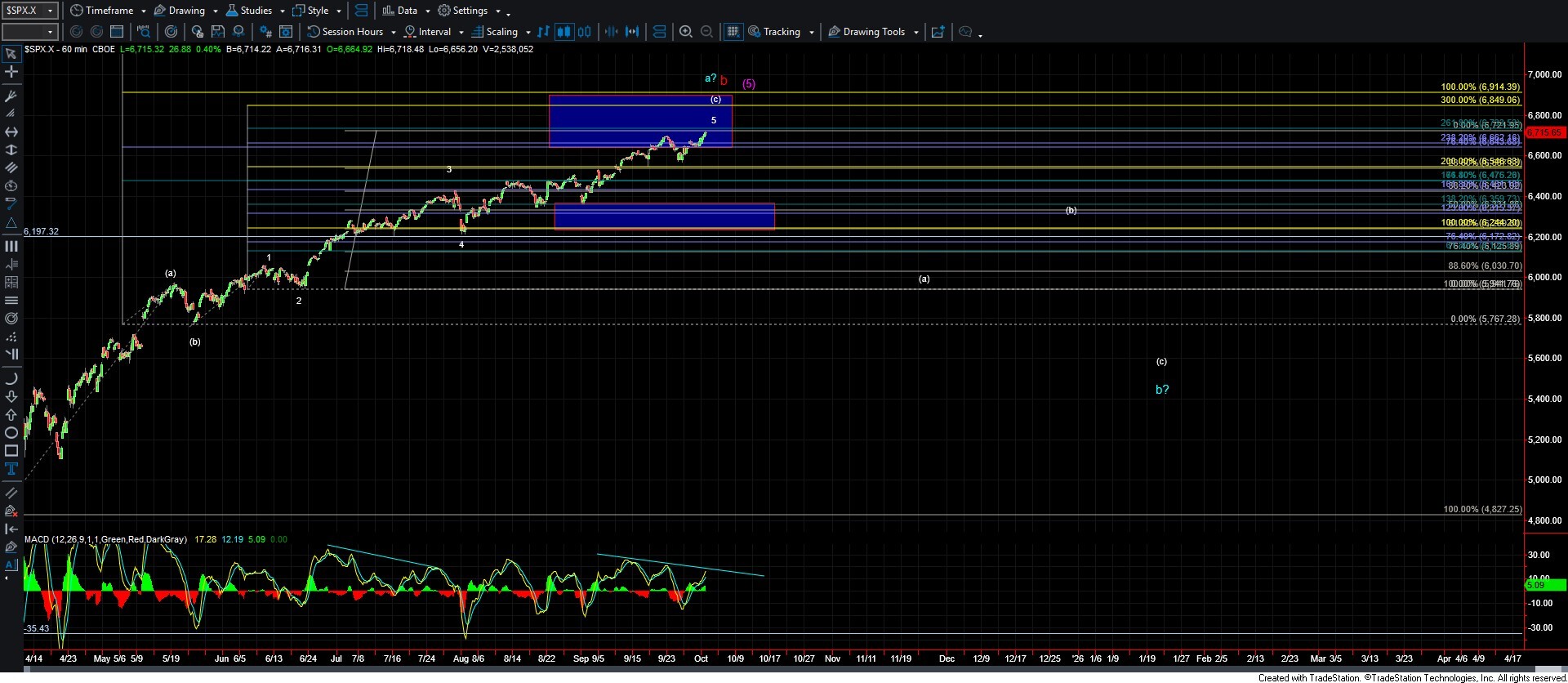

Today we saw both the SPX and Nasdaq push to new highs on what can best be described as sloppy wave action. The moves off the September 2nd low and, more recently, the September 25th low continue to trace out in three-wave corrective structures to the upside. This price action suggests we are still working within two potential Ending Diagonals, one off the 9/2 low and another of smaller degree off the 9/25 low.

Because we are dealing with diagonals rather than impulsive structures, this remains a more challenging pattern to analyze. For now, we will continue to watch the key support levels below. As long as those levels hold, the trend remains up and we have no confirmation that a top has been struck. That said, given that we are likely working on Ending Diagonals across multiple degrees, when this does finally top, the reversal back toward both the 9/25 and 9/2 lows should be relatively sharp. Until we begin to see breaks of support, however, the market still has room to grind higher toward the upper end of the target zone outlined on the 60-minute chart.

Drilling down to the smaller-degree time frame, today’s push to new highs looks like we are working on wave 5 of wave c off the 9/25 low. This move can continue to push higher toward the 6785–6845 target zone overhead; however, there are technically enough waves in place to consider a completed pattern. To begin confirming a top, we would need to see a break under the 6680 level, followed by 6624. If those levels give way, I will then watch the 6609 level for further confirmation. At that point, I would expect a sharp reversal targeting the 6427 region as an initial downside objective. From there, we’ll be looking at how the structure develops to the downside, as well as watching the larger-degree SPX support zone at 6363–6244.

So, for now, the bottom line remains as it has for months: until we see a meaningful break of support, there is no confirmation of a top, and this market can continue to grind higher.